ASX Value Picks Judo Capital Holdings And 2 More Stocks That May Be Trading At A Discount

As the Australian market winds down for the holiday season, investors are witnessing a slight dip, likely due to profit-taking before the break, while global indices approach record highs. In this environment, identifying undervalued stocks like Judo Capital Holdings can be crucial for those seeking potential opportunities amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wrkr (ASX:WRK) | A$0.12 | A$0.21 | 44% |

| Smart Parking (ASX:SPZ) | A$1.295 | A$2.26 | 42.8% |

| Resolute Mining (ASX:RSG) | A$1.255 | A$2.41 | 47.9% |

| NRW Holdings (ASX:NWH) | A$5.08 | A$8.97 | 43.4% |

| Lynas Rare Earths (ASX:LYC) | A$12.49 | A$23.40 | 46.6% |

| LGI (ASX:LGI) | A$4.03 | A$7.67 | 47.5% |

| Kogan.com (ASX:KGN) | A$3.57 | A$6.87 | 48.1% |

| Cromwell Property Group (ASX:CMW) | A$0.485 | A$0.87 | 44.1% |

| Betmakers Technology Group (ASX:BET) | A$0.18 | A$0.34 | 46.6% |

| Airtasker (ASX:ART) | A$0.345 | A$0.63 | 45.5% |

We're going to check out a few of the best picks from our screener tool.

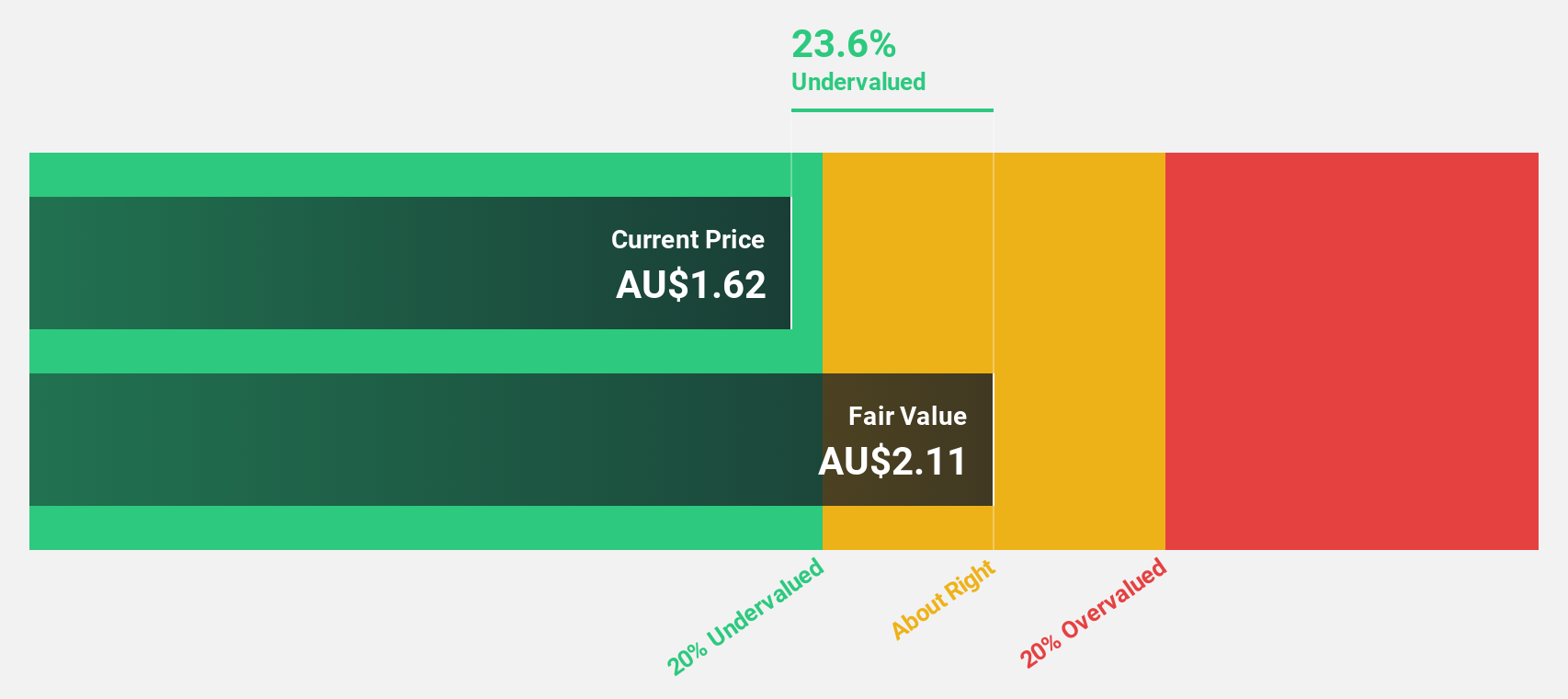

Judo Capital Holdings (ASX:JDO)

Overview: Judo Capital Holdings Limited operates through its subsidiaries to offer a range of banking products and services tailored for small and medium businesses in Australia, with a market capitalization of approximately A$1.95 billion.

Operations: The company generates revenue primarily from its Small and Medium Enterprises (SMEs) Lending segment, amounting to A$347.40 million.

Estimated Discount To Fair Value: 28.8%

Judo Capital Holdings is trading at A$1.74, significantly below its estimated fair value of A$2.44, indicating potential undervaluation based on cash flows. Despite a high level of bad loans (3.4%), the company's earnings are expected to grow significantly at 22.87% annually over the next three years, outpacing the Australian market's average growth rate of 12.2%. Although revenue growth is moderate at 16.4%, it remains above market expectations.

- Our expertly prepared growth report on Judo Capital Holdings implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Judo Capital Holdings' balance sheet health report.

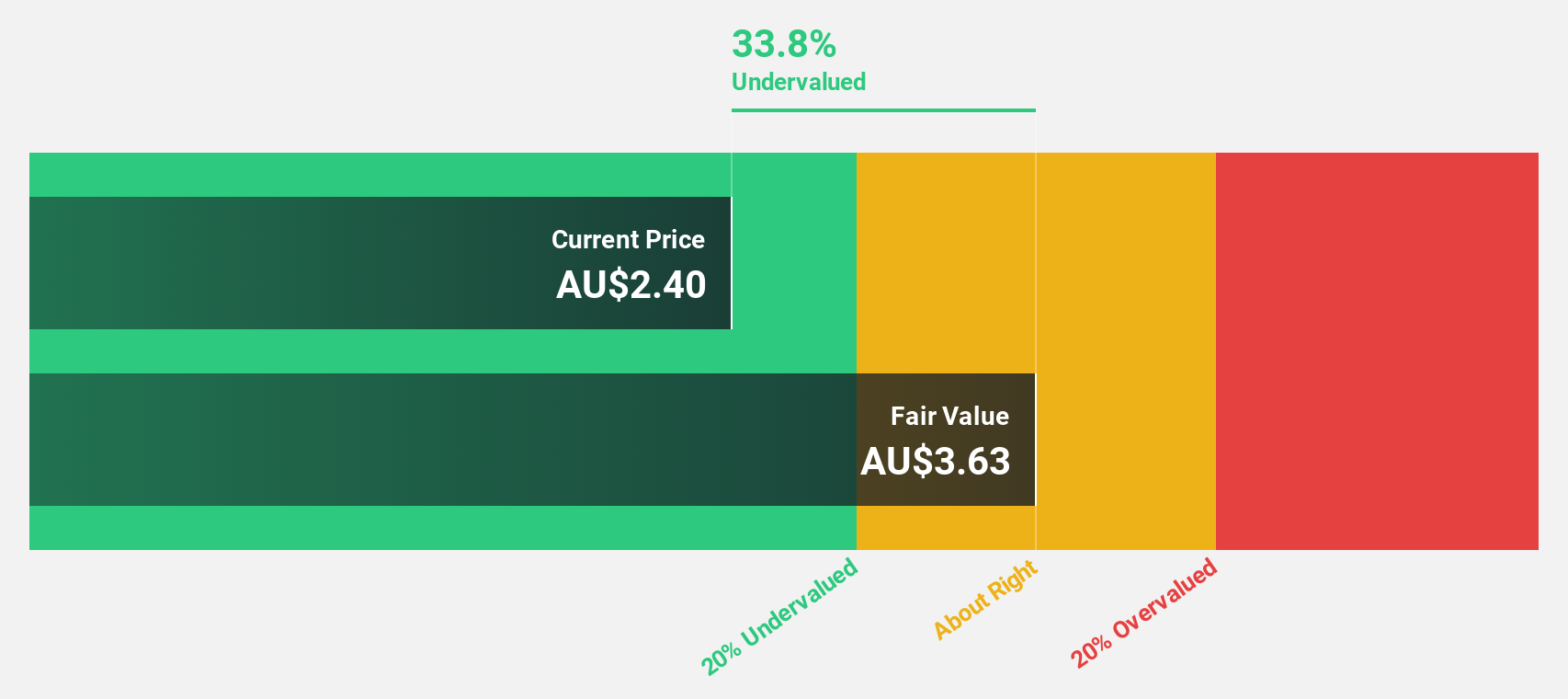

Regal Partners (ASX:RPL)

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$1.18 billion.

Operations: The company generates revenue primarily through the provision of investment management services, amounting to A$245.45 million.

Estimated Discount To Fair Value: 35.1%

Regal Partners is trading at A$3.22, considerably below its estimated fair value of A$4.97, highlighting potential undervaluation based on cash flows. Earnings are projected to grow significantly at 31.5% annually, surpassing the Australian market's average growth rate of 12.2%. However, the dividend yield of 4.97% is not well covered by earnings or free cash flows, and profit margins have decreased from last year’s figures despite strong revenue growth forecasts exceeding market expectations.

- Upon reviewing our latest growth report, Regal Partners' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Regal Partners.

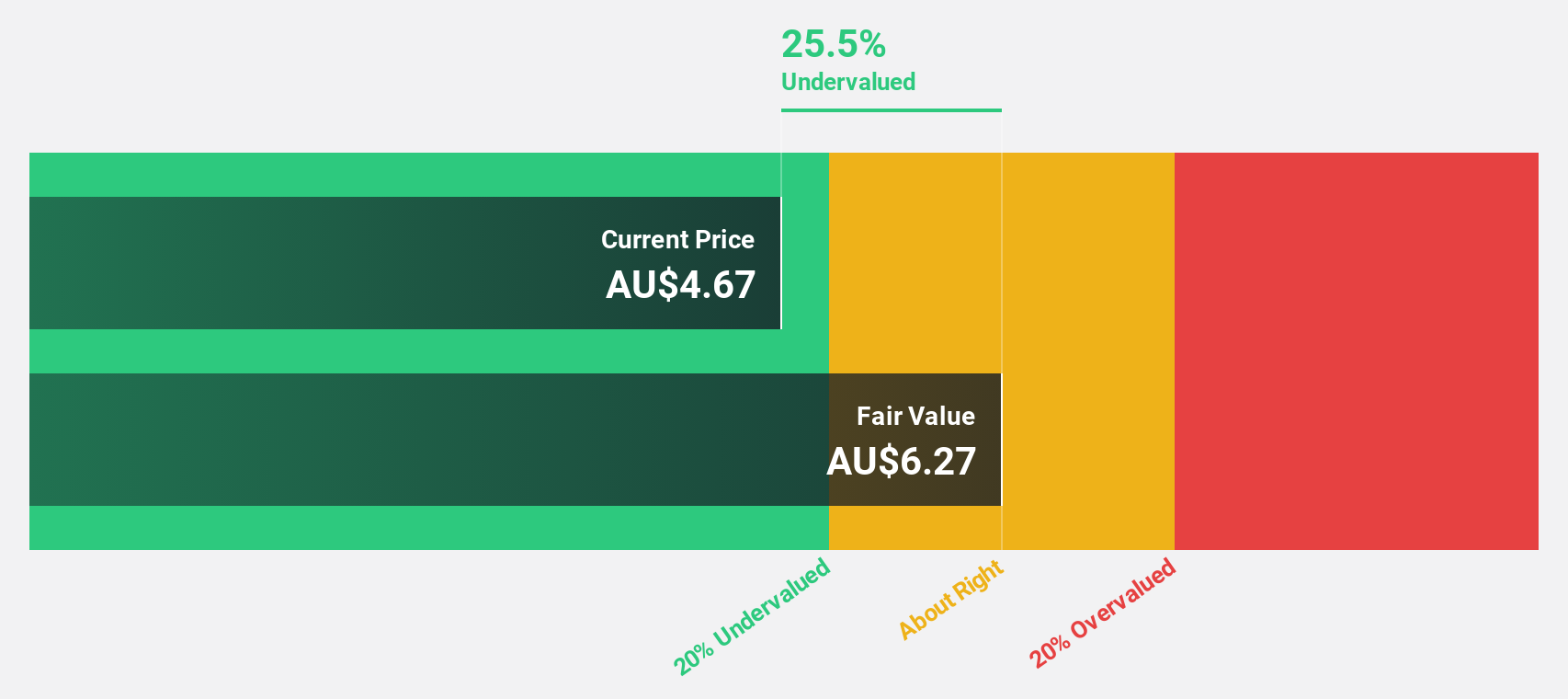

Web Travel Group (ASX:WEB)

Overview: Web Travel Group Limited operates as an online travel booking service provider across Australia, the United Arab Emirates, the United Kingdom, and internationally, with a market cap of A$1.75 billion.

Operations: The company's revenue is primarily derived from its Business to Business Travel (B2B) segment, which generated A$362.60 million.

Estimated Discount To Fair Value: 24.6%

Web Travel Group is trading at A$4.85, significantly below its estimated fair value of A$6.43, suggesting potential undervaluation based on cash flows. Despite a drop in net profit margin from 25.6% to 0.1%, earnings are forecasted to grow substantially at 43.3% annually, outpacing the Australian market's growth rate of 12.2%. However, recent executive changes and insider selling could introduce uncertainty despite strong revenue projections exceeding market averages.

- Insights from our recent growth report point to a promising forecast for Web Travel Group's business outlook.

- Dive into the specifics of Web Travel Group here with our thorough financial health report.

Summing It All Up

- Click this link to deep-dive into the 36 companies within our Undervalued ASX Stocks Based On Cash Flows screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal