Assessing Mid-America Apartment Communities’ Valuation After Its 16th Straight Year of Dividend Growth

Mid-America Apartment Communities (MAA) just extended its dividend growth streak to 16 years, approving a higher quarterly payout that signals steady cash generation and a clear commitment to rewarding long term shareholders.

See our latest analysis for Mid-America Apartment Communities.

The latest dividend hike comes as Mid-America Apartment Communities trades around $137.44, with a 30 day share price return of 3.1% but a year to date share price decline of 9.9%. The five year total shareholder return of 30.8% suggests long term holders have still been rewarded even as recent momentum has cooled.

If this kind of steady income story appeals to you, it could be a good moment to explore fast growing stocks with high insider ownership as a way to uncover other compelling ideas beyond REITs.

With MAA trading below analysts’ targets and at a sizeable discount to some intrinsic value estimates, the key question now is whether investors have a genuine value opportunity here or whether the market already anticipates future growth.

Most Popular Narrative Narrative: 6.9% Undervalued

With Mid-America Apartment Communities last closing at $137.44 against a narrative fair value of $147.60, the valuation case leans cautiously in favor of upside.

Decreasing construction starts and ongoing challenges in securing development capital are expected to extend a low-supply environment for several years. This may allow MAA's development pipeline and recently completed projects to deliver above-average stabilized yields, supporting long-term net operating income growth and margin expansion.

Curious how modest revenue growth, shrinking margins and a far higher future earnings multiple can still justify upside from here? The full narrative unpacks the math.

Result: Fair Value of $147.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated new apartment supply in key Sunbelt markets and persistently higher interest rates could pressure rent growth and margins, and ultimately challenge this upside case.

Find out about the key risks to this Mid-America Apartment Communities narrative.

Another Take On Valuation

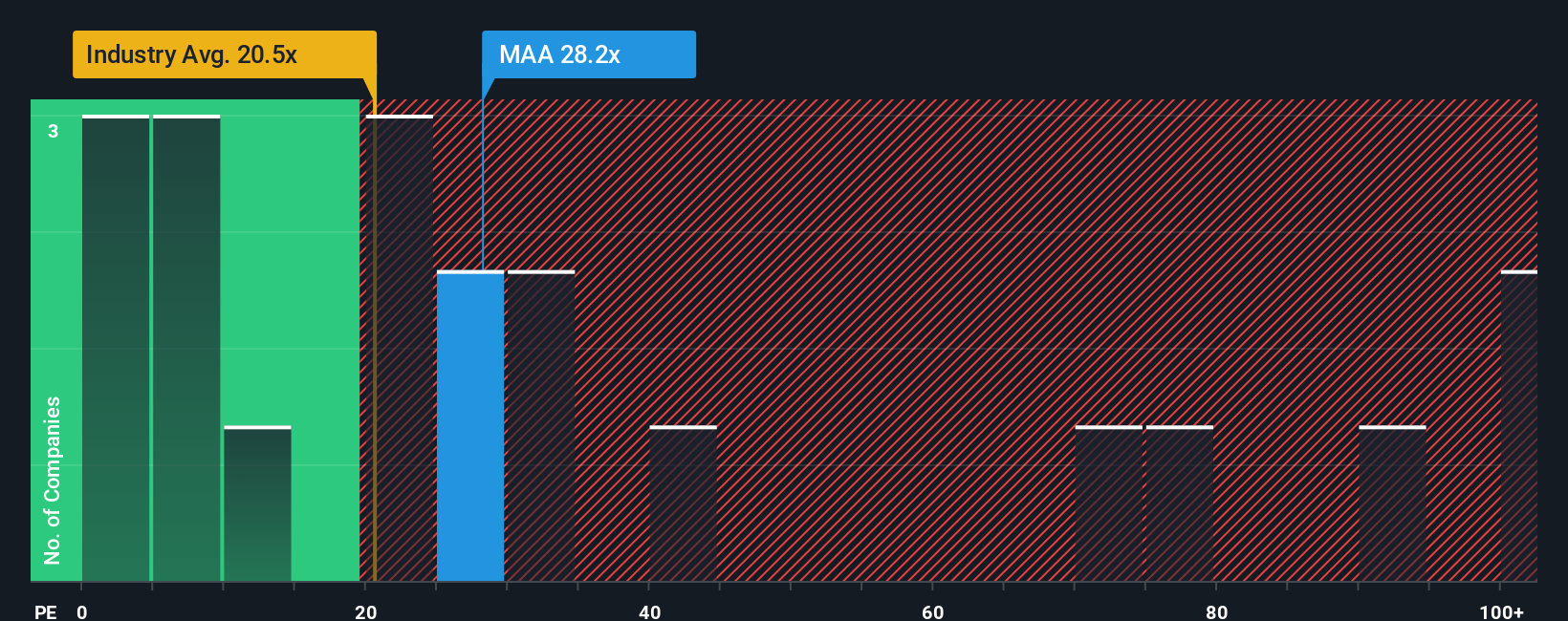

On earnings, MAA looks less obviously cheap. Its price to earnings ratio near 29 times edges above our fair ratio of about 28.7 times and sits higher than the North American residential REIT average of roughly 25.1 times. This hints at less margin for error if growth underwhelms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mid-America Apartment Communities Narrative

If you want to dig into the numbers yourself or challenge this view, you can build a personalized narrative in just a few minutes, Do it your way.

A great starting point for your Mid-America Apartment Communities research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about growing your wealth, do not stop at one stock. Use the Simply Wall Street Screener to unlock fresh, data driven opportunities now.

- Capture potential mispricings by running through these 904 undervalued stocks based on cash flows and stack your watchlist with companies the market may be overlooking.

- Ride powerful technology trends by scanning these 24 AI penny stocks and focus on businesses turning artificial intelligence into real earnings momentum.

- Strengthen your income strategy with these 10 dividend stocks with yields > 3% and pinpoint companies offering attractive yields backed by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal