Accenture (ACN) Valuation Check After Recent Share Price Rebound

Accenture (ACN) has quietly staged a meaningful rebound over the past month, climbing about 11% after a tough year in which the stock is still down roughly 23% year to date.

See our latest analysis for Accenture.

That recent 30 day share price return of about 11%, taking Accenture to around $269.98, stands in contrast to its negative year to date share price performance and softer one year total shareholder return. This hints that sentiment may be stabilising after a reset.

If this rebound has you rethinking the tech services space, it could be a good moment to see what else is gaining traction across high growth tech and AI stocks.

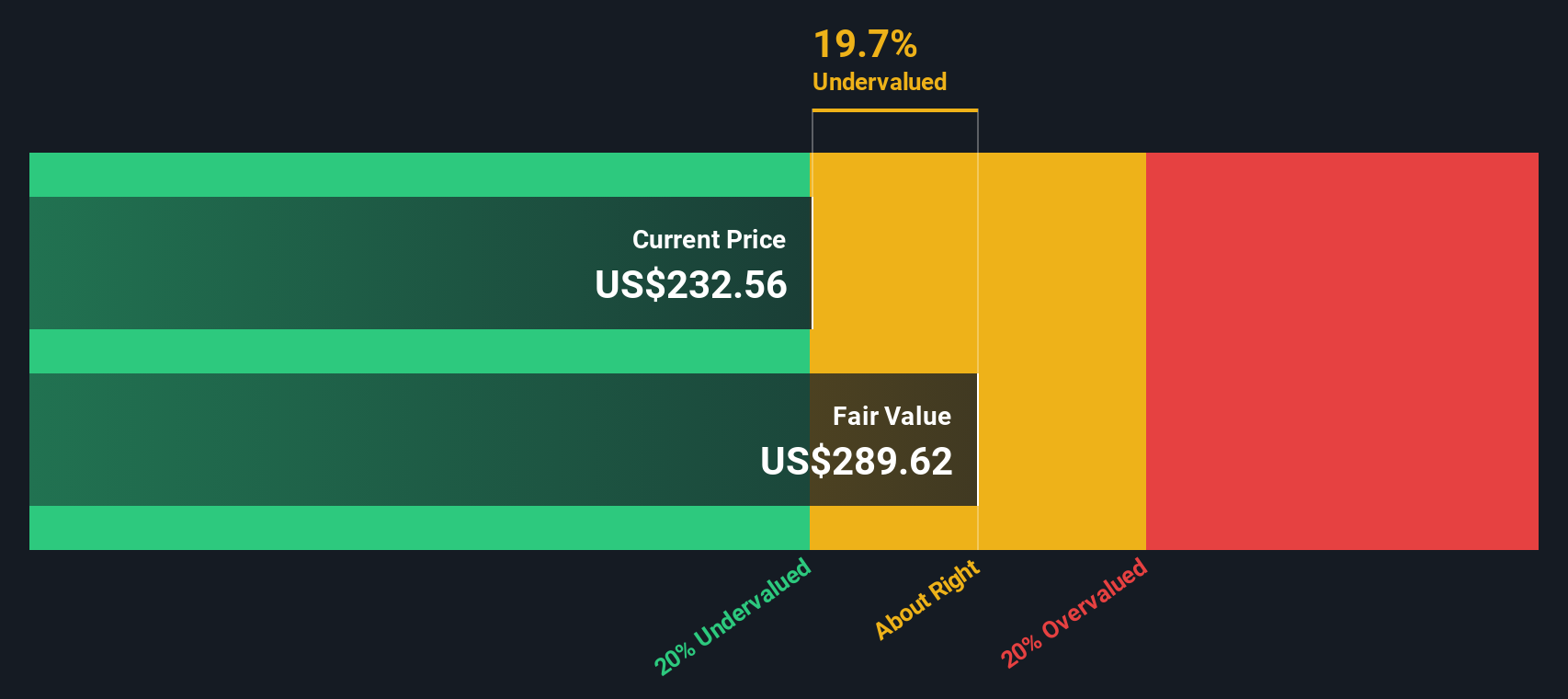

With Accenture still trading at a sizable intrinsic discount yet already near analyst targets, the key question now is simple: is this a genuine value opportunity, or has the market largely priced in its next leg of growth?

Most Popular Narrative Narrative: 33.4% Overvalued

According to FCruz, the most followed narrative sees Accenture trading materially above its estimated fair value of $202.38, despite Friday's $269.98 close.

Read through. After a sector de rating, ACN trades around its long run average multiple with superior profitability and returns on capital for a services name.

Curious how a company with strong margins, disciplined cash returns, and a rich future earnings multiple can still screen as overvalued on cash flows alone? Dive in.

Result: Fair Value of $202.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, soft bookings momentum and elongated consulting decision cycles could still undercut optimism if GenAI proof of concepts fail to scale meaningfully.

Find out about the key risks to this Accenture narrative.

Another Lens on Valuation

FCruz’s narrative leans on a fair value of $202.38 to call Accenture overvalued, but our DCF model points the other way, suggesting shares at $269.98 are trading about 23% below an intrinsic value of $351.33. When cash flows and multiples disagree this sharply, which signal should matter more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Accenture Narrative

If you see the story unfolding differently or prefer to lean on your own research, you can craft a complete view in minutes, Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Accenture.

Ready for your next investing moves?

Do not stop at one idea; use the Simply Wall Street Screener to quickly surface fresh opportunities that match your strategy before the market fully catches on.

- Capture potential multi baggers early by scanning these 3626 penny stocks with strong financials that pair small size with surprisingly resilient fundamentals and tangible business momentum.

- Position ahead of the next tech wave by targeting these 24 AI penny stocks shaping how software, automation, and intelligent workflows transform entire industries.

- Lock in stronger income streams by reviewing these 10 dividend stocks with yields > 3% that combine meaningful yields with balance sheets built to sustain regular payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal