How Investors May Respond To Cheniere Energy Partners (CQP) Focus On Long-Term LNG Fee Contracts

- Earlier this week, analysts reiterated a positive stance on Cheniere Energy Partners, emphasizing its Sabine Pass LNG operations and long-term, fee-based contracts that cover most of its production and underpin relatively predictable cash flows.

- An important nuance for income-focused investors is that this contract structure, combined with the proposed Sabine Pass Expansion Project, is seen as supporting the partnership’s ability to maintain and potentially grow cash distributions over time.

- Next, we’ll examine how this emphasis on long-term, fee-based LNG contracts shapes Cheniere Energy Partners’ investment narrative for investors.

Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Cheniere Energy Partners' Investment Narrative?

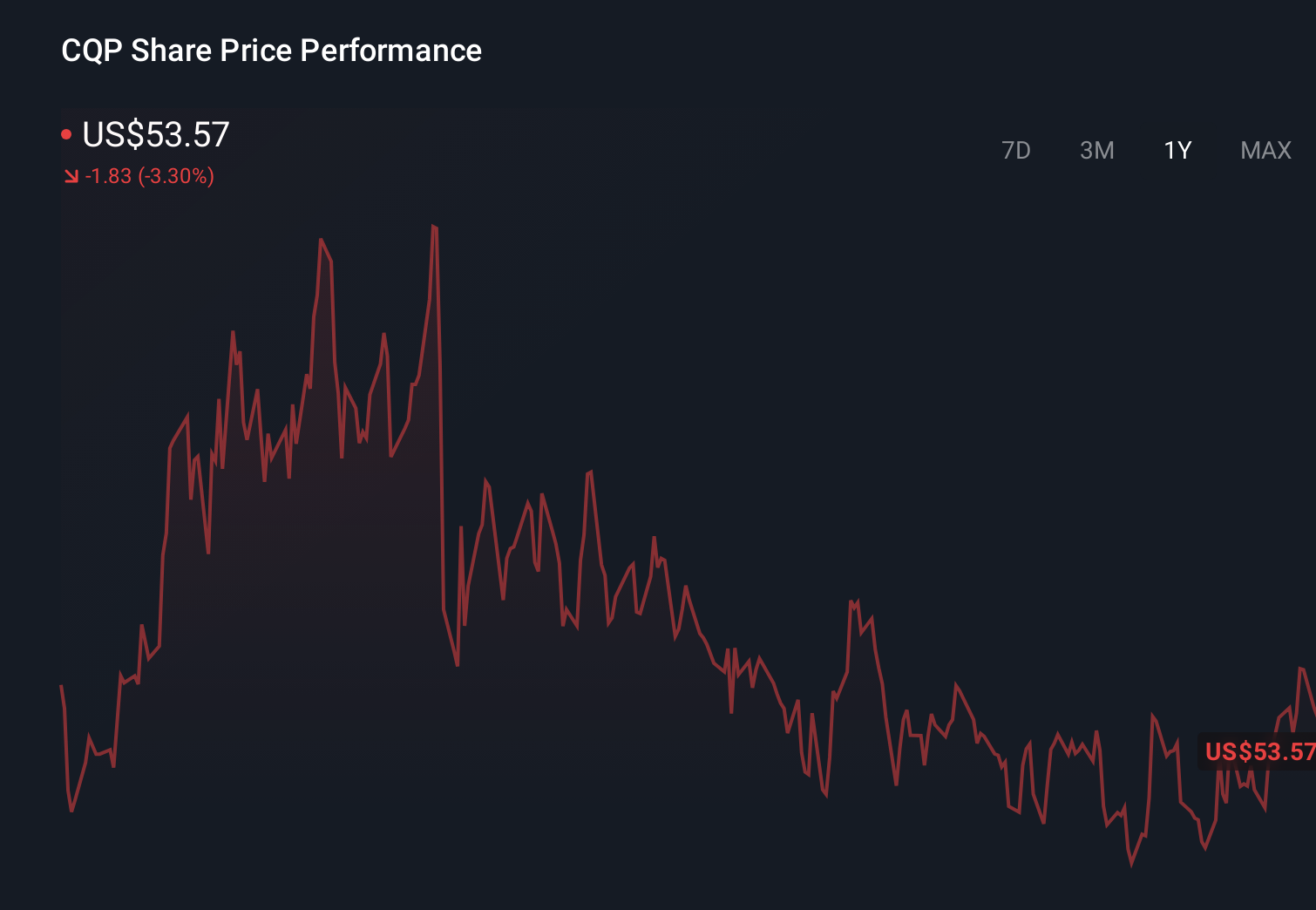

To own Cheniere Energy Partners, you need to be comfortable with a slow‑growth, income‑first story anchored in long‑term, fee‑based LNG contracts at Sabine Pass. The recent analyst reiteration largely reinforces what the numbers already suggest: cash flows look relatively stable, distributions are still being affirmed, and the Sabine Pass Expansion Project remains the key medium‑term swing factor rather than an immediate game‑changer. In the near term, the more practical catalysts are continued delivery on 2025 distribution guidance, progress on refinancing nearer‑dated debt, and any regulatory or funding milestones on the expansion. On the risk side, negative equity and debt not being well covered by operating cash flow keep the balance sheet in focus, and softer recent earnings and unit price underperformance show how quickly sentiment can cool if cash generation or project execution disappoints.

However, investors should not overlook how the current debt load and negative equity shape the risk profile. Cheniere Energy Partners' shares are on the way up, but they could be overextended by 7%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Cheniere Energy Partners - why the stock might be worth 6% less than the current price!

Build Your Own Cheniere Energy Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cheniere Energy Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Cheniere Energy Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cheniere Energy Partners' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal