Bitfarms Ltd.'s (TSE:BITF) 25% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Bitfarms Ltd. (TSE:BITF) shares have had a horrible month, losing 25% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 56%, which is great even in a bull market.

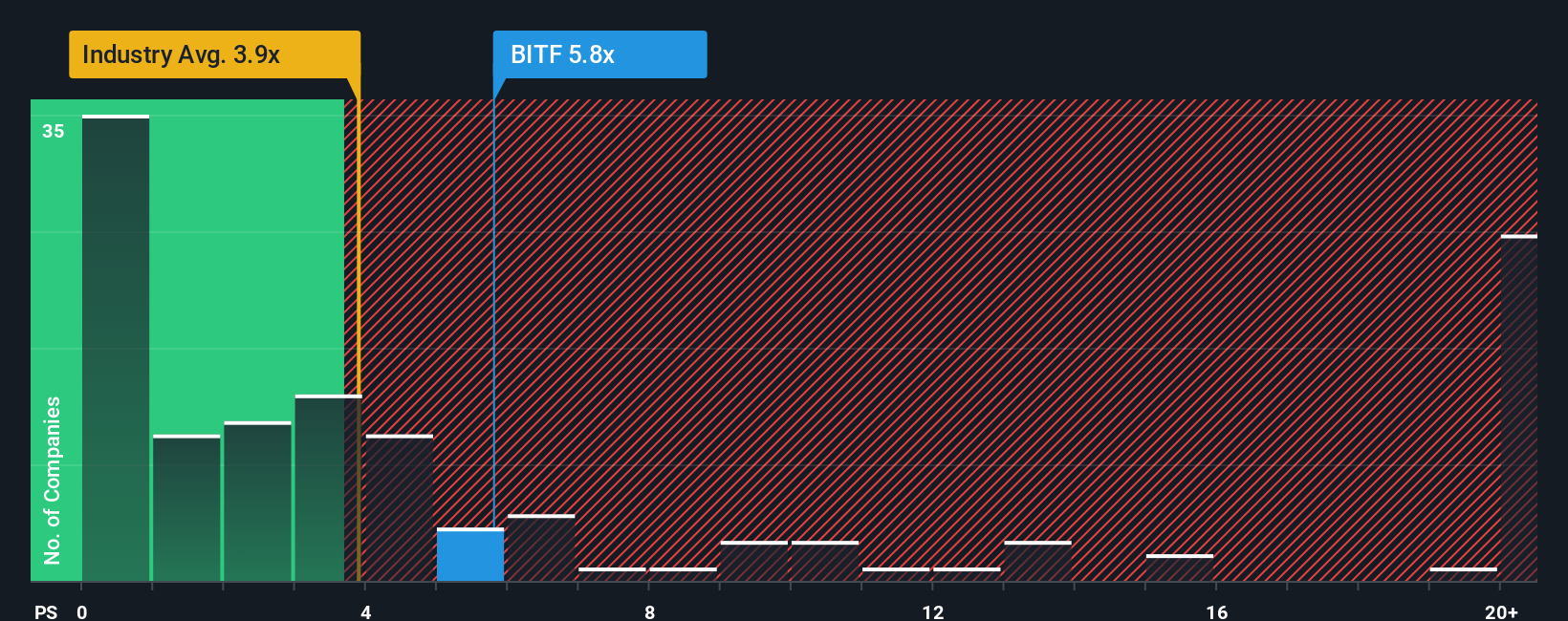

Although its price has dipped substantially, Bitfarms' price-to-sales (or "P/S") ratio of 5.8x might still make it look like a sell right now compared to the wider Software industry in Canada, where around half of the companies have P/S ratios below 3.9x and even P/S below 1.5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Bitfarms

What Does Bitfarms' P/S Mean For Shareholders?

Recent times have been advantageous for Bitfarms as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bitfarms.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Bitfarms would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 95% gain to the company's top line. The latest three year period has also seen an excellent 58% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 3.4% during the coming year according to the seven analysts following the company. That's not great when the rest of the industry is expected to grow by 34%.

With this in mind, we find it intriguing that Bitfarms' P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

There's still some elevation in Bitfarms' P/S, even if the same can't be said for its share price recently. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Bitfarms' analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 3 warning signs for Bitfarms (1 is concerning!) that we have uncovered.

If you're unsure about the strength of Bitfarms' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal