European Value Stock Picks For Estimated Discount Opportunities

As European markets experience a boost from steady economic growth and looser monetary policies, the pan-European STOXX Europe 600 Index has climbed 1.60% higher, with major stock indexes across Italy, France, Germany, and the UK also posting gains. In this environment of cautious optimism and stable interest rates set by the European Central Bank and other key institutions, investors may find opportunities in identifying undervalued stocks that could potentially benefit from these favorable conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Streamwide (ENXTPA:ALSTW) | €72.60 | €142.21 | 49% |

| Sanoma Oyj (HLSE:SANOMA) | €9.21 | €18.38 | 49.9% |

| Redelfi (BIT:RDF) | €11.70 | €23.31 | 49.8% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.278 | €8.48 | 49.6% |

| LINK Mobility Group Holding (OB:LINK) | NOK32.95 | NOK65.81 | 49.9% |

| Hemnet Group (OM:HEM) | SEK170.90 | SEK337.00 | 49.3% |

| cyan (XTRA:CYR) | €2.26 | €4.50 | 49.8% |

| Artifex Mundi (WSE:ART) | PLN12.20 | PLN24.34 | 49.9% |

| Allegro.eu (WSE:ALE) | PLN30.625 | PLN60.10 | 49% |

| Allcore (BIT:CORE) | €1.345 | €2.66 | 49.4% |

Here's a peek at a few of the choices from the screener.

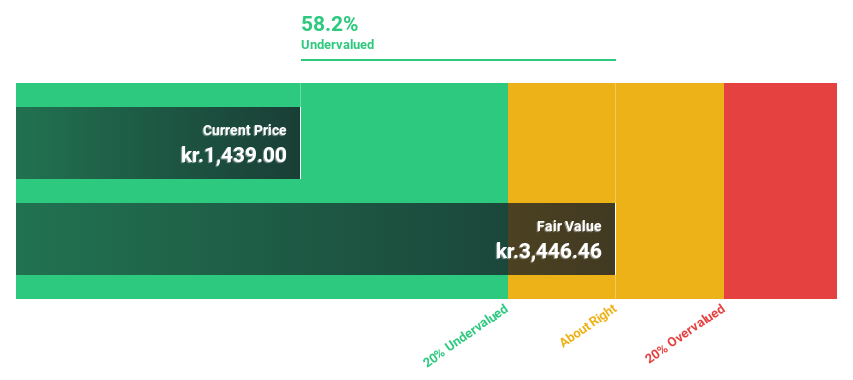

DSV (CPSE:DSV)

Overview: DSV A/S provides transport and logistics services across various regions including Europe, the Middle East, Africa, North America, South America, Asia, Australia, and the Pacific with a market cap of DKK376.01 billion.

Operations: The company's revenue is derived from several segments: Road (DKK63.81 billion), Solutions (DKK35.59 billion), Air & Sea - Air Freight (DKK68.84 billion), and Air & Sea - Sea Freight (DKK59.18 billion).

Estimated Discount To Fair Value: 37.8%

DSV is trading significantly below its estimated fair value, with a discounted cash flow valuation suggesting it is undervalued. Despite recent earnings showing a decline in net income and profit margins compared to the previous year, DSV's revenue growth forecast of 10.1% annually outpaces the Danish market. However, the company carries a high level of debt and lowered its earnings guidance for 2025. Recent strategic expansions in Virginia enhance its logistics capabilities on the East Coast.

- Our growth report here indicates DSV may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in DSV's balance sheet health report.

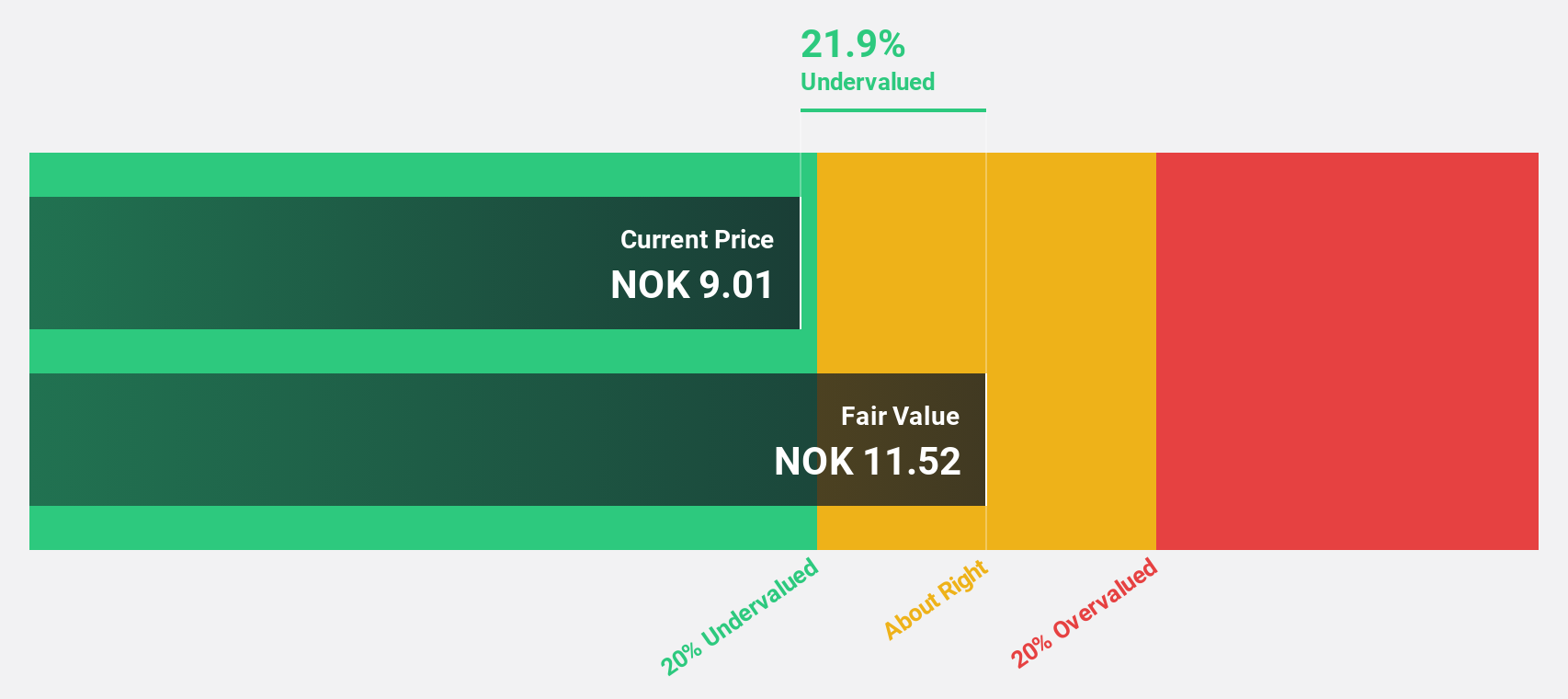

AutoStore Holdings (OB:AUTO)

Overview: AutoStore Holdings Ltd. is a company that offers robotic and software technology solutions across Norway, Germany, Europe, the United States, Asia, and other international markets with a market cap of NOK36.86 billion.

Operations: AutoStore Holdings Ltd. generates revenue from its Industrial Automation & Controls segment, amounting to $523.80 million.

Estimated Discount To Fair Value: 46.5%

AutoStore Holdings is trading significantly below its estimated fair value, with a discounted cash flow valuation indicating it is undervalued by more than 20%. Despite recent earnings showing a decline in sales and profit margins compared to the previous year, the company’s revenue growth forecast of 11.7% annually surpasses the Norwegian market average. However, AutoStore's return on equity remains low at 9.4%, and its share price has been highly volatile recently.

- According our earnings growth report, there's an indication that AutoStore Holdings might be ready to expand.

- Unlock comprehensive insights into our analysis of AutoStore Holdings stock in this financial health report.

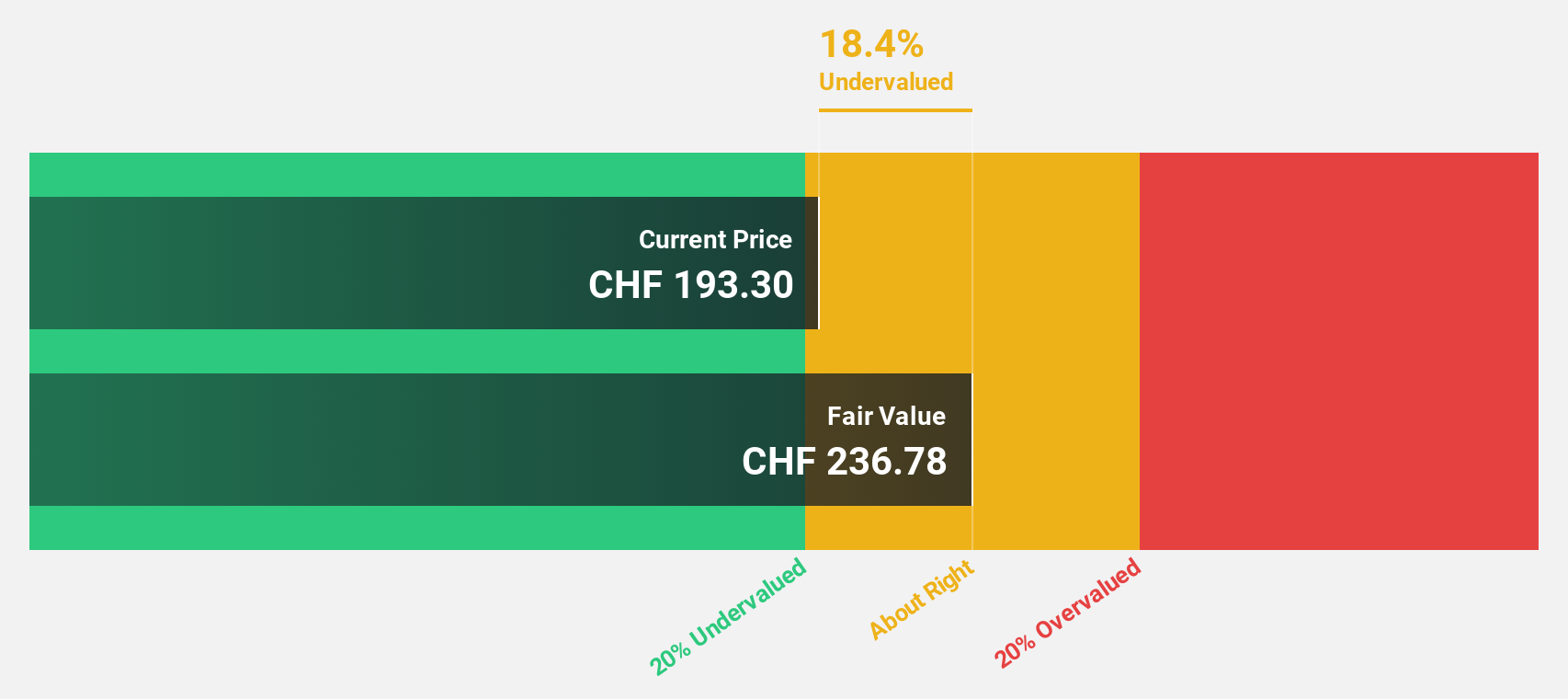

Helvetia Baloise Holding (SWX:HBAN)

Overview: Helvetia Baloise Holding AG operates in life and non-life insurance, as well as reinsurance across Switzerland, Germany, Austria, Spain, Italy, France, and internationally with a market cap of CHF11.10 billion.

Operations: The company's revenue is derived from three main segments: CHF2.11 billion from life insurance, CHF7.26 billion from non-life insurance, and CHF391.90 million from reinsurance.

Estimated Discount To Fair Value: 34.9%

Helvetia Baloise Holding is trading at CHF209.8, significantly below its estimated fair value of CHF322.07, highlighting its potential undervaluation based on cash flows. Recently added to multiple S&P indices, the company offers a reliable 3.19% dividend yield and forecasts indicate earnings growth of over 21% annually, outpacing the Swiss market average. However, its return on equity is expected to remain modest at 11.6% in three years.

- In light of our recent growth report, it seems possible that Helvetia Baloise Holding's financial performance will exceed current levels.

- Navigate through the intricacies of Helvetia Baloise Holding with our comprehensive financial health report here.

Make It Happen

- Reveal the 192 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal