Qunzhi Consulting: Global display panel market prices continued to maintain a steady trend in December, and it is expected that Q1 2026 will officially enter an upward channel

The Zhitong Finance App learned that on December 29, Sigmaintell (Sigmaintell) released the IT panel price trend vane for late December 2025. According to the content, prices in the global display panel market continued to maintain a steady trend in December. On the demand side, brand demand gradually came to an end at the end of the year, and overall market demand continued to weaken, but some brands increased their procurement efforts for low-cost display panels, which provided some support for December demand. On the supply side, the release of front-end demand for TV panels and the increase in production capacity for small-size G8.X generation applications further squeezed display panel production capacity space, and market supply continued the structurally tight pattern. Qunzhi Consulting predicts that display panel prices may officially enter an upward channel in the first quarter of 2026.

Monitor panel

In December, global display panel market prices continued to maintain a steady trend. On the demand side, brand demand gradually came to an end at the end of the year, and overall market demand continued to weaken; however, due to the stabilization of TV panel prices and the expected price increase in the first quarter of 2026, some brands increased their efforts to prepare and purchase low-cost display panels, which provided some support for December demand. On the supply side, the release of demand for front-end stocking of TV panels and the increase in production capacity for small-size applications in the G8.X generation line further squeezed display panel production capacity space, and market supply continued to be structurally tight. As the supply of some manufacturers shrinks, the concentration of mainstream panel supply has further increased, and the bargaining power of panel manufacturers has been further strengthened. Based on the current state of low profit for display panels and the cost pressure of rising prices of upstream materials, some manufacturers have begun to spread demand for price increases to brands.

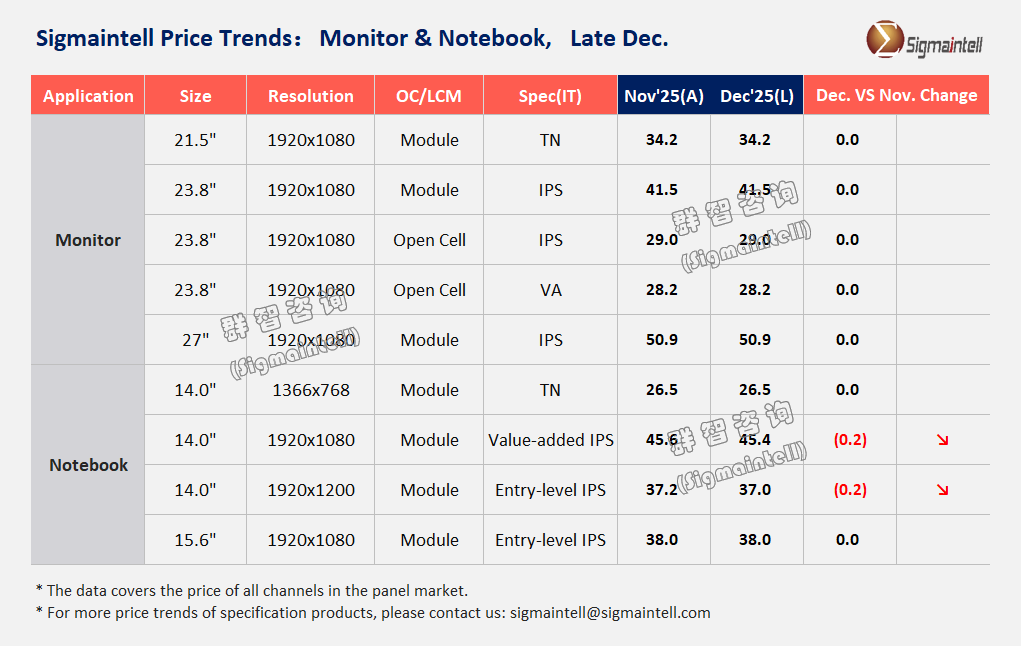

Combining both supply and demand, Qunzhi Consulting predicts that mainstream monitor OC and LCM panel prices are expected to remain stable in December, and the decline in high-end products will narrow; display panel prices may officially enter an upward channel in the first quarter of 2026.

21.5"FHD, Open Cell & LCM mainstream panel prices remained flat month-on-month in December;

23.8 “FHD, Open Cell & LCM mainstream panel prices remained flat month-on-month in December;

27" FHD, Open Cell & LCM mainstream panel prices remained flat month-on-month in December.

Notebook panel

In December, the global notebook panel market continued to be weak, and panel prices are still facing downward pressure. On the demand side, due to weak terminal retail performance, inventory pressure remains on some brands. Towards the end of the year, most brands have basically achieved their shipping targets. At this stage, inventory control is the core guide, and the pace of demand release tends to be cautious. On the supply side, laptop panels have now become a key target application for the layout of various panel manufacturers. They occupy a high priority in the G8.x generation line capacity allocation, and the overall supply trend in the market continues to be relaxed. Combined with the double impact of the shortage of core components and rising prices, the cost pressure on the brand side increased sharply, and the demand for cost transfer became more intense, further increasing the downward pressure on panel prices.

Combining both supply and demand factors, Qunzhi Consulting predicts that panel price competition in mainstream laptop market segments will further intensify in December. The panel price performance is as follows:

Low-end HD TN: The average price of mainstream TN LCM is expected to remain flat in December;

For IPS FHD&FHD+ products, the prices of mainstream panels fell slightly by $0.2 at 16:9 and 16:10 in December; the prices of mid-range and high-end panels continued to diverge.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal