Is Starbucks Share Price Justified After Recent Slide And Premium Valuation Metrics?

- If you are wondering whether Starbucks at around $84 a share is a bargain or a value trap right now, you are not alone. This makes it a good moment to unpack what the market is really pricing in.

- Over the past year the stock is down about 3.4%, with a softer 8.2% slide year to date, but a modest 1.5% gain over the last month hints that sentiment might be stabilizing as investors reassess its long term growth story.

- Recently, markets have been weighing Starbucks strategic push into new store formats and digital loyalty expansion alongside ongoing debates about labor relations and consumer spending resilience. These themes have kept the stock in focus as investors decide whether its global brand strength still justifies a premium multiple or demands a discount.

- Despite the brand power, Starbucks scores just 0/6 on our valuation checks, suggesting it does not screen as undervalued on any of the standard metrics we track. Next, we will walk through those traditional valuation approaches and then finish with a more nuanced way of thinking about what Starbucks might really be worth in a diversified portfolio.

Starbucks scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Starbucks Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in dollar terms.

For Starbucks, the model starts with last twelve months free cash flow of about $2.2 billion and uses analyst forecasts plus longer term extrapolations to map out how that figure could grow. By 2028, free cash flow is projected to reach roughly $3.6 billion, and the 2 Stage Free Cash Flow to Equity model then extends and tapers those growth assumptions over the following years.

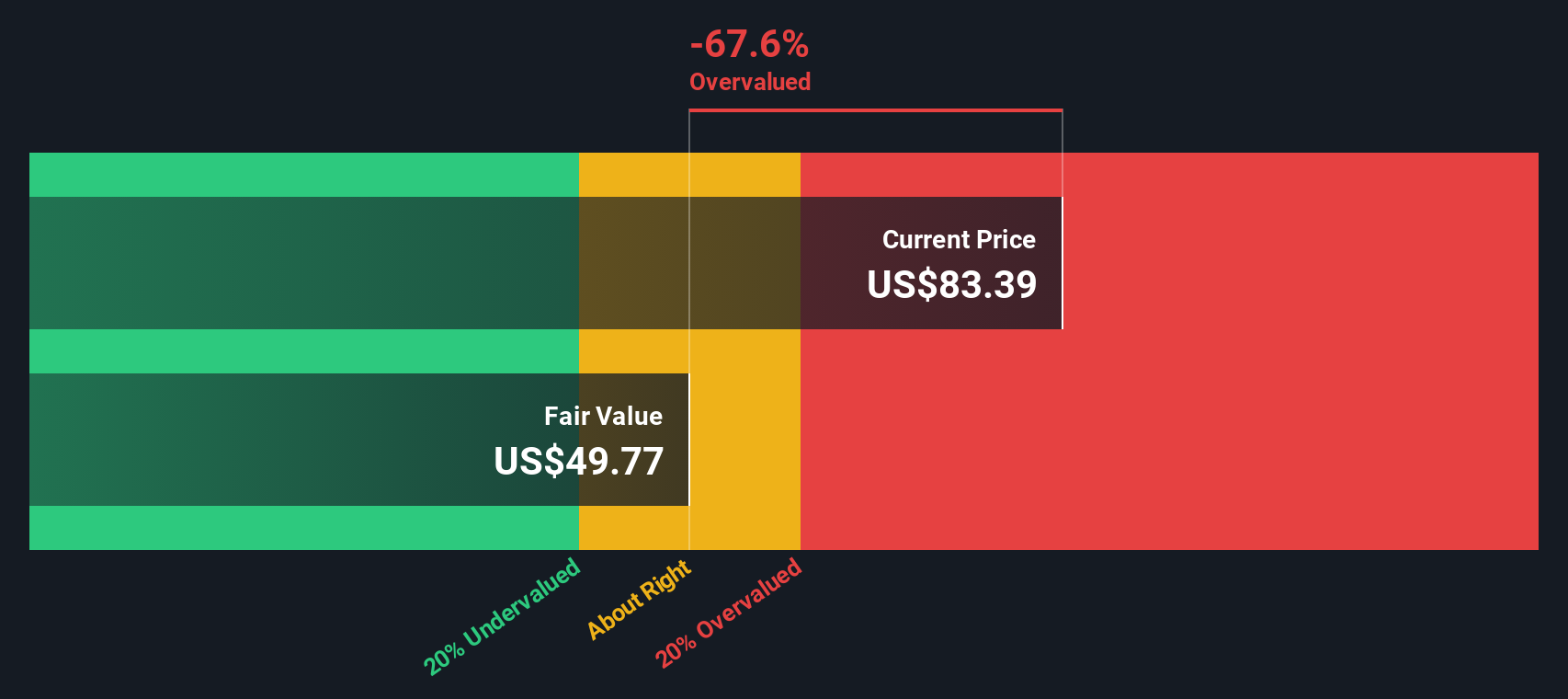

When all those future cash flows are discounted back to today, Simply Wall St arrives at an estimated intrinsic value of about $47.79 per share. Against a market price around $84, the DCF suggests the shares are trading at a substantial premium to this estimate of long term cash generation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Starbucks may be overvalued by 77.0%. Discover 904 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Starbucks Price vs Earnings

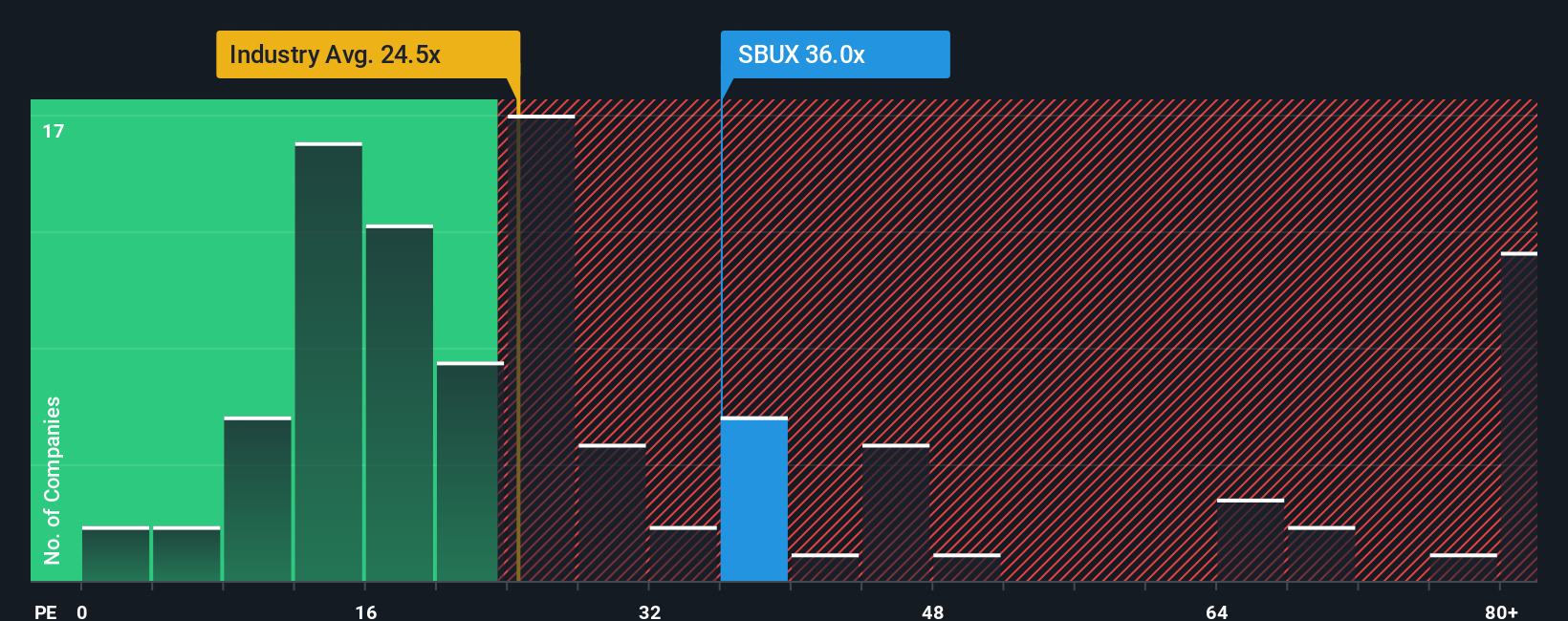

For profitable, mature consumer brands like Starbucks, the Price to Earnings ratio is often the cleanest way to gauge what investors are willing to pay for each dollar of current profits. It captures not only today’s earnings power but also how the market feels about the company’s future growth and resilience.

In practice, a higher growth outlook or lower perceived risk usually justifies a higher, or more generous, PE multiple, while slower growth or higher uncertainty should mean a lower one. Starbucks currently trades on a PE of about 51.8x, which is broadly in line with the peer group average of 51.2x, but far richer than the wider Hospitality industry on roughly 22.0x. On the surface, that suggests investors are still assigning a premium to Starbucks earnings relative to the sector.

Simply Wall St goes a step further with its Fair Ratio, an in house estimate of what PE multiple would make sense given Starbucks earnings growth, profitability, industry, market cap and key risks. That Fair PE for Starbucks is 36.8x, well below the current 51.8x. Because this metric incorporates more of the company specific fundamentals than a simple peer or industry comparison, it provides a more nuanced picture and implies the stock looks expensive relative to its underlying profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Starbucks Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to turn your view of Starbucks into a clear, numbers backed story by connecting your assumptions about its future revenue, earnings and margins to a forecast and then a Fair Value. You can easily compare this to today’s price to decide whether to buy, hold or sell, all inside the Simply Wall St Community. Narratives update automatically as new news or earnings arrive. One investor might, for example, build a cautious Starbucks Narrative that sees cost pressures and slower global growth driving a fair value closer to $73 a share. Another might create a more optimistic Narrative that assumes a successful turnaround and stronger margins that could justify a fair value nearer $115, with both stories coexisting and evolving in real time as the data changes.

Do you think there's more to the story for Starbucks? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal