ITT (ITT): Reassessing Valuation After a 25% Year-to-Date Rally and Recent Pullback

ITT (ITT) has quietly rewarded patient investors, with the stock up around 25% year to date despite a slight pullback this month. Under the hood, the industrial fundamentals look stronger than the recent price suggests.

See our latest analysis for ITT.

That climb has not been a straight line. The latest dip followed a strong run where the 7 day share price return was 3.28 percent and the 3 year total shareholder return reached 130.09 percent, suggesting momentum is still broadly constructive around a 177.73 dollar share price.

If the ITT story has you thinking more broadly about industrial demand and infrastructure spending, it could be a good moment to scan aerospace and defense stocks as a fresh set of ideas to research next.

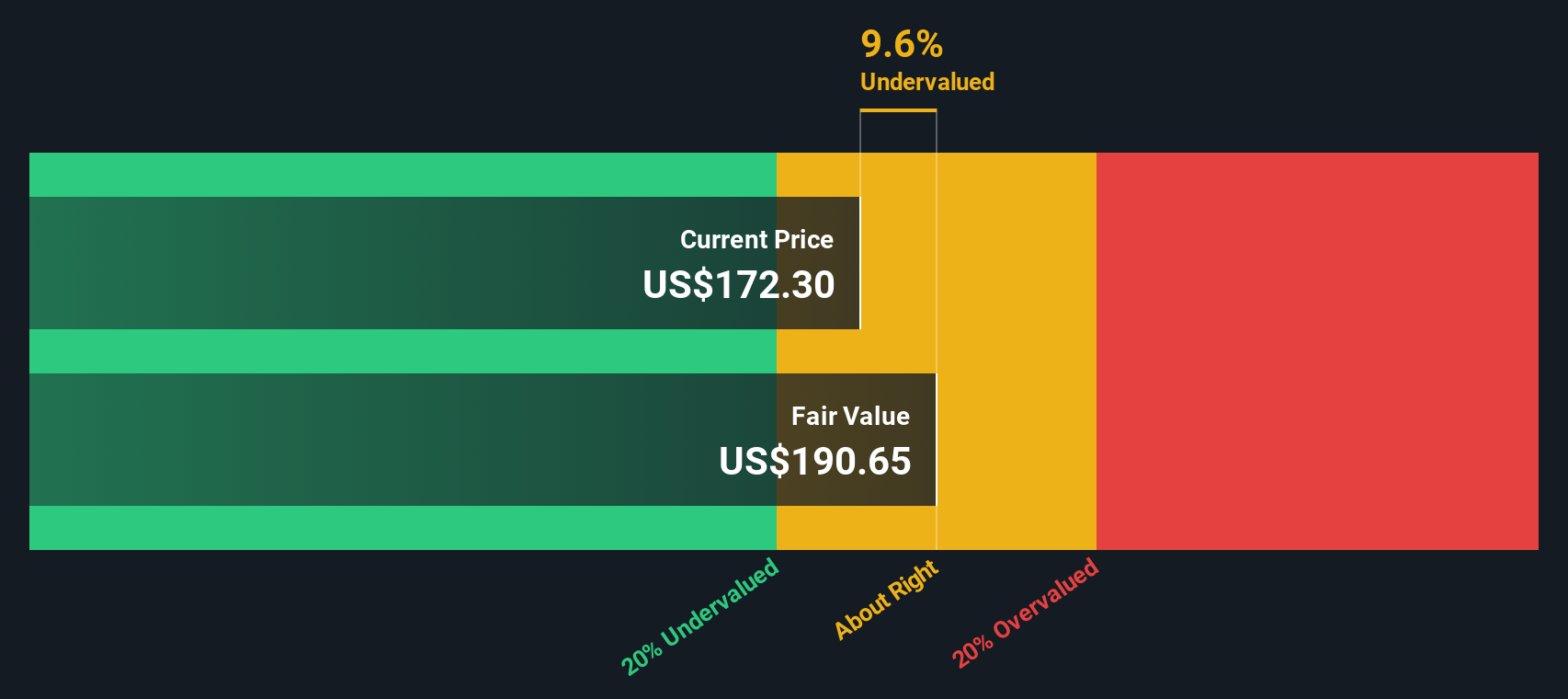

Yet with earnings still growing faster than sales and the stock sitting below consensus price targets, the key question now is simple: Is ITT still undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 14.7% Undervalued

With ITT closing at 177.73 dollars against a narrative fair value near 208 dollars, the story leans toward upside if execution holds.

Operational improvements such as automation, productivity initiatives, and strategic pricing combined with visibility from a 2 billion dollar backlog and resilient end markets are expected to drive further gains in operating margins, free cash flow conversion, and EPS over the medium and long term. These factors underpin expectations for sustained performance through industry cycles and contribute to a structurally stronger earnings profile.

Curious how steady, mid single digit growth can still justify a premium style valuation? The narrative leans heavily on margin upgrades and disciplined share count reduction. Want to see which forward earnings power assumptions make that 200 plus dollar fair value plausible, and how closely they mirror mature tech style multiples? Dive into the full narrative to unpack the exact growth, margin, and discount rate levers behind this call.

Result: Fair Value of $208.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on smooth project execution and disciplined M&A. Delays, integration missteps, or pricing pressure could quickly erode today’s margin narrative.

Find out about the key risks to this ITT narrative.

Another View: Cash Flows Point to Caution

While the narrative fair value suggests upside, our DCF model paints a different picture, with ITT trading around 177.73 dollars versus an estimated fair value near 149.34 dollars, which implies the shares may be overvalued. Which lens should investors consider when growth is steady but not spectacular?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ITT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ITT Narrative

If this perspective does not fully align with your own, you can quickly dig into the numbers yourself and craft a personal thesis in minutes, Do it your way.

A great starting point for your ITT research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at just one opportunity. Use the Simply Wall Street Screener to uncover focused, data driven stock ideas tailored to your next move.

- Target reliable income streams by scanning these 10 dividend stocks with yields > 3% that may strengthen your portfolio with consistent cash returns.

- Fuel your growth strategy by checking these 24 AI penny stocks positioned to benefit from accelerating demand for intelligent automation.

- Upgrade your value watchlist by reviewing these 903 undervalued stocks based on cash flows before the market fully prices in their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal