Reassessing PG&E (PCG) Valuation After Recent Underperformance and Signs of Share Price Stabilization

Why PG&E Is Back on Investors Radar

PG&E (PCG) has quietly lagged the broader market this year, and that underperformance is exactly why more value focused investors are starting to revisit the stock now.

See our latest analysis for PG&E.

At around $15.82, the share price tells a mixed story, with a sharply negative year to date share price return but a solid 90 day rebound suggesting sentiment might be stabilising even as the one year total shareholder return remains firmly in the red.

If PG&E has you rethinking where the next rerating could come from, this is a good moment to explore fast growing stocks with high insider ownership.

With a double digit annual earnings growth rate, a sizeable gap to analyst targets and a still bruised share price, the key question now is simple: is PG&E undervalued or is the market already pricing in its recovery?

Most Popular Narrative Narrative: 25.5% Undervalued

With PG&E last closing at $15.82 against a narrative fair value near the low $20s, the storyline hinges on sustained growth and capital deployment.

Expanding opportunities for capital investment in grid modernization, wildfire mitigation, and resilience fueled by both regulatory mandates and the need to serve new electrification and decarbonization requirements position PG&E to grow its rate base and regulated earnings steadily over the next decade.

Curious how moderate revenue growth, rising margins and a future earnings multiple all combine to justify a higher price today? The full narrative unpacks the cash flow path, the assumed earnings step up and the discount rate that together support this valuation roadmap.

Result: Fair Value of $21.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn wildfire liabilities and shifting California affordability politics could still derail earnings momentum and cap any valuation catch up.

Find out about the key risks to this PG&E narrative.

Another Angle on Value

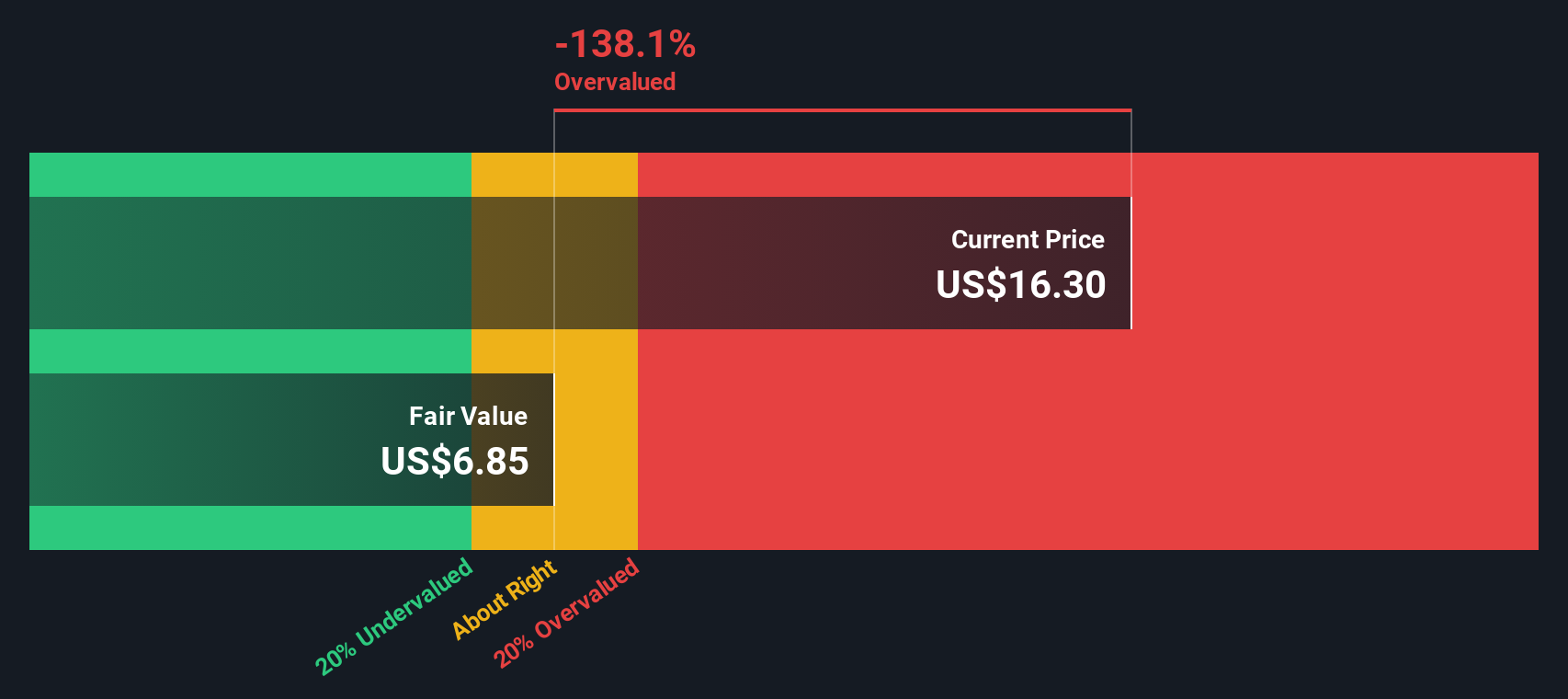

Our SWS DCF model paints a far more cautious picture, suggesting PG&E is actually overvalued at around $15.82 compared to an estimated fair value near $6.85. If the cash flows disappoint, today’s apparent discount to narrative fair value could quickly vanish. Could it be a value trap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PG&E for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PG&E Narrative

If this view does not quite align with your own, or you would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes with Do it your way.

A great starting point for your PG&E research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity now using the Simply Wall Street Screener so you never miss high quality setups again.

- Capitalize on mispriced opportunities by targeting these 901 undervalued stocks based on cash flows that pair strong fundamentals with attractive entry points.

- Ride powerful innovation waves by focusing on these 24 AI penny stocks positioned at the heart of machine learning and automation growth.

- Strengthen your income stream by zeroing in on these 10 dividend stocks with yields > 3% that can potentially support reliable long term payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal