Assessing American Eagle (AEO) Valuation After Its Strong Recent Share Price Rally

American Eagle Outfitters (AEO) has quietly outperformed many apparel peers this year, and its recent move higher has traders asking whether the rally still has room to run or is already pricing in the good news.

See our latest analysis for American Eagle Outfitters.

The stock has gone from a steady retailer to a quiet momentum story, with a roughly 40 percent 1 month share price return helping drive a 68 percent 1 year total shareholder return as investors warm to its earnings recovery.

If AEO’s run has you thinking about what else could surprise on the upside, this is a good moment to explore fast growing stocks with high insider ownership.

With earnings momentum accelerating but the share price now sitting above Wall Street’s targets, investors face a pivotal question: is American Eagle still undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 16.5% Overvalued

With American Eagle Outfitters closing at $26.65 and a narrative fair value near $22.88, the most followed storyline sees exuberance outpacing fundamentals.

The analysts have a consensus price target of $15.167 for American Eagle Outfitters based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.5, and the most bearish reporting a price target of just $10.0.

Curious how modest revenue growth assumptions, stronger margins and a compressed future earnings multiple can still justify a higher intrinsic value than today’s price? The full narrative explains the math, the timeline and the conviction behind that gap.

Result: Fair Value of $22.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer than expected consumer demand, or a margin hit from heavier promotions, could quickly challenge the optimistic earnings and valuation narrative.

Find out about the key risks to this American Eagle Outfitters narrative.

Another Angle On Value

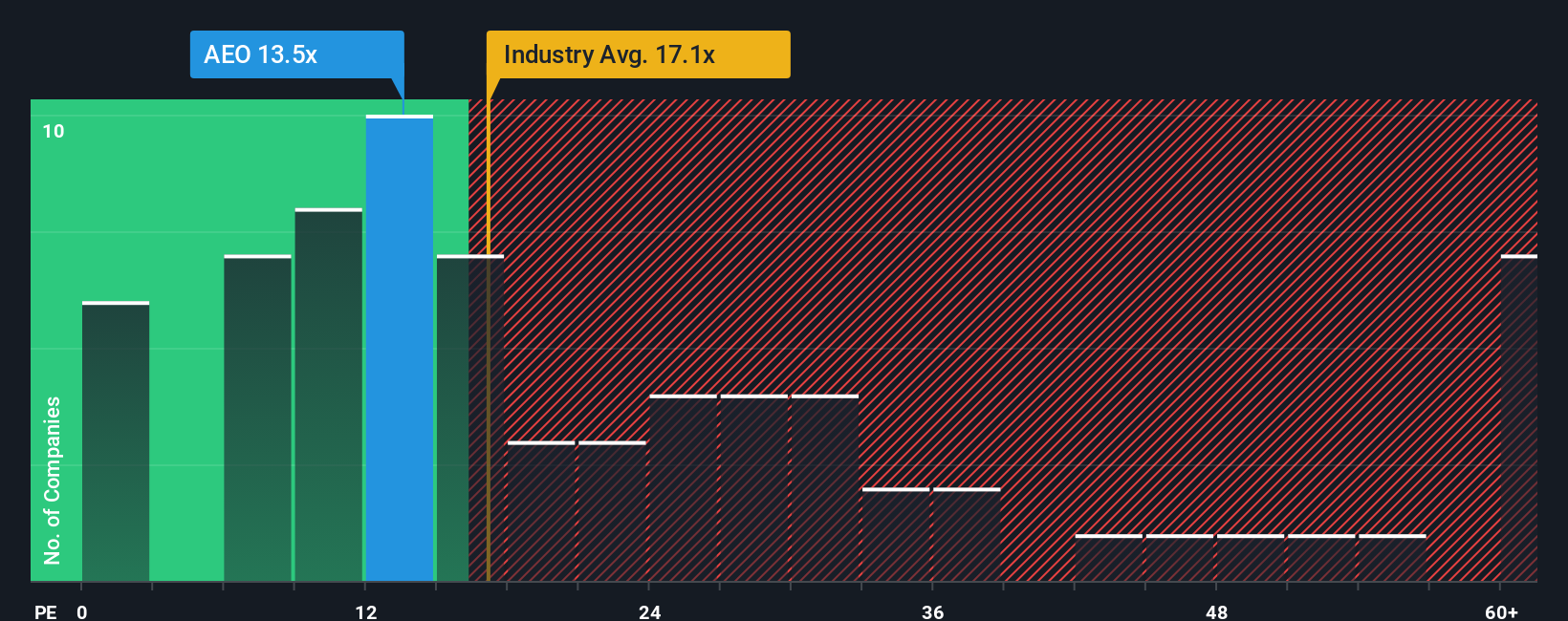

Our multiple based view is not fully one sided. AEO trades on a 21.7 times earnings ratio, slightly richer than the US Specialty Retail sector at 19.9 times and its peer average of 19.7 times, yet still below a 26.2 times fair ratio. Is that buffer enough if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Eagle Outfitters Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your American Eagle Outfitters research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before momentum shifts again, give yourself more high conviction options by using the Simply Wall St screener to pinpoint stocks that match your strategy with precision.

- Capture mispriced opportunities early by targeting these 901 undervalued stocks based on cash flows that the market has not fully recognised yet.

- Capitalize on powerful secular trends by focusing on these 24 AI penny stocks shaping the future of intelligent technology.

- Strengthen your income strategy by locking onto these 10 dividend stocks with yields > 3% that can support reliable cash flow in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal