Global Dividend Stocks And 2 More To Boost Your Portfolio

As global markets experience a mix of record highs and cautious optimism, driven by robust U.S. economic growth and AI advancements, investors are keenly observing these dynamics to navigate their portfolios. In such an environment, dividend stocks can offer a blend of income stability and potential appreciation, making them attractive options for those looking to bolster their investment strategies amidst evolving market conditions.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.62% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.71% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.51% | ★★★★★★ |

| NCD (TSE:4783) | 4.03% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.02% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.62% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.79% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.75% | ★★★★★★ |

Click here to see the full list of 1294 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Nippon Denko (TSE:5563)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Denko Co., Ltd. operates in Japan through its subsidiaries, focusing on ferroalloys, functional materials, incineration ash recycling, aqua solutions, and electric power businesses with a market cap of ¥43.52 billion.

Operations: Nippon Denko Co., Ltd.'s revenue is primarily derived from its Ferroalloy Business at ¥51.19 billion, followed by the Functional Materials Business at ¥15.04 billion, Incineration Ash Recycling Business at ¥8.48 billion, Aqua Solution Business at ¥1.63 billion, and Electric Power Business at ¥1.35 billion.

Dividend Yield: 3.1%

Nippon Denko's dividend payments have been volatile over the past decade, lacking reliability despite a recent increase. The current payout ratio of 79.7% suggests dividends are covered by earnings, and a cash payout ratio of 38% indicates solid coverage by cash flows. However, its dividend yield of 3.14% is below the top tier in Japan's market. Recent buybacks and strategic expansions in recycling facilities could impact future financial stability and dividend potential positively or negatively.

- Take a closer look at Nippon Denko's potential here in our dividend report.

- Our valuation report unveils the possibility Nippon Denko's shares may be trading at a premium.

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Financial Partners Group Co., Ltd., along with its subsidiaries, offers a range of financial products and services in Japan, with a market capitalization of ¥157.42 billion.

Operations: Financial Partners Group Co., Ltd. generates revenue through its diverse offerings of financial products and services within Japan.

Dividend Yield: 6.7%

Financial Partners Group's dividend yield is among the top 25% in Japan, yet its history of volatile payments raises concerns about reliability. The recent decrease from JPY 81.55 to JPY 65.20 per share highlights this volatility. Despite a reasonable payout ratio of 70.3% and strong cash flow coverage at a cash payout ratio of 9.7%, high debt levels and fluctuating share prices may affect future stability and dividend consistency, especially following their recent JPY 13.5 billion debt financing agreement.

- Get an in-depth perspective on Financial Partners GroupLtd's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Financial Partners GroupLtd's share price might be too pessimistic.

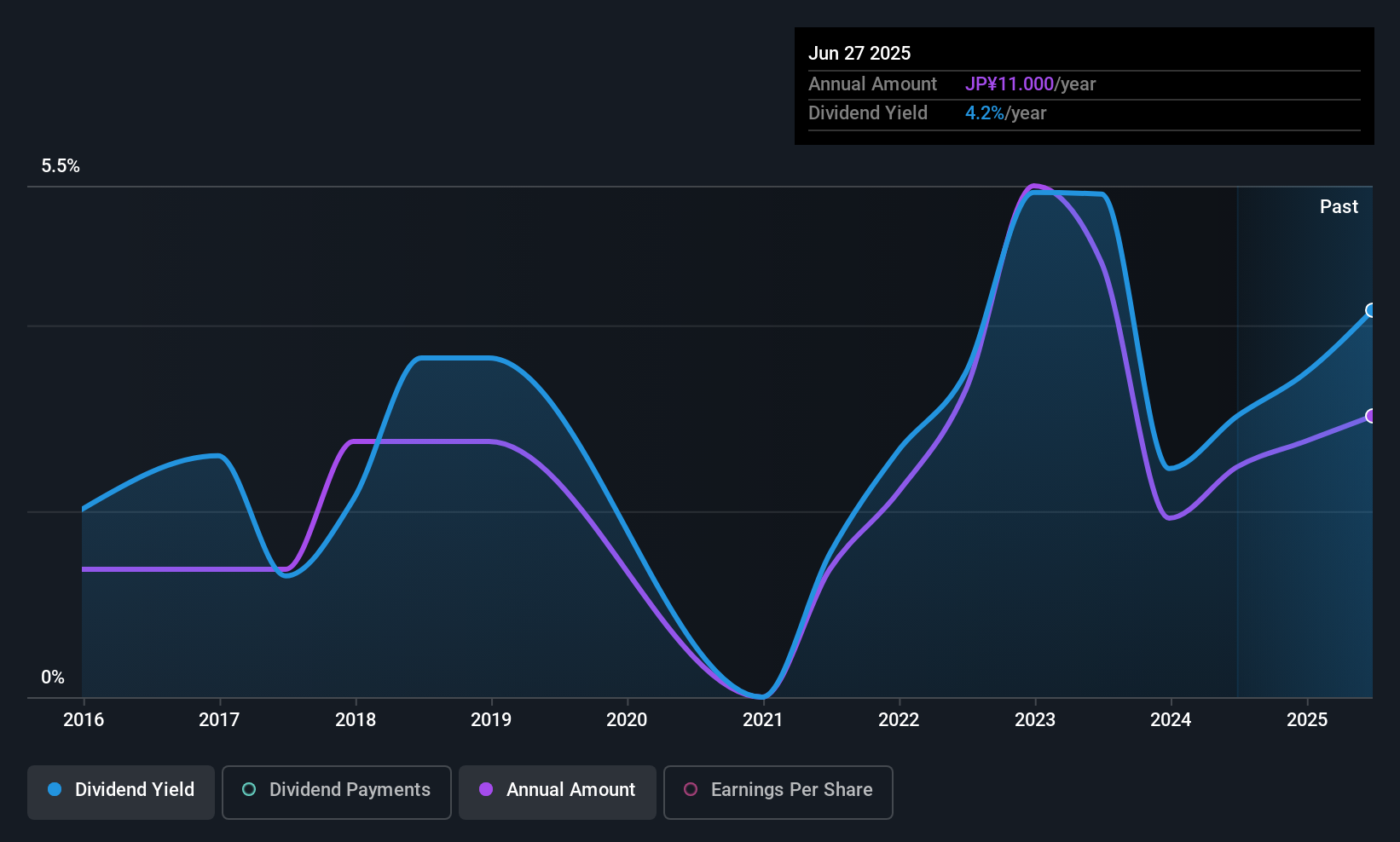

Japan Pulp and Paper (TSE:8032)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Japan Pulp and Paper Company Limited is involved in the manufacture, import, export, distribution, wholesale, and sale of paper-related products globally with a market cap of ¥98.81 billion.

Operations: Japan Pulp and Paper Company Limited generates revenue through its operations in the manufacture, import, export, distribution, wholesale, and sale of paper, paperboards, pulp, and related products across Japan and various international markets including Europe, Asia, Oceania, and North America.

Dividend Yield: 4.7%

Japan Pulp and Paper offers a high dividend yield of 4.65%, ranking in the top 25% of Japanese dividend payers, with stable payouts over the past decade supported by a payout ratio of 55.5% and cash payout ratio of 29.9%. However, recent earnings guidance revisions indicate challenges, including reduced operating profit forecasts to ¥11.5 billion and profit attributable to owners down to ¥2 billion, amid competitive pressures and increased costs in key markets.

- Click to explore a detailed breakdown of our findings in Japan Pulp and Paper's dividend report.

- Our expertly prepared valuation report Japan Pulp and Paper implies its share price may be too high.

Next Steps

- Unlock our comprehensive list of 1294 Top Global Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal