Alpha Metallurgical Resources (AMR): Reassessing Valuation After 2026 Coal Shipment Guidance Update

Alpha Metallurgical Resources (AMR) just laid out its 2026 playbook, guiding for 15.1 million to 16.5 million tons of total coal shipments, a key datapoint for anyone tracking future cash flow and valuation.

See our latest analysis for Alpha Metallurgical Resources.

That guidance lands after a powerful run, with a roughly 35.6% 1 month share price return and a 47.7% 3 year total shareholder return. This suggests momentum is still firmly with Alpha Metallurgical Resources even as investors reassess coal demand and execution risk.

If this kind of cyclical upswing has you thinking more broadly about what else could surprise, now is a good moment to explore fast growing stocks with high insider ownership.

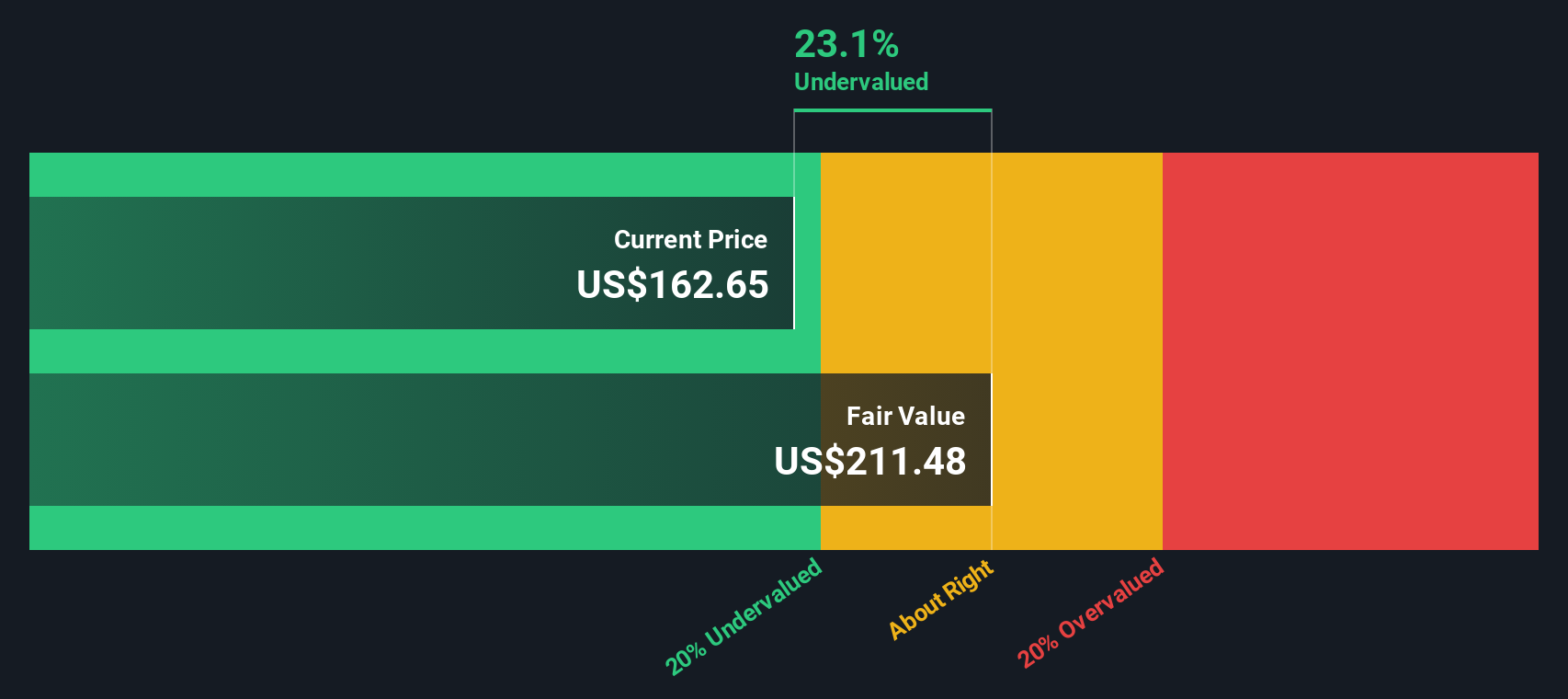

Still, with shares trading above the average analyst target but our intrinsic estimates implying a steep discount, the real question is whether Alpha is mispriced value or if markets already reflect its future growth potential.

Most Popular Narrative Narrative: 12.7% Overvalued

With Alpha Metallurgical Resources last closing at $207.89 against a narrative fair value near $184.50, investors are weighing a premium against embedded growth assumptions.

Global underinvestment and persistent supply constraints in metallurgical coal mining (compounded by recent industry idlings and bankruptcies) are likely to elevate future prices and market share for well-capitalized producers like Alpha, pointing to potential upside for future revenue and margins as demand recovers or steadies, especially in high-growth markets like India and Brazil.

Curious how steady top line expansion, rising margins, and a low implied earnings multiple can still point to a premium price tag? The narrative stitches these moving parts into one bold valuation story that is not obvious from the share price alone.

Result: Fair Value of $184.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural shifts toward scrap based steelmaking, along with potential regulatory tightening on coal, could quickly erode Alpha's demand profile and margin resilience.

Find out about the key risks to this Alpha Metallurgical Resources narrative.

Another View, DCF Signals Deep Value

While the narrative fair value implies Alpha Metallurgical Resources is 12.7 percent overvalued, our DCF model paints a very different picture, suggesting fair value near $463.68 versus the current $207.89. If cash flows are even roughly right, is the market misreading the long term story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alpha Metallurgical Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alpha Metallurgical Resources Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Alpha Metallurgical Resources.

Ready for your next investing move?

Before you move on, lock in your next opportunity by using targeted screeners that surface high conviction ideas tailored to very different market themes and risk profiles.

- Capture potential mispricings by tracking these 902 undervalued stocks based on cash flows that may offer stronger cash flow support than the market currently recognizes.

- Ride powerful technological shifts by focusing on these 24 AI penny stocks positioned to benefit from accelerating adoption of advanced automation and machine learning.

- Strengthen your income base by filtering for these 10 dividend stocks with yields > 3% that can help anchor long term returns with consistent cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal