Carlyle Group (CG): Assessing Valuation After Analyst Upgrades, KFC Korea Deal and Medline IPO Plans

Carlyle Group (CG) has been back in the spotlight after a string of bullish developments, from analyst upgrades flagging undervaluation to the KFC Korea acquisition and Medline’s planned multibillion dollar IPO.

See our latest analysis for Carlyle Group.

Those catalysts seem to be feeding into sentiment, with the share price at $60.99 and a strong year to date share price return suggesting momentum is rebuilding, while multi year total shareholder returns remain robust.

If Carlyle’s recent run has you thinking more broadly about where capital is flowing, this could be a good moment to explore fast growing stocks with high insider ownership.

But after a 20 percent year to date rally and a share price now just shy of consensus targets, is Carlyle still trading at a discount to its true earnings power, or has the market already priced in the next leg of growth?

Most Popular Narrative: 7.2% Undervalued

With Carlyle last closing at $60.99 against a narrative fair value of about $65.73, the story here leans toward upside built on recurring fee growth and expanding margins.

Surging institutional allocations to alternatives, reinforced by significant momentum in areas like private credit and asset-based finance (with AUM up 40% YoY), as well as a growing insurance channel (notably Fortitude Re and reinsurance flows), increasingly diversify Carlyle's revenue streams and enhance margins by providing higher recurring, stable fee income across cycles.

Curious how steady fees, rising profitability, and a richer earnings multiple all stack up into that fair value target? The full narrative unpacks the growth math, the margin reset, and the earnings trajectory that aim to justify a higher long term valuation.

Result: Fair Value of $65.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition and higher funding costs could squeeze fees and returns, challenging assumptions around Carlyle’s margin expansion and earnings trajectory.

Find out about the key risks to this Carlyle Group narrative.

Another View: Market Ratios Flash a Caution Sign

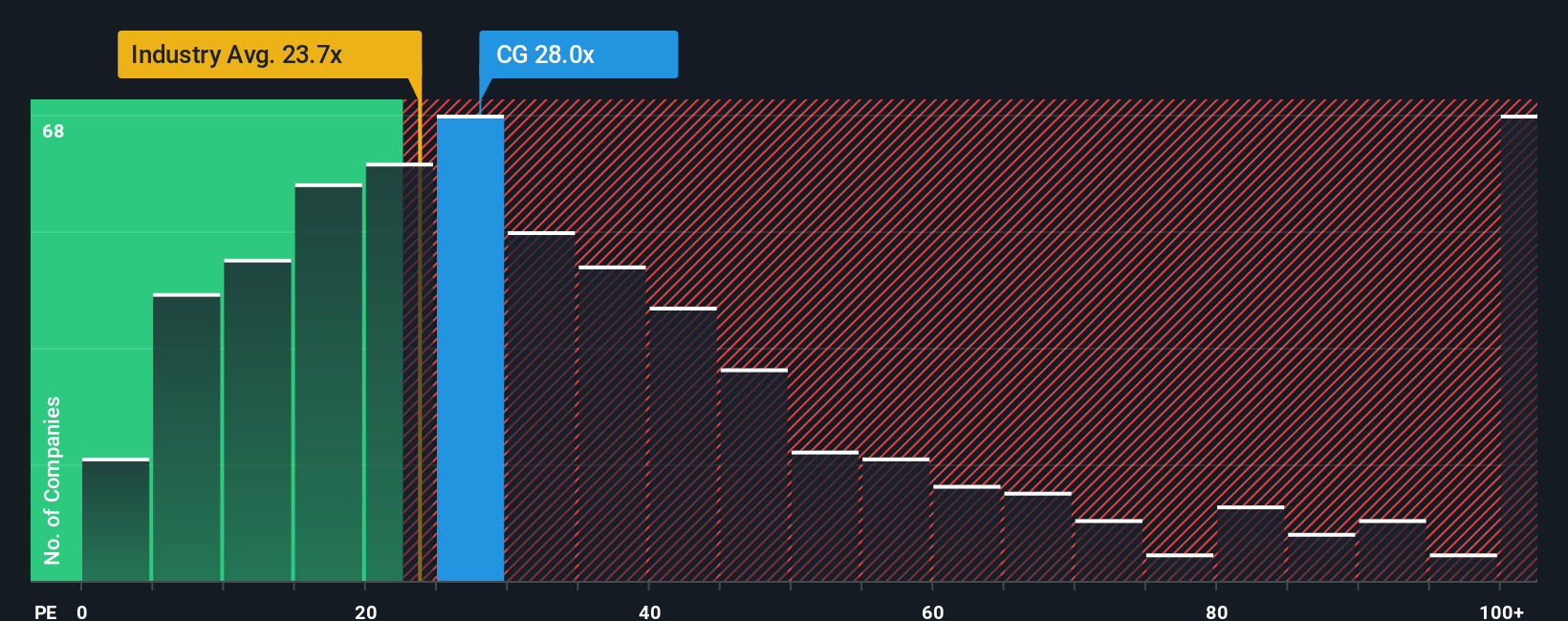

While the narrative fair value suggests upside, Carlyle’s current price implies a price to earnings ratio of 33.2 times, far above its 19.4 times fair ratio and the industry’s 25.6 times. That gap points to valuation risk rather than a clear bargain. So what gives?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Carlyle Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Carlyle Group Narrative

If you want to stress test these assumptions yourself, or trust your own digging more than ours, you can build a custom take in minutes: Do it your way.

A great starting point for your Carlyle Group research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before the next catalyst hits, lock in your watchlist by using the Simply Wall Street Screener to surface high potential stocks that fit your strategy.

- Capture asymmetric upside by targeting under followed opportunities using these 3626 penny stocks with strong financials that pair tiny market caps with surprisingly solid fundamentals.

- Capitalize on structural growth by focusing on cash rich businesses through these 901 undervalued stocks based on cash flows that appear mispriced relative to their future cash flows.

- Reinforce your income stream by reviewing these 10 dividend stocks with yields > 3% that offer attractive yields backed by sustainable payout ratios and resilient cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal