Is Williams-Sonoma Still Attractive After Its 249% Three Year Share Price Surge?

- If you are wondering whether Williams-Sonoma is still a bargain after its huge run up, you are not alone. This stock has quietly turned into one of the market's standout retail winners.

- The share price is now around $189.47, up roughly 2.0% over the past week, 9.1% over the last month, and an eye catching 249.2% over three years. This naturally raises the question of how much upside is really left.

- Investors have been reacting to a steady drumbeat of positive business updates, from strong demand for premium home goods to ongoing buybacks and an emphasis on higher margin, design led brands. In addition, the market has been rewarding companies that show pricing power and disciplined inventory management. Both of these factors have helped Williams-Sonoma stand out in a competitive retail landscape.

- Despite this strong track record, Williams-Sonoma only scores a 2/6 valuation checks for being undervalued, which means there is a mixed message when you look at different models. Next, we will break down those valuation approaches in detail and then finish with a more holistic way to think about what the market might really be pricing in.

Williams-Sonoma scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Williams-Sonoma Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and then discounting those cash flows back to their value in todays dollars.

For Williams-Sonoma, the model starts with last twelve month Free Cash Flow of about $1.11 billion and projects how this might evolve over time. Analyst estimates cover the next few years, with Free Cash Flow expected to reach around $1.30 billion by 2028. Beyond that, Simply Wall St extrapolates cash flows out to 2035, assuming progressively slower growth as the business matures.

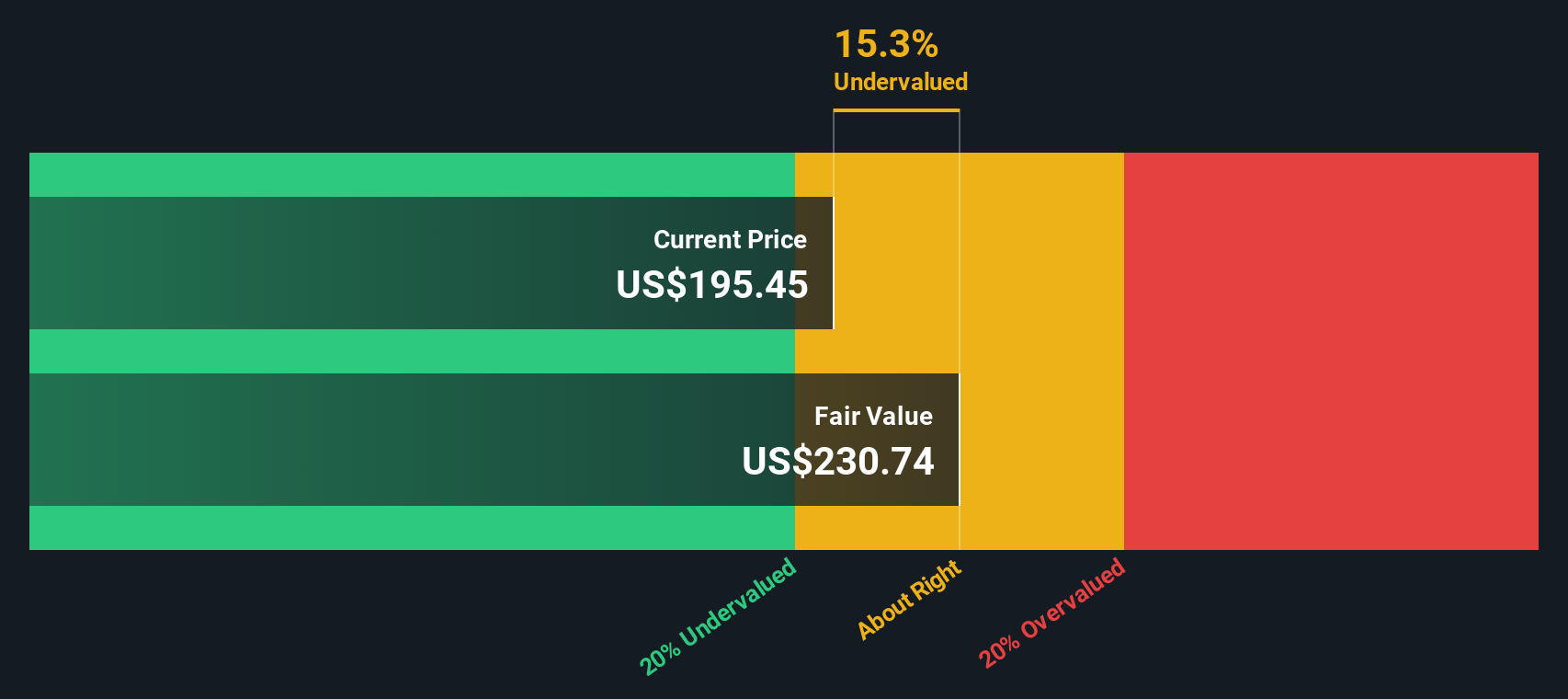

When all those projected cash flows are discounted back and added together under the 2 Stage Free Cash Flow to Equity approach, the implied intrinsic value comes out to roughly $203.54 per share. Compared with the recent share price of about $189.47, the DCF suggests the stock is trading at a modest 6.9% discount, so only slightly below estimated fair value.

Result: ABOUT RIGHT

Williams-Sonoma is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Williams-Sonoma Price vs Earnings

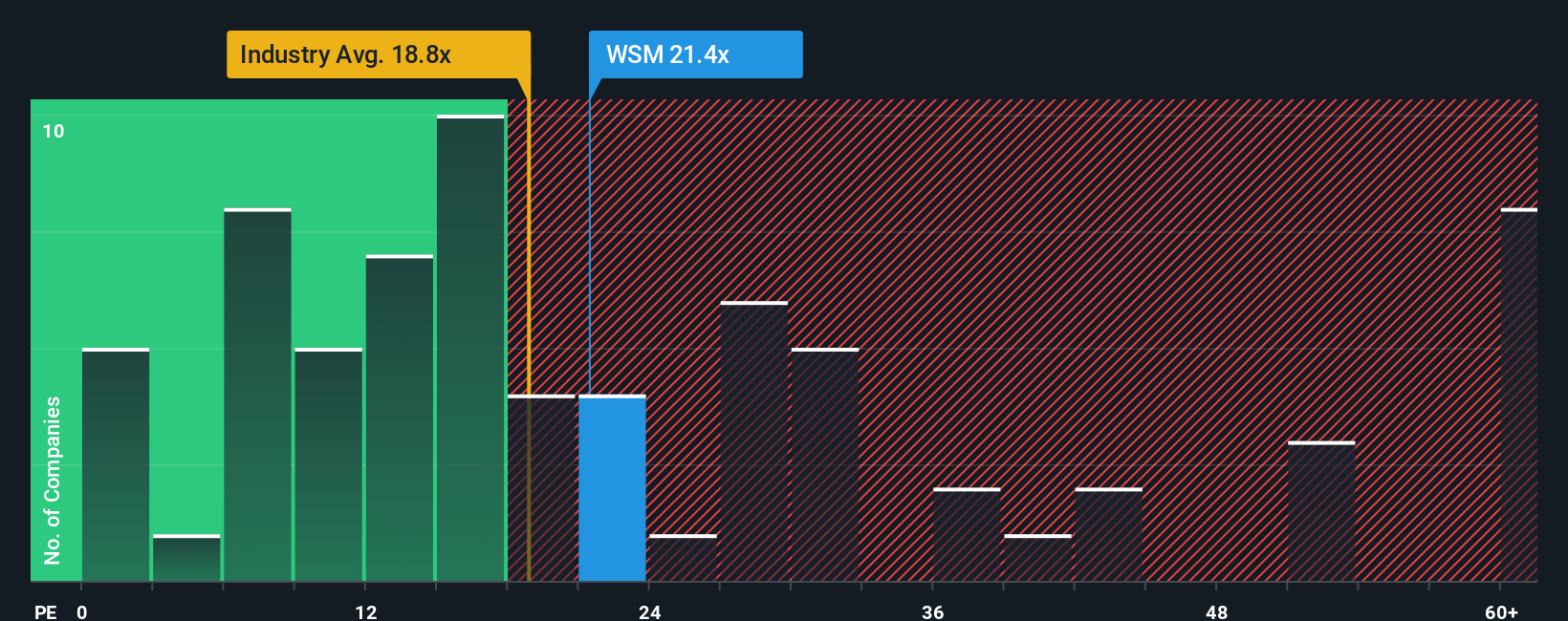

For profitable, established businesses like Williams-Sonoma, the price to earnings ratio is often the most intuitive yardstick, because it directly links what investors pay today with the companys current earning power. In general, faster growing and lower risk companies can justify trading on higher PE multiples, while slower or more volatile businesses tend to warrant lower ones.

Williams-Sonoma currently trades on a PE of about 20.0x, which is slightly above the broader Specialty Retail industry average of roughly 19.9x and below the peer group average of around 25.3x. Simply Wall St also calculates a Fair Ratio of about 17.0x, a proprietary estimate of what a reasonable PE should be once you factor in Williams-Sonomas specific earnings growth outlook, profitability, risk profile, industry positioning and market cap.

This Fair Ratio approach is more tailored than simple peer or industry comparisons, which can be skewed by very high growth or distressed companies. In this case, the shares trade meaningfully above the 17.0x Fair Ratio, suggesting the market is already pricing in a premium for quality and resilience beyond what those fundamentals alone would support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Williams-Sonoma Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page where you connect your view of Williams-Sonoma’s story to explicit forecasts for revenue, earnings, and margins. These then roll up into a Fair Value you can compare with today’s price to decide whether to buy, hold, or sell.

Instead of relying only on static ratios, a Narrative lets you spell out why you think, for example, ongoing AI powered supply chain gains and premium brand strength justify a Fair Value closer to the bullish case around $230, or why tariff and housing risks mean you prefer a more cautious Fair Value near the bearish $138. The platform will dynamically refresh that Narrative as new results, news, and guidance arrive so your decision making stays aligned with the latest information.

Do you think there's more to the story for Williams-Sonoma? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal