European Value Stocks Trading Below Estimated Worth December 2025

As the pan-European STOXX Europe 600 Index hovers near record highs, buoyed by positive sentiment about future earnings and economic prospects, investors are increasingly on the lookout for stocks trading below their intrinsic value. In such a market environment, identifying undervalued stocks can offer potential opportunities for those who focus on strong fundamentals and long-term growth potential.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Streamwide (ENXTPA:ALSTW) | €72.60 | €142.33 | 49% |

| Sanoma Oyj (HLSE:SANOMA) | €9.21 | €18.39 | 49.9% |

| Redelfi (BIT:RDF) | €11.70 | €23.29 | 49.8% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.278 | €8.48 | 49.6% |

| LINK Mobility Group Holding (OB:LINK) | NOK32.95 | NOK65.86 | 50% |

| Hemnet Group (OM:HEM) | SEK170.90 | SEK337.28 | 49.3% |

| cyan (XTRA:CYR) | €2.26 | €4.51 | 49.8% |

| Artifex Mundi (WSE:ART) | PLN12.20 | PLN24.33 | 49.9% |

| Allegro.eu (WSE:ALE) | PLN30.625 | PLN60.14 | 49.1% |

| Allcore (BIT:CORE) | €1.345 | €2.66 | 49.4% |

Let's review some notable picks from our screened stocks.

Tinexta (BIT:TNXT)

Overview: Tinexta S.p.A. and its subsidiaries offer digital trust, cybersecurity, and business innovation services across several regions including Italy, France, Spain, the rest of the EU, the United Kingdom, and the UAE; it has a market cap of €682.41 million.

Operations: Tinexta's revenue is derived from its segments in cybersecurity (€132.23 million), digital trust (€214.40 million), and business innovation services (€160.30 million).

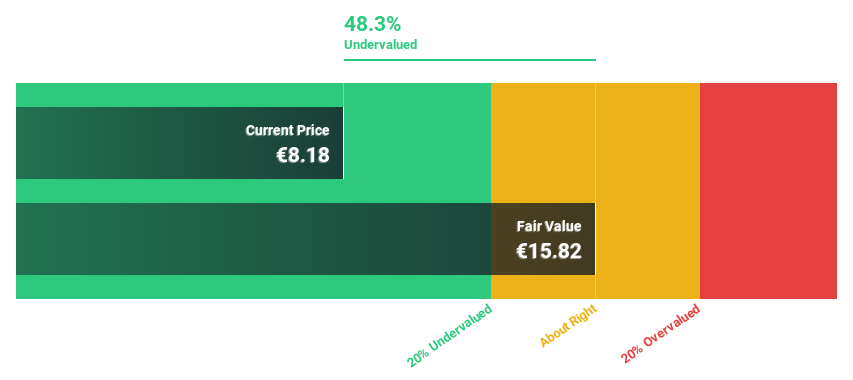

Estimated Discount To Fair Value: 15.4%

Tinexta S.p.A. is trading at €14.87, 15.4% below its estimated fair value of €17.57, suggesting it may be undervalued based on cash flows despite a high level of debt and a net loss of €17.56 million for the nine months ended September 30, 2025. While earnings are forecast to grow significantly at 44.1% annually over the next three years, recent results show large one-off items impacting financials and a dividend not well covered by earnings.

- Our growth report here indicates Tinexta may be poised for an improving outlook.

- Navigate through the intricacies of Tinexta with our comprehensive financial health report here.

MilDef Group (OM:MILDEF)

Overview: MilDef Group AB (publ) develops, manufactures, and sells rugged IT solutions across various countries including Sweden, Norway, Finland, Denmark, the United Kingdom, Germany, Switzerland, the United States, and Australia with a market cap of SEK5.79 billion.

Operations: The company's revenue from its computer hardware segment is SEK1.68 billion.

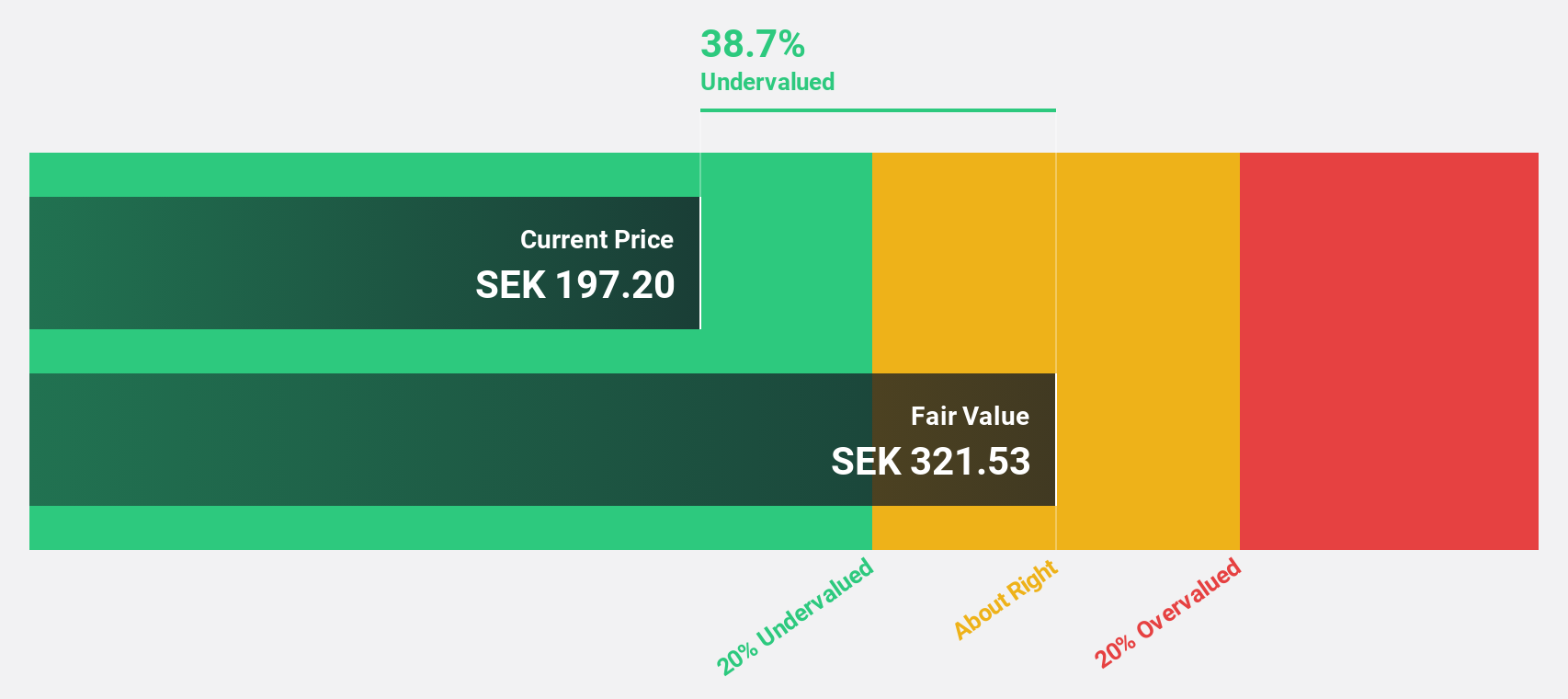

Estimated Discount To Fair Value: 43.4%

MilDef Group, trading at SEK122.9, is significantly undervalued with a fair value estimate of SEK217.01 and is poised for robust growth, forecasting 83% annual earnings increase over the next three years. Recent Q3 results showed substantial sales growth to SEK539.7 million from SEK249.9 million year-over-year, alongside increased net income and EPS figures. The company’s expansion in Sweden and significant NATO-related contracts underscore its capacity to capitalize on defense sector demands efficiently.

- Our comprehensive growth report raises the possibility that MilDef Group is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in MilDef Group's balance sheet health report.

Vitrolife (OM:VITR)

Overview: Vitrolife AB (publ) is a company that offers assisted reproduction products across Europe, the Middle East, Africa, Asia-Pacific, and the Americas with a market cap of approximately SEK18.67 billion.

Operations: The company's revenue is derived from three primary segments: Genetics (SEK1.44 billion), Consumables (SEK1.38 billion), and Technologies (SEK694 million).

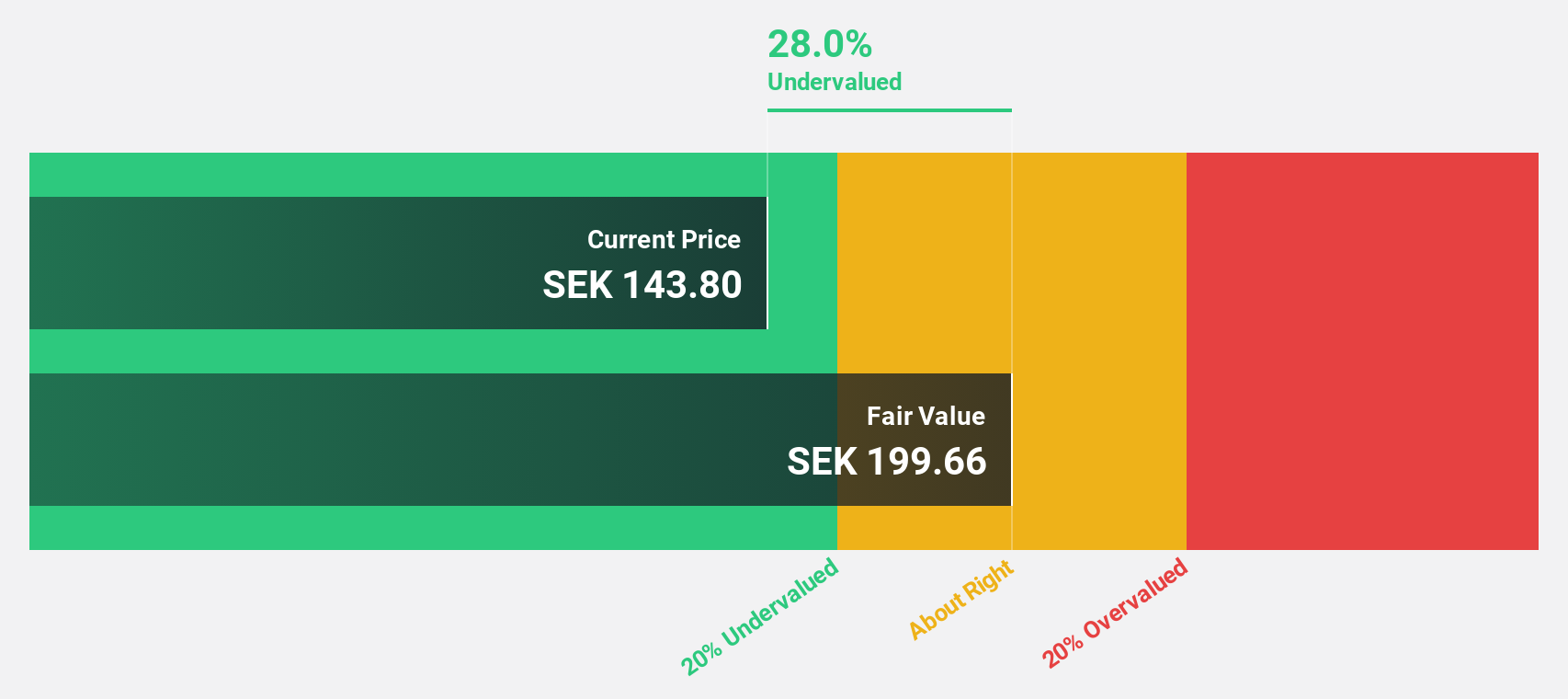

Estimated Discount To Fair Value: 30.3%

Vitrolife, trading at SEK137.9, is undervalued with a fair value estimate of SEK197.97 and anticipates significant earnings growth of 21.2% annually over the next three years, outpacing the Swedish market's 13.6%. Despite a goodwill impairment of SEK5.4 billion due to Igenomix acquisition and restructuring costs of SEK55 million in Q4 2025, strategic downsizing aims for annual savings of SEK65 million by Q3 2026, enhancing profitability potential amidst slower revenue growth projections.

- The analysis detailed in our Vitrolife growth report hints at robust future financial performance.

- Take a closer look at Vitrolife's balance sheet health here in our report.

Next Steps

- Unlock our comprehensive list of 191 Undervalued European Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal