Welltower (WELL): Assessing Valuation After a Strong Multi‑Year Share Price Run

Welltower (WELL) has quietly become one of the strongest performers in healthcare real estate, with shares up about 51% over the past year as investors lean into aging demographic trends.

See our latest analysis for Welltower.

That strong run has come with some bumps, including a recent 1 month share price return of minus 7.22 percent after a powerful year to date share price gain of 50.5 percent and a striking 5 year total shareholder return of 236.2 percent. This still points to momentum consolidating rather than collapsing as investors reassess how much future growth is already priced in at 187.7 dollars per share.

If Welltower has you rethinking the healthcare theme, it could be a good time to scan other high quality names using our curated screener for healthcare stocks.

With revenues and earnings still growing briskly and the share price sitting just below analyst targets, is Welltower now trading at a rare discount to its long term prospects, or has the market already priced in years of demographic tailwinds?

Most Popular Narrative Narrative: 9.5% Undervalued

With Welltower last closing at 187.7 dollars versus a fair value near 207 dollars, the most followed narrative implies notable upside from here.

The analysts have a consensus price target of $180.368 for Welltower based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $240.0, and the most bearish reporting a price target of just $146.0.

Want to see how ambitious revenue growth, rising margins and a lofty future earnings multiple come together to justify this valuation story? The full narrative shows the math behind that optimism, and the single set of assumptions everything hinges on.

Result: Fair Value of $207.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated acquisition spending and persistent macro uncertainty around rates and occupancy could quickly challenge today’s optimistic growth and valuation assumptions.

Find out about the key risks to this Welltower narrative.

Another Angle on Valuation

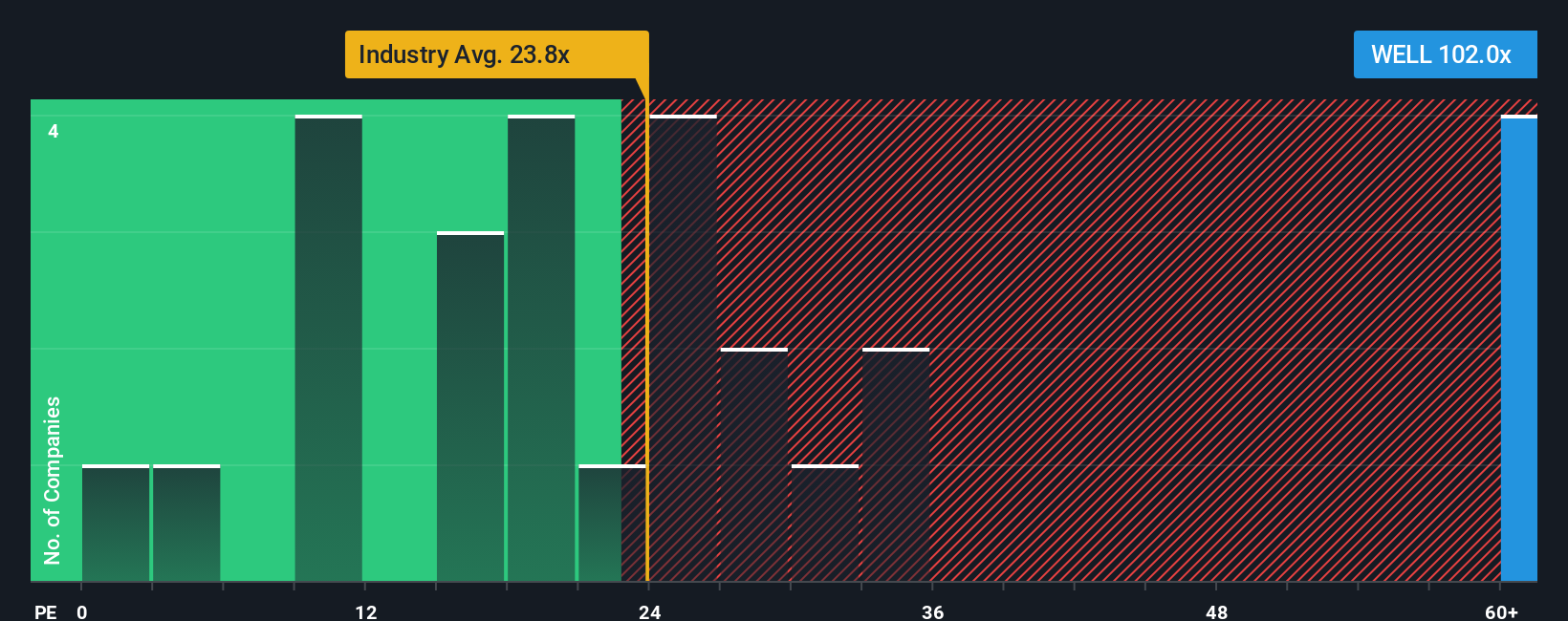

On earnings based metrics, Welltower looks far less forgiving. Its price to earnings ratio of 134.1 times towers over both the sector average of 60.1 times and a fair ratio nearer 37.5 times, suggesting investors are paying a rich premium that could quickly unwind if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Welltower Narrative

If you see the story differently or want to stress test the assumptions with your own numbers, you can build a fresh view in minutes: Do it your way.

A great starting point for your Welltower research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Do not stop with one strong idea. Use the Simply Wall Street Screener to surface fresh opportunities before the crowd spots them and moves the market.

- Capture potential bargain opportunities by targeting companies trading below intrinsic value using these 901 undervalued stocks based on cash flows built from detailed cash flow analysis.

- Capitalize on cutting edge breakthroughs by focusing on innovators reshaping the digital frontier with these 80 cryptocurrency and blockchain stocks.

- Strengthen your income strategy by filtering for reliable payouts with these 10 dividend stocks with yields > 3% that meet your yield targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal