US stock outlook | Futures of the three major stock indexes fell sharply, and the “Christmas market” may have plummeted this week after silver continued to reach new highs

Pre-market market trends

1. On December 29 (Monday), the futures of the three major US stock indexes fell sharply before the US stock market. As of press release, Dow futures were down 0.04%, S&P 500 futures were down 0.19%, and NASDAQ futures were down 0.35%.

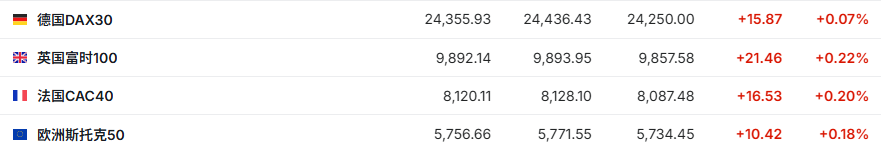

2. As of press release, the German DAX index rose 0.07%, the UK FTSE 100 index rose 0.22%, the French CAC40 index rose 0.20%, and the European Stoxx 50 index rose 0.18%.

3. As of press release, WTI crude oil rose 2.17% to $57.97 per barrel. Brent crude rose 1.96% to $61.42 per barrel.

Market news

This week's market focus: The Federal Reserve's December minutes and the chairman's nomination are approaching, and the market is seeking policy clues for next year in the “Christmas Market.” Wall Street has entered another relatively deserted holiday week. Labor market data provider ADP's employment data and the minutes of the December meeting of the Federal Reserve Open Market Committee (FOMC) will both be released on Wednesday. As Wall Street seeks to step high into 2026, these two figures will be the focus of attention. According to reports, US President Trump will appoint a candidate for the new chairman of the Federal Reserve in the first week of January. This is an uncertain event, and it is likely that the announcement will be delayed. As the stock market reached a new high last weekend, the market seemed ready for a positive “Santa Claus” — this usually refers to the last five trading days of December and the first two trading days of January. LPL Financial's chief technology strategist said, “The momentum towards the end of the year shows that the 'Santa Claus' market is showing a favorable trend — this is usually a bullish sign for January and the year ahead.”

Wall Street is betting firmly on the AI wave: there has been no “AI bubble” in recent years, and the S&P 500 index points 10,000 points. As the US stock market continues to hover near its all-time high, top Wall Street strategists are constantly downplaying investors' concerns about the AI bubble. They expect the S&P 500 Index and Nasdaq 100 Index to strongly continue this round of “super bull market” since 2023 in 2026, at least for now. Mary Ann Bartels, chief investment strategist at Sanctuary Wealth, a well-known Wall Street investment agency, thoroughly compared the current market with previous bubble periods, including the bear trajectory of global stock markets caused by the bursting of the internet bubble in the late 1920s and 2000. Similar to the predictions of Ed Yardeni, the “Wall Street Seer,” the strategist believes that by 2030, the S&P 500 index will be between 10,000 and 13,000.

Powell left a message on Wall Street before leaving office: US stocks are already very expensive. Generally, Federal Reserve Chairman Powell and other Fed governors avoid directly commenting on stock market performance. However, Powell, whose term expires in May 2026, recently clearly mentioned the potential impact of stock market valuations on Federal Open Market Committee (FOMC) policy formulation in response to questions. Powell said, “We do look at the overall financial situation and ask ourselves if our policies are affecting these conditions in the expected way. But you're right. For example, according to many indicators, stock prices are already at a fairly high valuation level.”

Silver dives fast! After hitting a record high of $84, it plummeted. As the precious metal with the craziest rise during the year, the price of spot silver once rose to nearly $84 per ounce on Monday, but since then it has dived in a straight line, highlighting the end of speculative capital profits. As of press release, spot silver fell more than 5% to 74.88 US dollars/ounce. Meanwhile, as the RSI indicator reaches a technical pullback point, silver fluctuations are likely to become more intense. Technical indicators suggest that silver's rise may be too strong and too fast. The metal's 14-day Relative Strength Index (RSI) reading is close to 80, far above the 70 threshold considered “overbought.”

Bank of America CEO judged that Trump's tariff policy will ease. Bank of America CEO Brian Moynihan said that although the 2025 tariff measures had impacted the US economy, he expected the Trump administration to cool down trade tensions next year. Moynihan said that the Bank of America currently judges that the situation will “ease rather than escalate.” Under the new tariff framework, the average tax rate will remain at 15%, while the tax rate will be higher for countries that are unwilling to commit to expanding purchases with the US or lowering non-tariff barriers. He said, “For most countries, the impact from the full imposition of the 10% tariff to the 15% adjustment is not significant. Our analysis team determined that this was a sign that the situation was beginning to ease.”

Individual stock news

SoftBank is betting heavily on AI infrastructure and is rumored to be close to acquiring data center investment giant DigitalBridge (DBRG.US). According to people familiar with the matter, SoftBank Group is in in-depth negotiations to acquire the private equity firm DigitalBridge Group, which mainly invests in assets such as data centers. The Japanese conglomerate may announce an agreement on DigitalBridge as early as Monday, according to people familiar with the matter. The deal is part of SoftBank's strategic layout to seize the digital infrastructure boom driven by artificial intelligence. The specific terms have not been disclosed. As of press release, DigitalBridge's US stock surged more than 30% before the market on Monday.

Amazon (AMZN.US) suspended Italy's drone delivery plan, and the commercial regulatory environment became a “roadblock.” Amazon said the company has suspended plans to launch a commercial drone delivery service in Italy after a strategic evaluation. An Amazon spokesperson said in an email statement, “Despite positive communication and progress with Alitalia regulators, the country's broader commercial regulatory framework currently does not support the long-term goals of the plan.” Prior to this move, Amazon had active talks with the Italian Civil Aviation Authority (ENAC) in June.

South Korean retail giant Coupang (CPNG.US) provided users with more than 1.1 billion US dollars in compensation due to the data breach. Coupang announced that it will provide 1.69 trillion won (about 1.17 billion US dollars) of compensation to 34 million users affected by last month's large-scale data breach. The company issued a statement on Monday local time stating that it plans to provide each eligible customer with a voucher worth 50,000 won to purchase various services. Even old users who have cancelled their accounts after the data breach are eligible. Coupang's interim CEO Harold Rogers called the move a “responsible approach to customers” and promised that the company would “resolutely fulfill all of its responsibilities.” As of press release, Coupang's pre-market shares rose more than 2% on Monday.

Key economic data and event forecasts

At 23:00 Beijing time, the monthly rate of the US existing home contract sales index after the November seasonal adjustment

Changes in US EIA crude oil inventories for the week ending December 19 at 23:30 Beijing time

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal