European Growth Companies With Insider Ownership Up To 39%

In recent weeks, the European market has shown signs of steady economic growth and benefited from looser monetary policy, as evidenced by a 1.60% rise in the pan-European STOXX Europe 600 Index. In this environment, companies with strong insider ownership can be particularly attractive to investors, as such ownership often signals confidence in the company’s future prospects and aligns management's interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Skolon (OM:SKOLON) | 32.3% | 126.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Let's uncover some gems from our specialized screener.

Plejd (DB:3CA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Plejd AB (publ) is a technology company that develops products and services for smart lighting control across several countries including Sweden, Norway, Finland, the Netherlands, and Germany, with a market cap of €8.15 billion.

Operations: The company's revenue is primarily derived from its Electronic Security Devices segment, which generated approximately 978.99 million SEK.

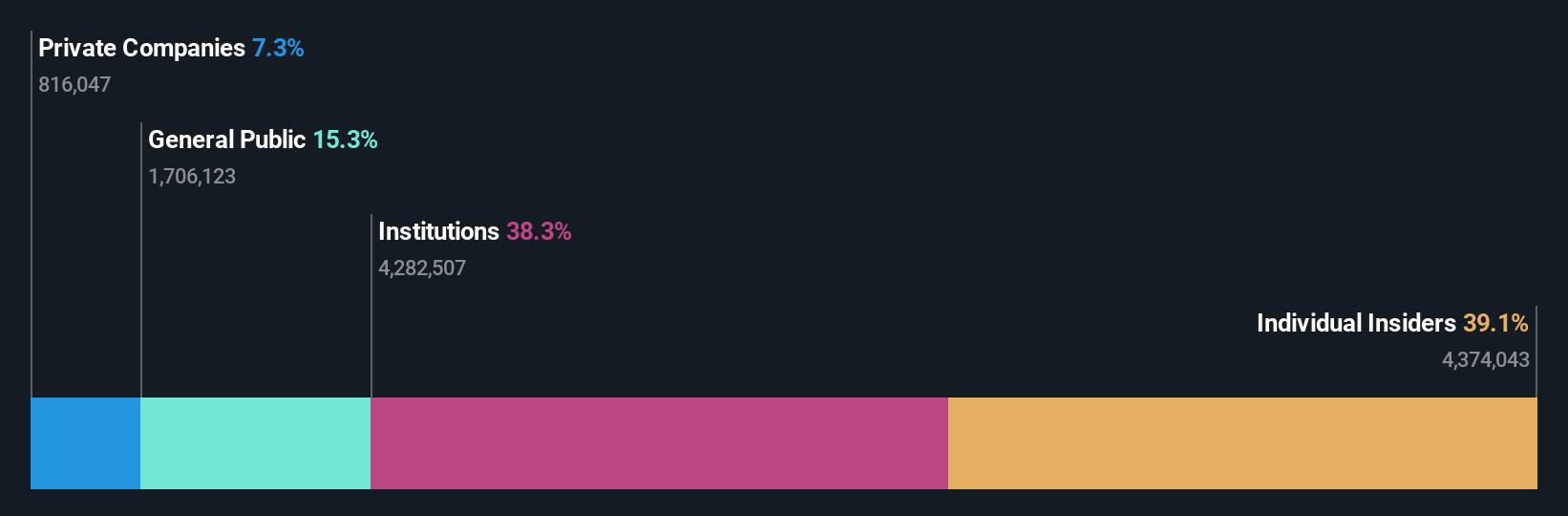

Insider Ownership: 39.1%

Plejd demonstrates strong growth potential, with earnings forecast to grow significantly at 31.9% annually, outpacing the German market. Despite significant insider selling recently, the company reported impressive financial results for Q3 2025, with net income rising to SEK 35.24 million from SEK 20.32 million year-over-year and revenue increasing substantially. This growth trajectory indicates robust performance amid high insider ownership, highlighting Plejd's position in the European growth landscape despite recent insider activity concerns.

- Take a closer look at Plejd's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Plejd is priced higher than what may be justified by its financials.

Bittium Oyj (HLSE:BITTI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bittium Oyj specializes in communications and connectivity solutions, healthcare technology products and services, as well as biosignal measuring and monitoring across Finland, Germany, and the United States, with a market cap of €946.50 million.

Operations: The company's revenue is derived from segments including Medical (€29.00 million), Defense & Security (€55.50 million), and Engineering Services (€14.72 million).

Insider Ownership: 12.4%

Bittium Oyj showcases substantial growth potential, with earnings expected to rise significantly at 40.5% annually, surpassing the Finnish market's growth rate. Recent purchase orders from the Finnish Defence Forces for Bittium Tough SDR radios, valued at €15.9 million, bolster its revenue prospects and reinforce its strategic partnership through 2036. Despite a volatile share price recently, Bittium's projected revenue growth of 20.3% per year positions it favorably within Europe's competitive landscape.

- Click here to discover the nuances of Bittium Oyj with our detailed analytical future growth report.

- The analysis detailed in our Bittium Oyj valuation report hints at an inflated share price compared to its estimated value.

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market cap of €461.79 million.

Operations: The company's revenue segments include the provision of intelligent transportation systems solutions for public transportation worldwide.

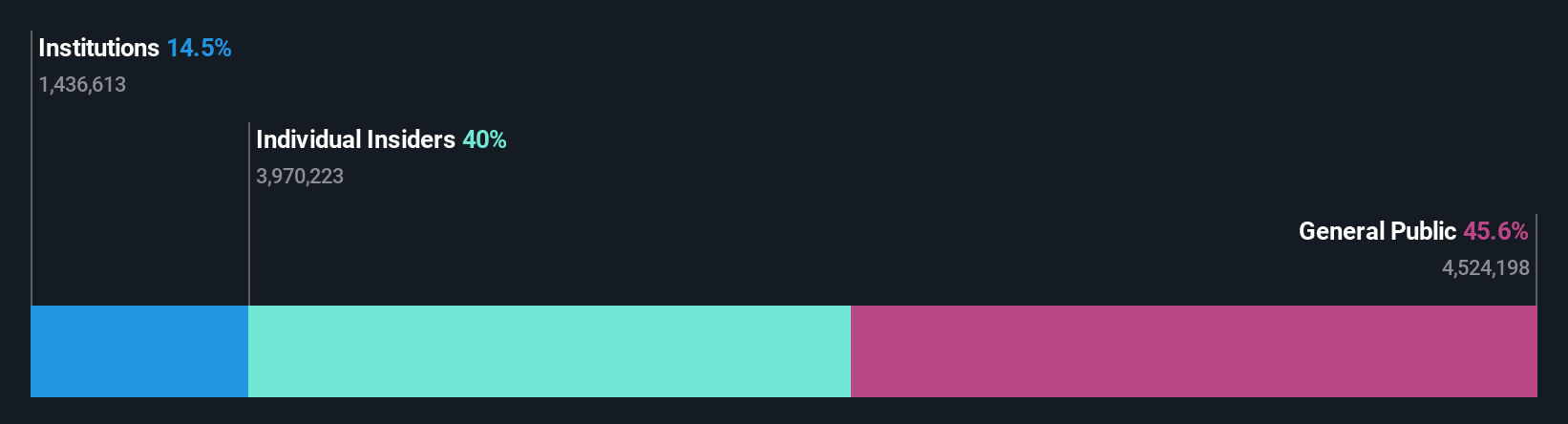

Insider Ownership: 40%

init innovation in traffic systems SE exhibits promising growth potential, with earnings forecasted to grow significantly at 29.6% annually, outpacing the German market's growth rate. Recent earnings reports show substantial increases, with third-quarter sales reaching €85.12 million and net income at €5.45 million. Analysts agree on a potential stock price rise of 28.7%. Despite an unstable dividend track record, high insider ownership aligns management interests with shareholders for long-term value creation.

- Delve into the full analysis future growth report here for a deeper understanding of init innovation in traffic systems.

- Insights from our recent valuation report point to the potential overvaluation of init innovation in traffic systems shares in the market.

Seize The Opportunity

- Reveal the 212 hidden gems among our Fast Growing European Companies With High Insider Ownership screener with a single click here.

- Searching for a Fresh Perspective? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal