Investors Appear Satisfied With DataWalk S.A.'s (WSE:DAT) Prospects As Shares Rocket 37%

DataWalk S.A. (WSE:DAT) shareholders would be excited to see that the share price has had a great month, posting a 37% gain and recovering from prior weakness. The annual gain comes to 130% following the latest surge, making investors sit up and take notice.

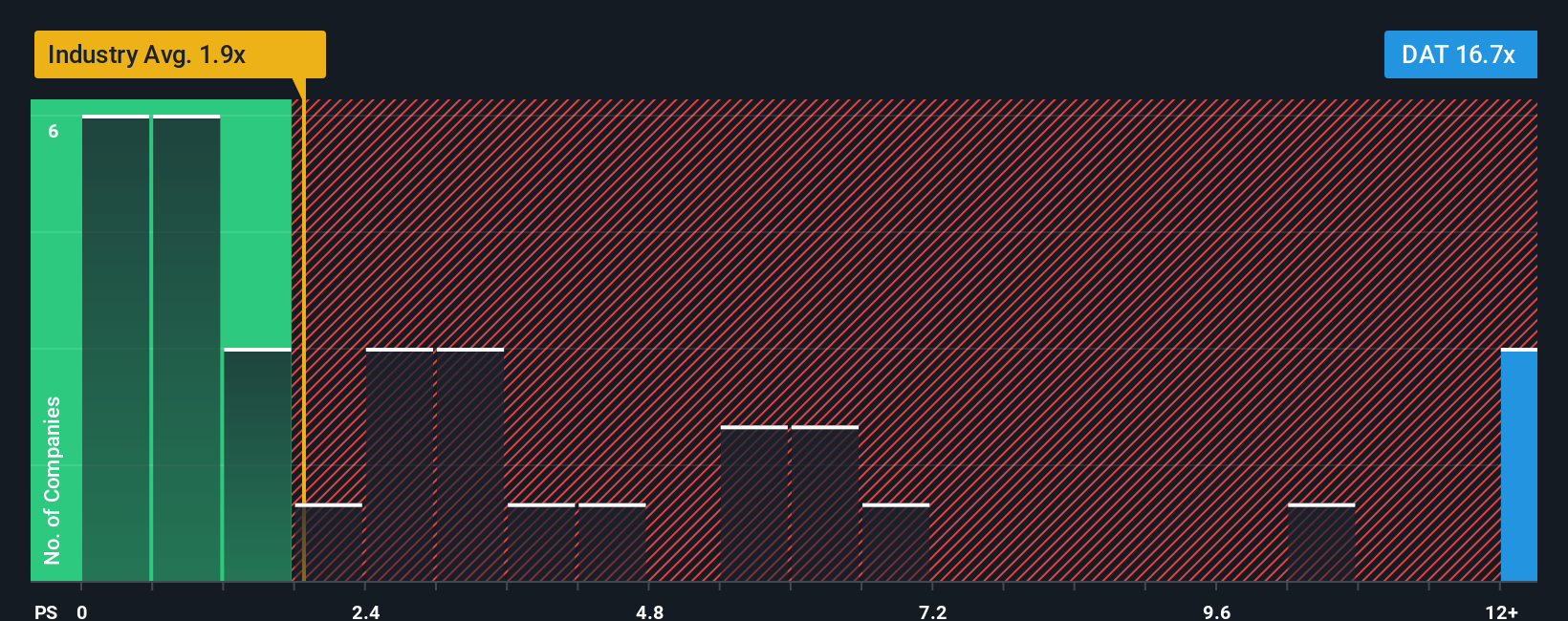

After such a large jump in price, when almost half of the companies in Poland's Software industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider DataWalk as a stock not worth researching with its 16.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for DataWalk

What Does DataWalk's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, DataWalk has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think DataWalk's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, DataWalk would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 73% last year. As a result, it also grew revenue by 9.6% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 49% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 10%, which is noticeably less attractive.

In light of this, it's understandable that DataWalk's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From DataWalk's P/S?

The strong share price surge has lead to DataWalk's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that DataWalk maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for DataWalk (1 shouldn't be ignored!) that you should be aware of.

If these risks are making you reconsider your opinion on DataWalk, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal