Ares Management (ARES): Reassessing Valuation After Recent Share Price Rebound

Ares Management (ARES) has quietly outperformed over the past month, gaining about 13% even as its year to date return remains slightly negative. That divergence is where the story starts getting interesting.

See our latest analysis for Ares Management.

That recent 12.6% 1 month share price return has started to repair what is still a weak year to date share price performance, but long term total shareholder returns above 170% over three years suggest momentum is pausing rather than broken.

If you are weighing where to put capital to work next, it could be a good moment to look beyond Ares and explore fast growing stocks with high insider ownership.

With solid double digit revenue and earnings growth, a premium valuation multiple, and the share price still about 12 percent below the average analyst target, is Ares quietly undervalued or already pricing in its next leg of growth?

Most Popular Narrative: 7.9% Undervalued

With Ares Management last closing at $169.06 versus a narrative fair value near the mid $180s, the current pricing gap demands a closer look at the growth math behind it.

The significant ramp in perpetual capital (now nearly 50% of fee-paying AUM), combined with consistent investment performance and low client redemptions, is expected to drive higher recurring fee revenues, greater profitability, and improved earnings visibility.

Read the complete narrative.

Curious how a fee driven model supports such an ambitious earnings and margin reset, while still baking in aggressive growth and dilution assumptions, without stretching the valuation beyond breaking point?

Result: Fair Value of $183.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and potential fee pressure, along with regulatory shifts impacting retail capital flows, could quickly challenge that seemingly comfortable valuation gap.

Find out about the key risks to this Ares Management narrative.

Another View on Valuation

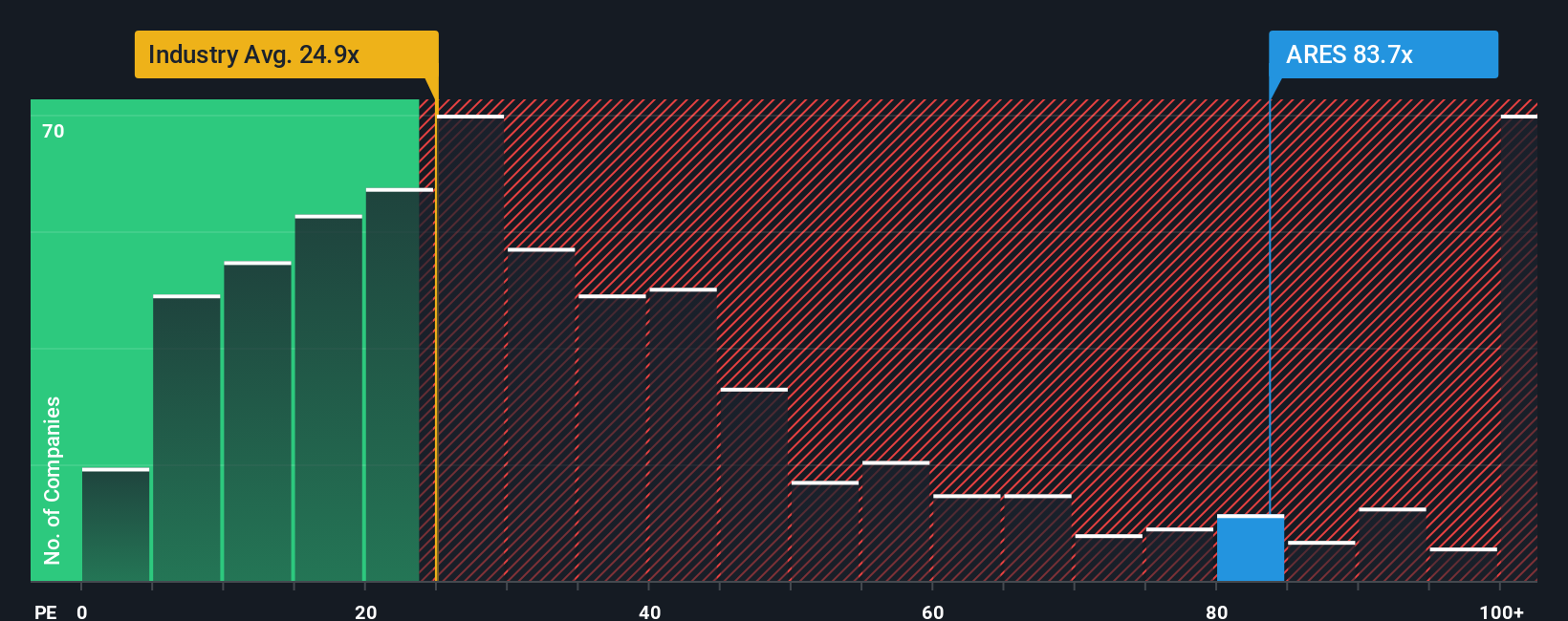

That 7.9 percent narrative discount looks tempting, but a closer look at the price to earnings picture tells a different story. Ares trades on about 72.8 times earnings, far above peers at 14.7 times and a fair ratio closer to 23 times. This implies meaningful downside valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ares Management Narrative

If this framing does not quite match your view, or you prefer to dig into the numbers yourself, you can craft a custom narrative in minutes: Do it your way.

A great starting point for your Ares Management research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single opportunity. The Simply Wall St Screener quickly surfaces focused stock ideas so you always have your next smart move lined up.

- Capture potential mispricings as you scan these 904 undervalued stocks based on cash flows that stand out on cash flow based valuation.

- Accelerate your search for income by reviewing these 10 dividend stocks with yields > 3% that balance yield with fundamentals.

- Position ahead of structural change while you assess these 80 cryptocurrency and blockchain stocks reshaping payments, security, and digital ownership.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal