Will Brookfield's New US$4 Billion Shelf Shape Brookfield's (TSX:BN) Capital Deployment Narrative?

- Earlier this month, Brookfield Corporation filed a very large US$4.00 billion omnibus shelf registration covering a mix of debt, preferred securities, and Class A shares across multiple financing subsidiaries.

- The filing, coupled with fresh interest from institutional investors like Qualivian Investment Partners, underscores Brookfield’s growing profile as a global real-assets capital allocator with over US$1.00 trillion in assets under management.

- We’ll now examine how Brookfield’s new US$4.00 billion shelf registration might influence its investment narrative around funding growth and capital deployment.

We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Brookfield Investment Narrative Recap

To own Brookfield, you generally need to believe in its role as a global real-assets manager that can turn fee-based capital and operating assets into steady distributable earnings. The new US$4.00 billion shelf registration mainly reinforces its existing playbook of flexible funding and does not materially change the near term catalyst around capital deployment, nor the key risk that weaker market conditions could slow asset sales and pressure earnings.

The most relevant recent development is Brookfield’s CAD 1.0 billion medium term note issuance earlier this month, which sits alongside the new shelf as part of a broader funding toolkit. Together, they highlight how Brookfield is actively managing its balance sheet while pursuing transaction volume, even as interest costs and market volatility remain important swing factors for returns and valuation.

Yet investors should be aware that Brookfield’s reliance on constructive markets for asset monetizations means that if conditions turn...

Read the full narrative on Brookfield (it's free!)

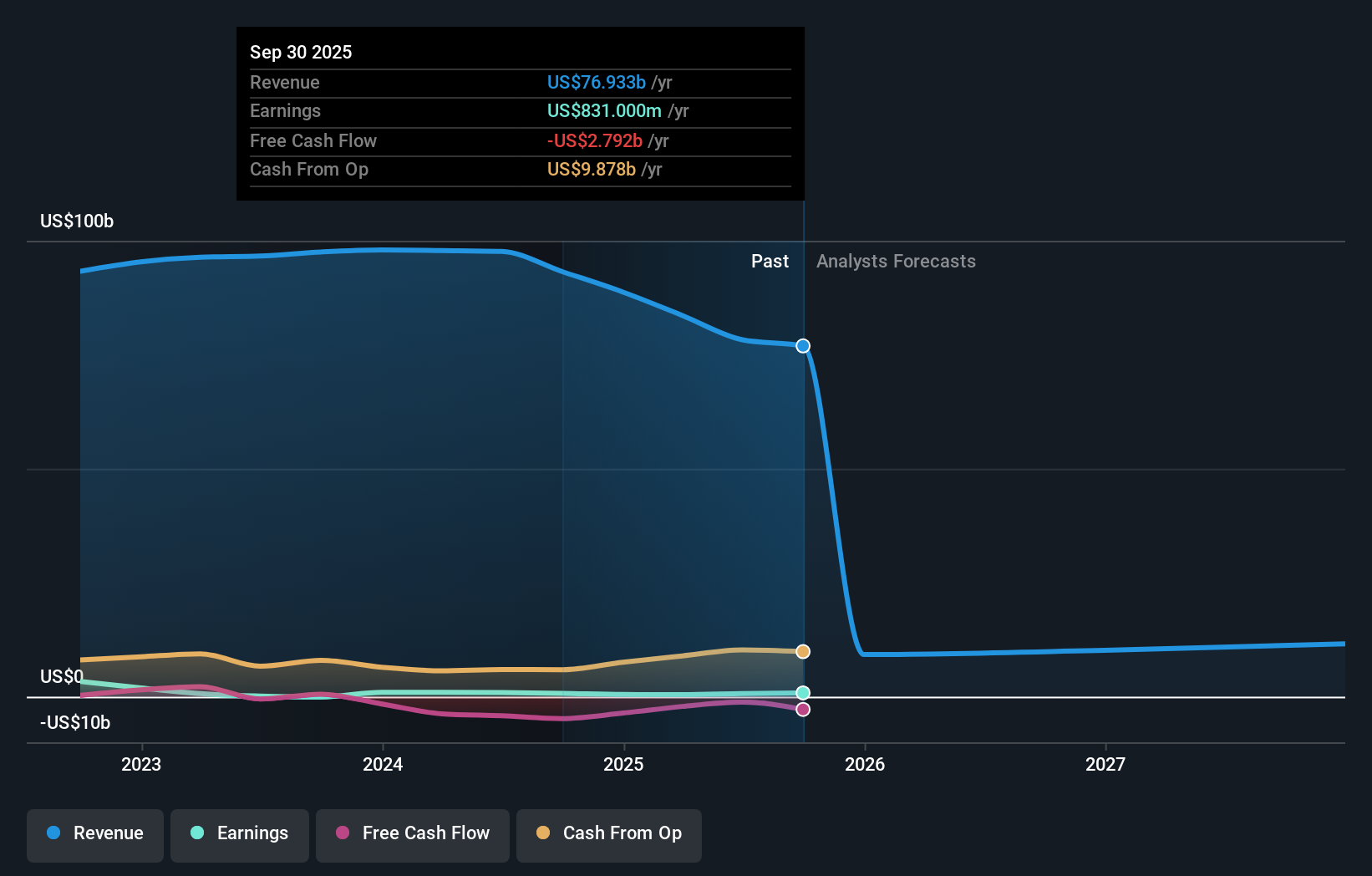

Brookfield's narrative projects $8.5 billion revenue and $7.2 billion earnings by 2028. This requires a 54.2% yearly revenue decline and an earnings increase of about $6.7 billion from $473.0 million today.

Uncover how Brookfield's forecasts yield a CA$97.28 fair value, a 53% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently see Brookfield’s fair value between US$74.25 and US$97.28, highlighting a wide spread of individual assumptions. You may want to weigh those views against Brookfield’s reliance on supportive market conditions for asset monetizations and what that could mean for future distributable earnings.

Explore 4 other fair value estimates on Brookfield - why the stock might be worth just CA$74.25!

Build Your Own Brookfield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Brookfield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal