Assessing Aon’s Valuation as Its 2026 Client Treaty Expansion Targets Broader Global Reinsurance Risk-Sharing

Aon (AON) just renewed its Aon Client Treaty facility for 2026, expanding beyond aviation and construction into facultative reinsurance and opening access to global clients seeking broader, more diversified risk-sharing capacity.

See our latest analysis for Aon.

That renewed treaty comes as Aon’s share price edges higher, with a 30 day share price return of 3.47 percent and a resilient 5 year total shareholder return of 79.49 percent suggesting momentum is gradually rebuilding.

If this kind of risk focused growth story appeals, it could be a good moment to explore other insurance linked plays and uncover opportunities among fast growing stocks with high insider ownership.

With earnings still growing faster than revenue, a modest pullback over 12 months, and the share price trading below analyst targets, is Aon quietly undervalued here, or are investors already paying up for its next leg of growth?

Most Popular Narrative Narrative: 10.7% Undervalued

With Aon last closing at $356.65 against a narrative fair value near $399, the current setup leans toward upside if key growth levers deliver.

The analysts have a consensus price target of $411.828 for Aon based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $451.0, and the most bearish reporting a price target of just $349.0.

Curious how mid single digit revenue growth, rising margins and a premium earnings multiple can still imply upside from here? See the full narrative and uncover the numbers driving that call.

Result: Fair Value of $399.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer commercial risk pricing and a heavier post NFP debt load could quickly erode margin expansion and limit the upside implied in today’s valuations.

Find out about the key risks to this Aon narrative.

Another Take On Valuation

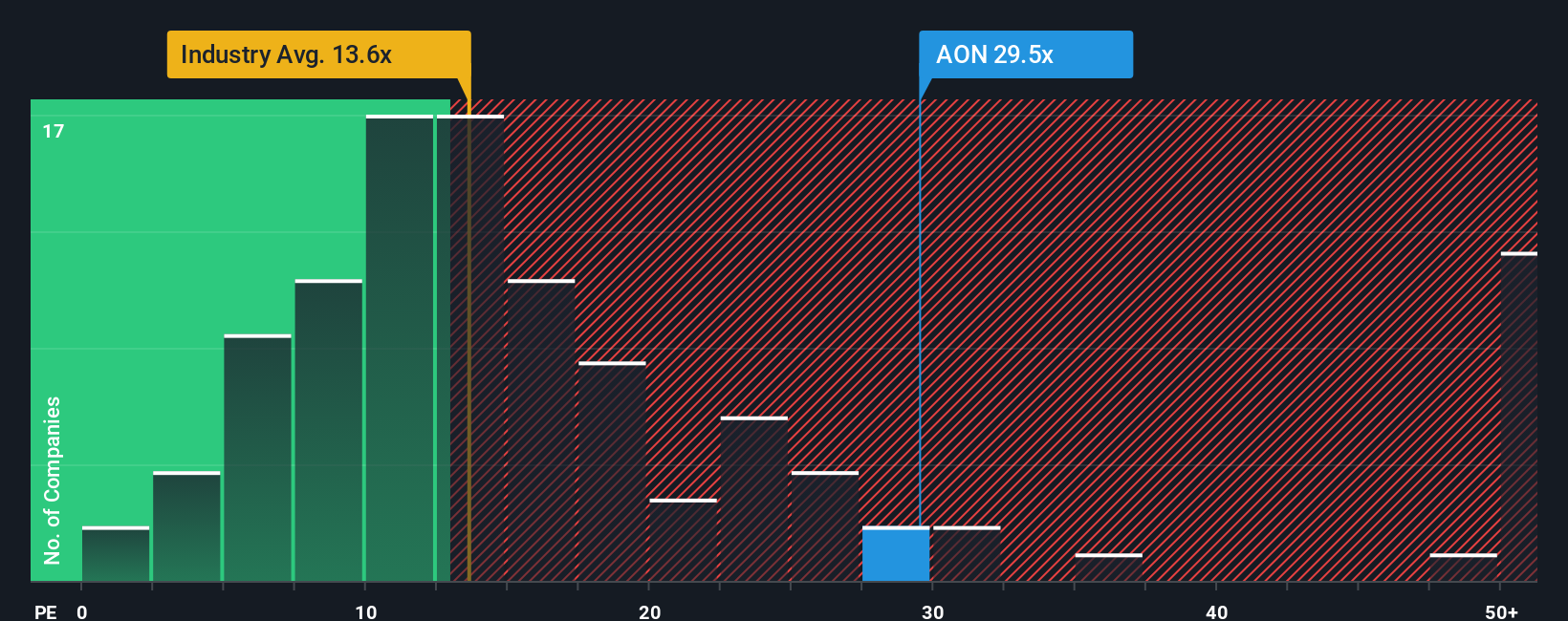

On earnings, the picture looks very different. Aon trades on about 28.2 times earnings, well above the US insurance industry at 13.4 times and even its peer average of 26.8 times, and far from a fair ratio near 15.8 times, which signals real de rating risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aon Narrative

If your view differs or you would rather dig into the numbers yourself, you can build a complete narrative in just minutes: Do it your way.

A great starting point for your Aon research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next set of opportunities with targeted stock ideas from the Simply Wall Street Screener that many investors overlook.

- Tap into reliable income potential with these 10 dividend stocks with yields > 3% that combine attractive yields with the backing of established businesses.

- Ride structural growth trends by targeting innovation powered by these 24 AI penny stocks at the intersection of data, automation and next generation software.

- Seize mispriced opportunities using these 904 undervalued stocks based on cash flows to focus on companies where market expectations still trail underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal