Blackstone Mortgage Trust (BXMT): Is the Recent Total Return Rebound Already Priced Into Its Valuation?

Recent Performance and Investor Context

Blackstone Mortgage Trust (BXMT) has quietly delivered a solid run for income-focused investors, with the stock up about 20 % over the past year and roughly 11 % year to date.

See our latest analysis for Blackstone Mortgage Trust.

That steady climb toward the current 19.83 dollar share price, with an 11.59 percent year to date share price return and a 19.86 percent one year total shareholder return, suggests momentum is gradually rebuilding as investors reassess income and credit risk.

If BXMT has you rethinking income and risk, it could be worth exploring fast growing stocks with high insider ownership as another way to spot under the radar opportunities backed by aligned management.

With BXMT trading just below analyst targets after a strong total return rebound, the key question now is whether investors are overlooking further upside or if the current price already reflects its future growth potential.

Most Popular Narrative: 3.3% Undervalued

With Blackstone Mortgage Trust closing at 19.83 dollar versus a narrative fair value of 20.5 dollar, the narrative sees modest upside baked into today’s price.

The launch of a net lease investment strategy, particularly in defensive business sectors, is expected to provide stable cash flows, enhancing the diversification and resilience of the revenue stream, which could support consistent revenue growth.

Curious how a business coming off a loss is projected to generate robust profits, richer margins, and a valuation multiple below sector norms, all discounted at a precise hurdle rate? The narrative stitches together bold assumptions on scaling revenues, reshaping margins, and shrinking the share count into a single, tightly argued fair value story that is very different from what the current share price implies.

Result: Fair Value of $20.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering impaired loans and potential macro volatility around repayments and redeployment could still derail the optimistic earnings and valuation trajectory.

Find out about the key risks to this Blackstone Mortgage Trust narrative.

Another View: Rich On Earnings

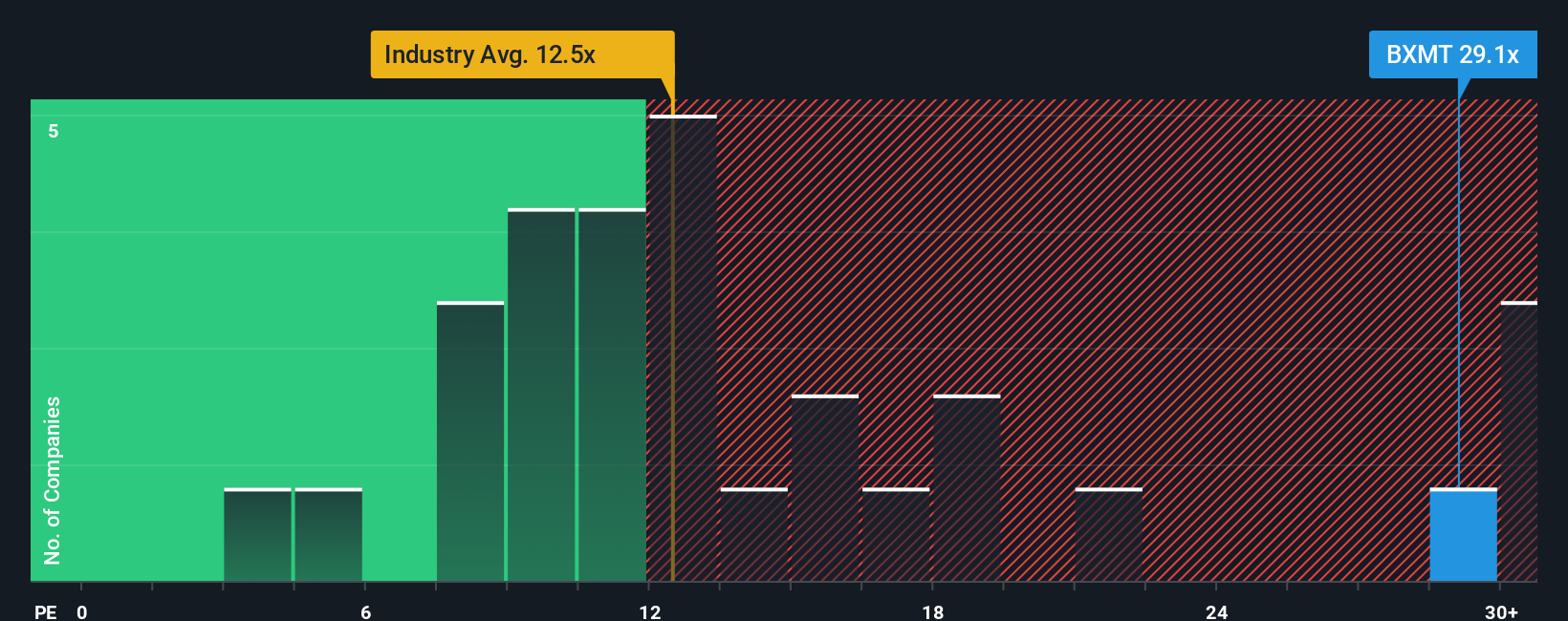

While the narrative points to a small undervaluation, the earnings based lens tells a different story. BXMT trades on a 31.3 times price to earnings ratio, far above the US Mortgage REITs average of 12.9 times and its own 17.8 times fair ratio, which hints at limited margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Mortgage Trust Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a fresh narrative in just minutes, Do it your way.

A great starting point for your Blackstone Mortgage Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one opportunity. Use the Simply Wall St Screener now to pinpoint fresh stocks that match your goals before the market moves on.

- Capture potential multi baggers early by scanning these 3626 penny stocks with strong financials that already show solid underlying financial strength.

- Ride the next wave of innovation by targeting these 24 AI penny stocks positioned at the intersection of automation, software, and data driven business models.

- Lock in value focused opportunities with these 901 undervalued stocks based on cash flows that appear mispriced based on future cash flows rather than short term market noise.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal