Assessing Virtus Investment Partners (VRTS) Valuation After Launching Its 26th Actively Managed ETF

Virtus Investment Partners has just rolled out the Virtus Silvant Growth Opportunities ETF, its 26th ETF, extending the firm’s actively managed lineup and signaling ongoing conviction in growth focused, research driven strategies.

See our latest analysis for Virtus Investment Partners.

The launch of VGRO comes as Virtus shares trade at $166.56, with a solid 1 month share price return of about 7 percent but a weak year to date share price return of roughly minus 24 percent. The 3 year total shareholder return is only slightly positive, suggesting sentiment is still recovering despite the latest product expansion and steady dividends.

If this kind of active management story has your attention, it might be a good moment to see what else is gaining traction and explore fast growing stocks with high insider ownership.

With the shares still trading well below their recent highs yet showing a modest intrinsic discount and upside to analyst targets, investors now face a key question: is Virtus a value entry point, or is future growth already priced in?

Price-to-Earnings of 8.3x: Is it justified?

On a price to earnings basis, Virtus looks inexpensive at 8.3 times earnings versus peers, even as the share price sits at $166.56 and below analyst targets.

The price to earnings ratio compares what investors pay for each dollar of current earnings, a key yardstick for asset managers where fee based profitability drives value.

For Virtus, the 8.3 times earnings multiple stands in stark contrast to both direct peers at 24.5 times and the wider US capital markets industry at 25.6 times. This implies the market is heavily discounting its profit stream despite high quality earnings, improving margins and a forecast return on equity rising to 21.2 percent.

Against that backdrop, the gap between Virtus and the rest of the sector is not just modest; it is dramatic, suggesting a valuation reset would require a significant rerating rather than small incremental moves if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 8.3x (UNDERVALUED)

However, investors still face risks from declining revenue growth and lingering negative multiyear returns, which could signal deeper structural challenges ahead.

Find out about the key risks to this Virtus Investment Partners narrative.

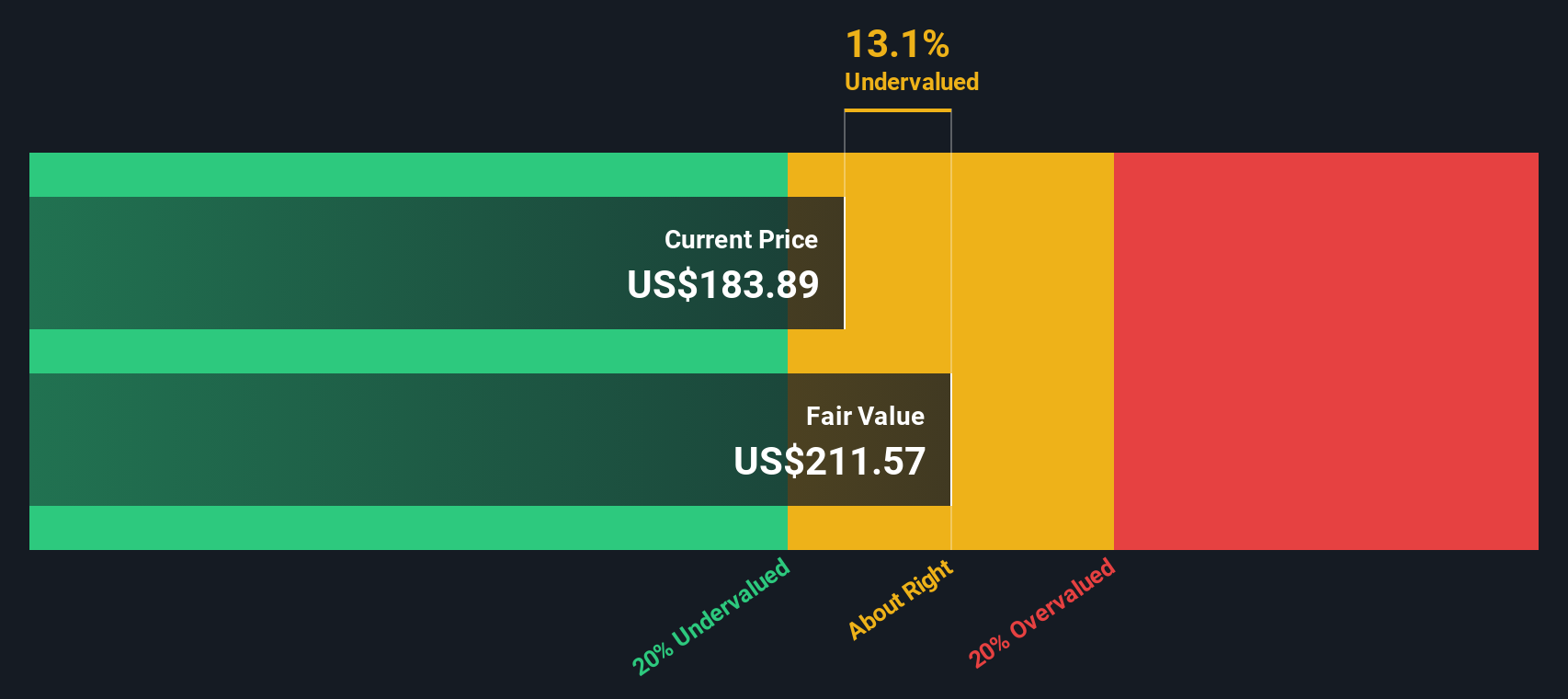

Another View Using Our DCF Model

Our DCF model paints a similar picture, with Virtus trading about 20 percent below an estimated fair value of roughly $208. This still points to undervaluation, but raises a softer question for investors: is the discount a margin of safety or a warning sign?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Virtus Investment Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Virtus Investment Partners Narrative

If you see things differently or would rather rely on your own due diligence, you can quickly build a personalized view in just minutes: Do it your way.

A great starting point for your Virtus Investment Partners research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single opportunity when you can scan the market for fresh angles, overlooked winners, and powerful themes shaping the next stage of returns.

- Capture potential mispricing by reviewing these 904 undervalued stocks based on cash flows that may offer stronger cash flow upside than the market currently expects.

- Ride structural innovation trends by targeting these 24 AI penny stocks positioned at the heart of the AI and automation wave.

- Strengthen your income stream by focusing on these 10 dividend stocks with yields > 3% that could help anchor your portfolio with reliable cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal