Top European Dividend Stocks To Consider In December 2025

As the European markets continue to show signs of steady economic growth, with the pan-European STOXX Europe 600 Index rising by 1.60% and major stock indexes gaining ground, investors are keeping a close eye on dividend stocks as a potential source of stable income amidst looser monetary policies. In this environment, selecting dividend stocks that offer consistent payouts and have strong fundamentals can be an effective strategy for those looking to capitalize on Europe's current economic climate.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.07% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.51% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.64% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.00% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| Evolution (OM:EVO) | 4.87% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.14% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 4.91% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.30% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.22% | ★★★★★★ |

Click here to see the full list of 195 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Banco Bilbao Vizcaya Argentaria (BME:BBVA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco Bilbao Vizcaya Argentaria, S.A. is a financial institution offering retail banking, wholesale banking, and asset management services across various regions including Spain, Mexico, Turkey, South America, Europe, the United States, and Asia with a market capitalization of approximately €112.75 billion.

Operations: Banco Bilbao Vizcaya Argentaria, S.A.'s revenue is primarily derived from its operations in Mexico (€11.80 billion), Spain (€9.24 billion), South America (€4.36 billion), Turkey (€4.29 billion), and the Rest of Business segment (€1.61 billion).

Dividend Yield: 3.7%

Banco Bilbao Vizcaya Argentaria's dividend payments have been volatile over the past decade, with a current yield of 3.7%, below the top Spanish market payers. Despite this, dividends are well covered by earnings with a payout ratio of 42%, forecasted to remain sustainable at 48.8%. Recent strategic alliances, like the one with OpenAI, aim to enhance operational efficiency and customer service through AI innovations, potentially supporting future financial stability and dividend reliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Banco Bilbao Vizcaya Argentaria.

- Insights from our recent valuation report point to the potential undervaluation of Banco Bilbao Vizcaya Argentaria shares in the market.

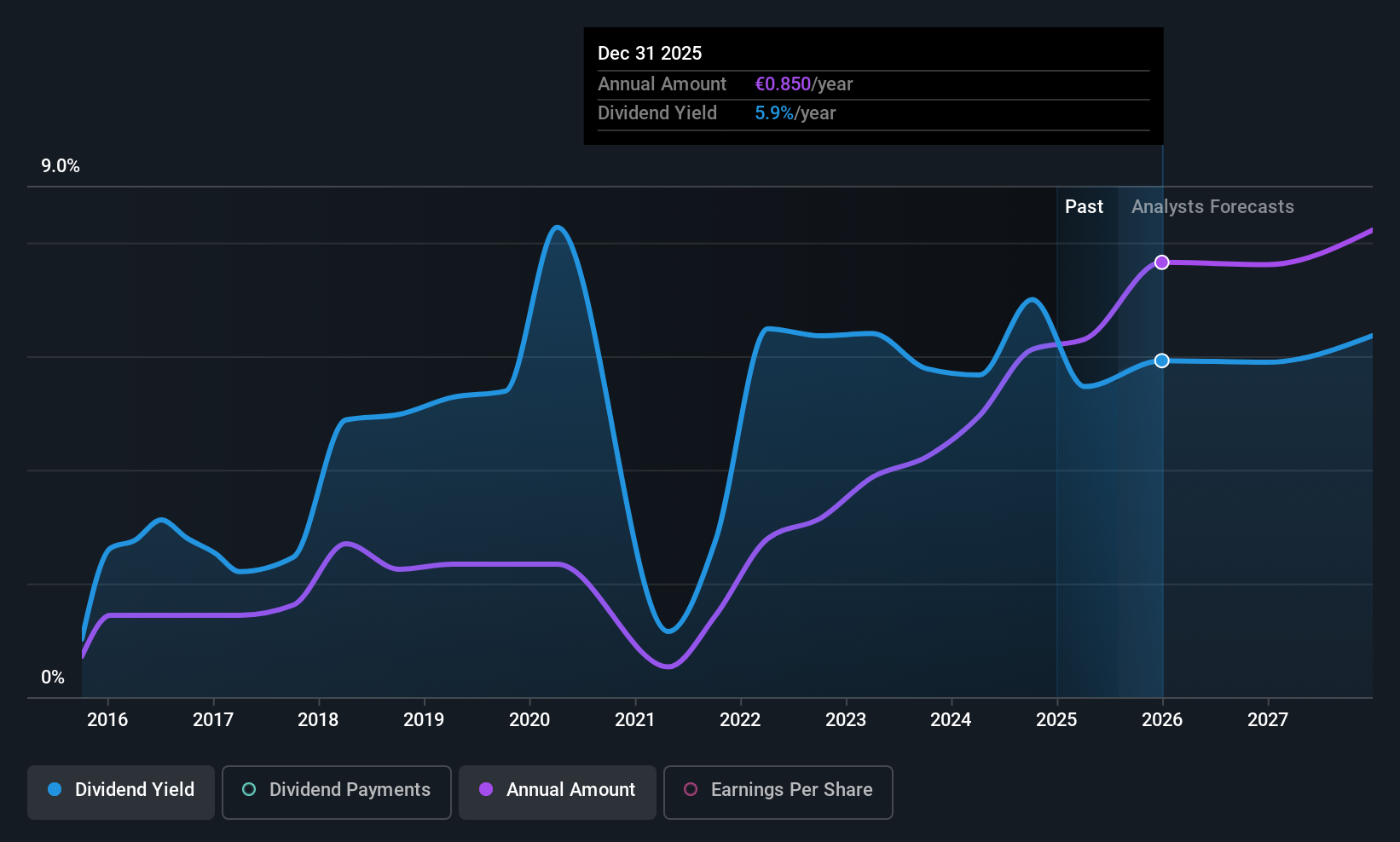

SpareBank 1 Nord-Norge (OB:NONG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 Nord-Norge offers banking services in Northern Norway and has a market cap of NOK15.13 billion.

Operations: SpareBank 1 Nord-Norge's revenue is primarily derived from the Retail Market (NOK2.57 billion), Corporate Banking (Excluding SMB) (NOK1.80 billion), Sparebank 1 Finans Nord-Norge (NOK381 million), Eiendoms- Megler 1 Nord-Norge (NOK250 million), and Sparebank 1 Regnskaps- Huset Nord-Norge (NOK333 million).

Dividend Yield: 5.8%

SpareBank 1 Nord-Norge offers a reliable dividend, currently yielding 5.81%, though it trails the top Norwegian market payers. The bank maintains stable dividends, covered by earnings with a payout ratio of 56.3%, forecasted to remain sustainable at 65.7% in three years. Despite trading below estimated fair value and showing potential profit growth, challenges include high bad loans at 2.6%. Recent earnings showed a decline in net income year-over-year, impacting short-term financial performance.

- Click here to discover the nuances of SpareBank 1 Nord-Norge with our detailed analytical dividend report.

- The analysis detailed in our SpareBank 1 Nord-Norge valuation report hints at an deflated share price compared to its estimated value.

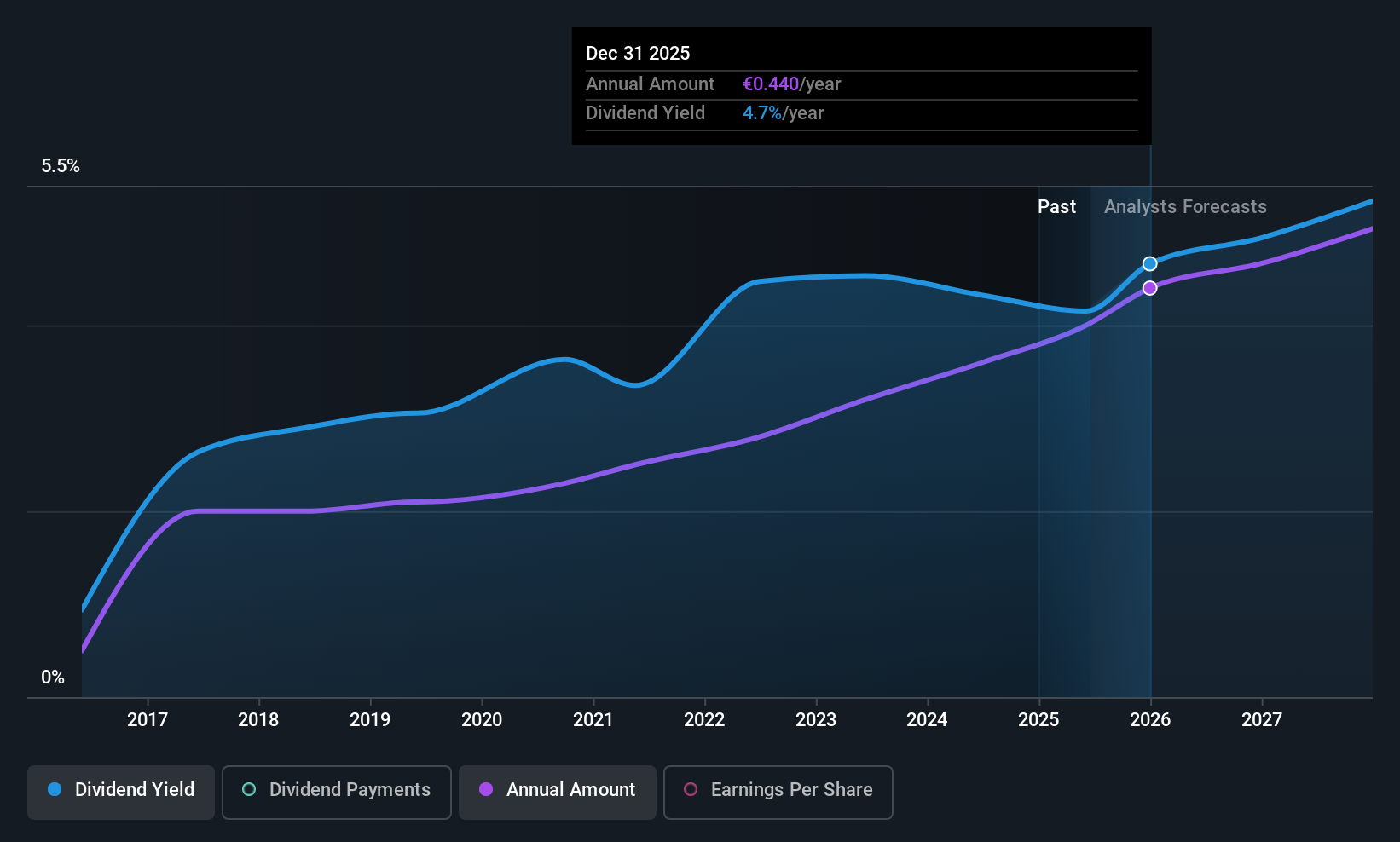

Telekom Austria (WBAG:TKA)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Telekom Austria AG, with a market cap of €5.89 billion, offers fixed-line and mobile communications solutions across Austria, Belarus, Bulgaria, Croatia, North Macedonia, Serbia, and Slovenia.

Operations: Telekom Austria AG generates revenue primarily from its wireless communications services, amounting to €5.46 billion.

Dividend Yield: 4.5%

Telekom Austria offers a stable dividend with a yield of 4.51%, ranking among the top in Austria. Its dividends are well-covered by earnings and cash flows, with payout ratios of 40.7% and 24%, respectively, indicating sustainability. Earnings have grown recently, supporting potential future dividend stability. The company reported increased Q3 revenue at €1.40 billion and net income at €191 million, confirming its financial health amidst steady growth expectations for the year.

- Click to explore a detailed breakdown of our findings in Telekom Austria's dividend report.

- According our valuation report, there's an indication that Telekom Austria's share price might be on the cheaper side.

Seize The Opportunity

- Click here to access our complete index of 195 Top European Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal