Graco (GGG): Rethinking Valuation After Flat Sales, EPS Declines and Softer Returns on Capital

Recent analysis of Graco (GGG) is putting its slowing momentum in the spotlight, with two years of flat sales, shrinking earnings per share, and weaker returns on capital raising fresh questions about its long term growth story.

See our latest analysis for Graco.

Despite the recent operational questions, the share price has been fairly steady, with a modestly positive year to date share price return and a strong three year total shareholder return suggesting long term holders are still ahead, even as near term momentum cools.

If Graco's slower pace has you rethinking where growth might come from next, it could be worth exploring fast growing stocks with high insider ownership as a fresh set of ideas.

With growth slowing, yet the stock sitting only around 10% below analyst targets and trading at a slight premium to some intrinsic estimates, is this a patient buying opportunity, or is the market already pricing in a rebound?

Most Popular Narrative: 9.6% Undervalued

With Graco last closing at $83.60 against a narrative fair value near $92, the current pricing assumes only moderate progress on its growth blueprint.

The strategic decision to maintain a strong U.S. manufacturing footprint may give Graco an advantage over competitors who manufacture offshore, especially in light of ongoing trade tensions and tariffs, potentially improving net margins due to cost control and pricing power.

Curious how steady volume growth, rising margins and a lower future earnings multiple can still justify a richer price than today? Unpack the full narrative to see which specific revenue and profit assumptions are doing the heavy lifting in this valuation story.

Result: Fair Value of $92.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sharper tariff pressures or weaker contractor segment margins could quickly erode the expected earnings uplift and challenge that modest undervaluation thesis.

Find out about the key risks to this Graco narrative.

Another View: Rich Multiples Signal Less Cushion

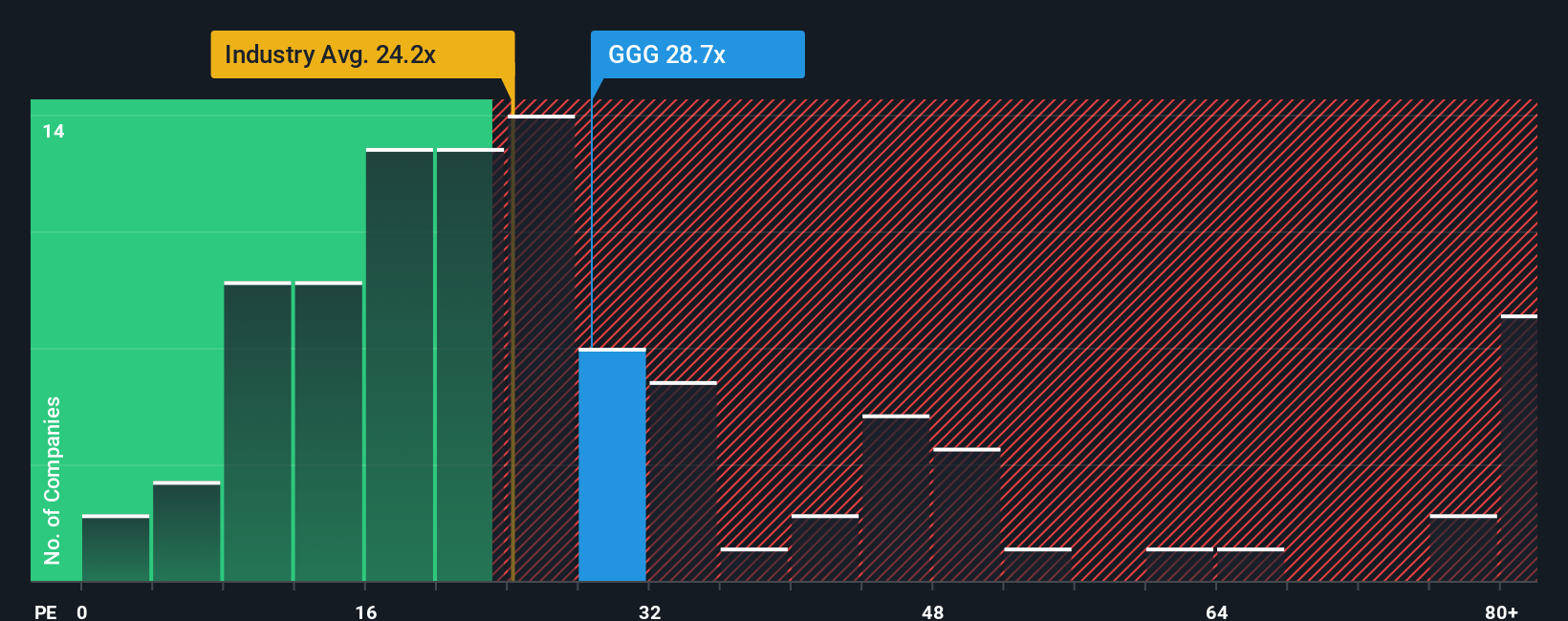

While the narrative fair value suggests Graco is 9.6% undervalued, its 27.8x price to earnings multiple tells a tougher story versus peers at 24.9x, the US Machinery industry at 25.5x, and a fair ratio nearer 22.3x. This leaves less room for disappointment if growth underwhelms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Graco Narrative

If your view diverges or you prefer to dig into the numbers yourself, you can build a personalized Graco storyline in just minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Graco.

Looking for more investment ideas?

Before you move on, set yourself up for smarter decisions by scanning fresh opportunities in minutes using these focused Simply Wall Street stock screens.

- Target reliable income by reviewing these 10 dividend stocks with yields > 3% that may help anchor your portfolio with steadier cash flows through different market cycles.

- Capture future growth themes early by checking out these 24 AI penny stocks that are positioned at the forefront of intelligent automation and data driven innovation.

- Capitalize on market mispricing by scanning these 904 undervalued stocks based on cash flows where cash flow fundamentals suggest the share price has not yet caught up with underlying performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal