DoorDash (DASH): Revisiting Valuation After Strong Multi‑Year Share Price Performance

DoorDash (DASH) has quietly outperformed the broader market this year, with the stock up roughly 36% year to date and about 35% over the past year, drawing fresh attention to its valuation.

See our latest analysis for DoorDash.

That strength has not been a straight line, with a 23.38% 1 month share price return contrasting with a weaker 90 day patch, but the longer term trend and three year total shareholder return of 395.33% still point to solid momentum.

If DoorDash has you rethinking growth stories in this market, it could be a good moment to explore other high potential names through fast growing stocks with high insider ownership.

With shares near all time highs, double digit revenue growth, and analysts still seeing upside, investors now face a key question: is DoorDash still undervalued or is the market already pricing in its future expansion?

Most Popular Narrative Narrative: 16% Undervalued

With DoorDash last closing at $232.06 against a narrative fair value near $276, the story centers on whether powerful growth levers can sustain that gap.

Accelerating growth of high margin revenue streams (notably, platform advertising and emerging SaaS offerings like the SevenRooms acquisition) is expanding DoorDash's profit pool beyond core delivery, supporting further earnings upside.

Curious how much faster profits must grow, and which margin uplift justifies this premium price tag? The narrative leans on bold revenue, margin, and earnings assumptions that radically reshape DoorDash's long term earnings power.

Result: Fair Value of $276.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory pressure on gig work and heavier international investment could inflate costs and compress margins, which could quickly challenge today’s optimistic growth assumptions.

Find out about the key risks to this DoorDash narrative.

Another Lens On Valuation

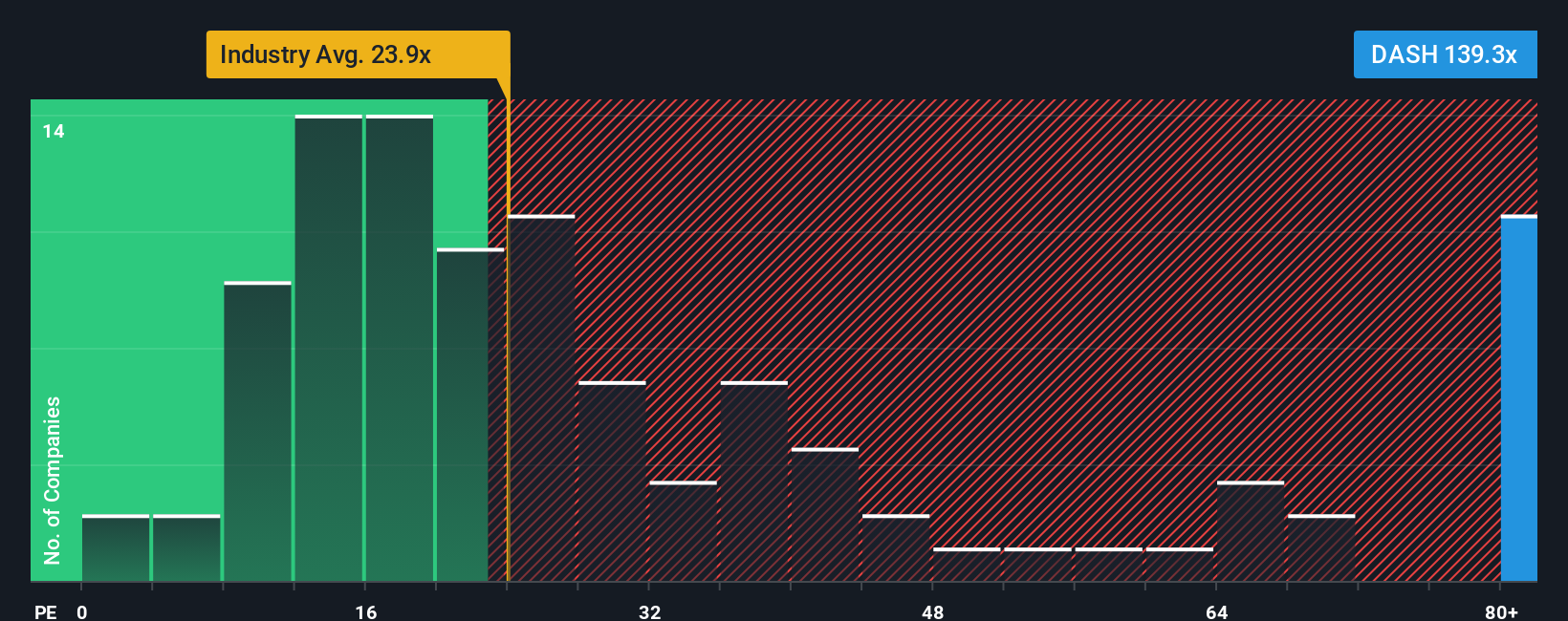

On earnings, the picture flips. DoorDash trades on a lofty 115.9x price to earnings ratio versus a 21.9x industry average and a 35.1x peer average. Our fair ratio points closer to 50.3x, suggesting meaningful downside risk if sentiment or growth expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DoorDash Narrative

If you see DoorDash differently, or want to stress test the numbers yourself, you can build a personalized thesis in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding DoorDash.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning hand picked ideas on Simply Wall St that match your strategy and keep you one step ahead.

- Target reliable cash generators with these 10 dividend stocks with yields > 3% that can potentially boost portfolio income while still keeping fundamentals in focus.

- Position yourself for the next wave of innovation by reviewing these 24 AI penny stocks that could benefit most from accelerating AI adoption.

- Capitalize on mispriced opportunities through these 901 undervalued stocks based on cash flows and avoid watching tomorrow’s winners run away without you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal