Does Pinnacle Financial Partners’ Recent Rally Leave More Room for Long Term Upside?

- Wondering whether Pinnacle Financial Partners at around $101 a share is a bargain or a value trap right now? You are not alone, and that is exactly what we are going to unpack.

- The stock has climbed 1.1% over the last week and 12.4% over the past month, but it is still down around 10.8% year to date and 10.7% over the last year, despite delivering 44.2% and 65.3% over the past 3 and 5 years respectively.

- Recent headlines have focused on regional banks balancing tighter funding conditions with ongoing loan demand and capital requirements. This has kept investor attention firmly on balance sheet strength and credit quality. Pinnacle has been cited in commentary as one of the better positioned regional players in terms of deposit franchise and growth profile, which helps explain why the market has been willing to reward the stock again after a weaker spell.

- On our framework, Pinnacle scores a 4 out of 6 valuation checks, suggesting the shares lean toward undervalued territory. Next we will walk through DCF, multiples, and other approaches, before closing with a more holistic way to think about what this valuation really means for long term investors.

Approach 1: Pinnacle Financial Partners Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate above the return that shareholders reasonably demand, and then capitalizes those extra profits into an intrinsic value per share.

For Pinnacle Financial Partners, the analysis starts with an estimated Book Value of $86.33 per share and a Stable EPS of $10.67 per share, based on weighted future Return on Equity estimates from 8 analysts. Against a Cost of Equity of $8.23 per share, this implies an Excess Return of $2.44 per share, meaning the bank is expected to earn more than its shareholders required return on each dollar of equity.

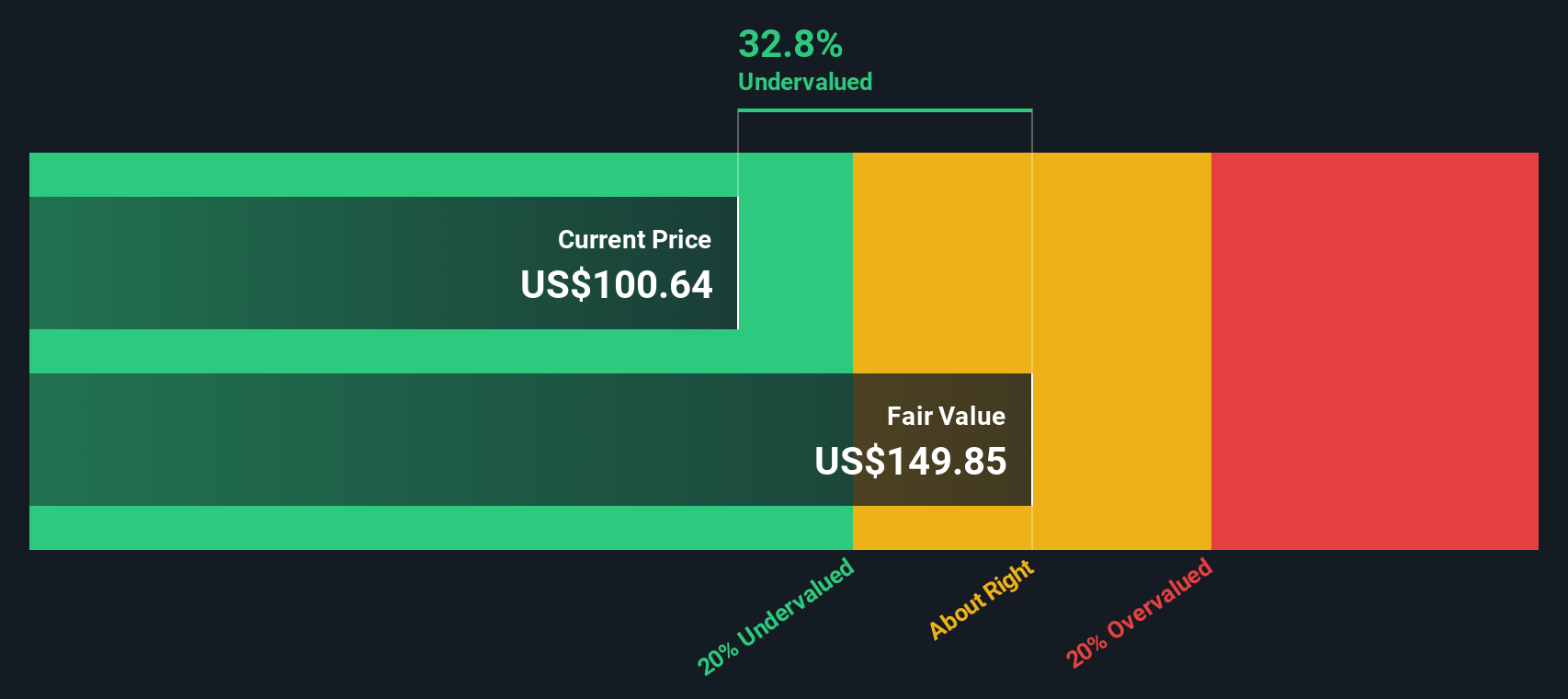

The model also assumes an Average Return on Equity of 10.64% and a Stable Book Value rising to $100.28 per share, supported by estimates from 10 analysts. When these excess returns are projected and discounted, they imply an intrinsic value of about $149.58 per share, suggesting the stock is roughly 32.3% undervalued versus the current price near $101.

Result: UNDERVALUED

Our Excess Returns analysis suggests Pinnacle Financial Partners is undervalued by 32.3%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

Approach 2: Pinnacle Financial Partners Price vs Earnings

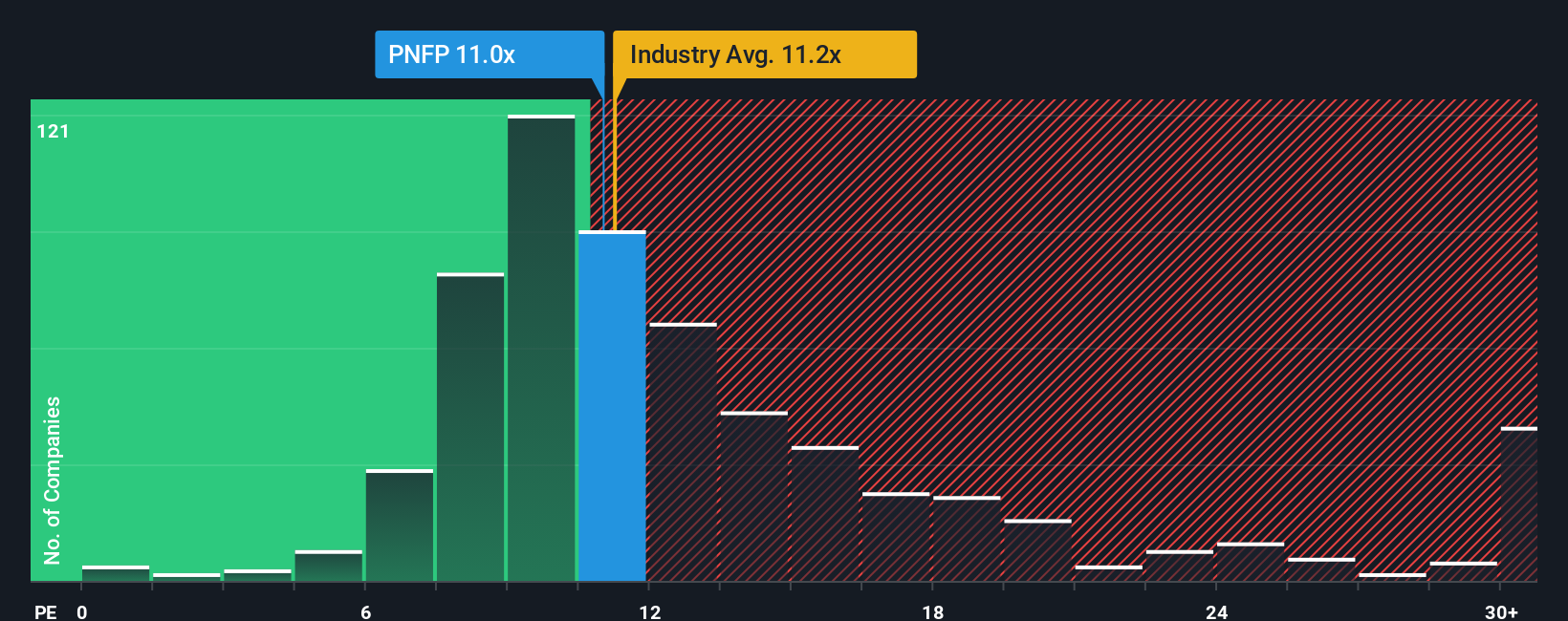

For a consistently profitable bank like Pinnacle Financial Partners, the price to earnings ratio is a useful way to judge whether investors are paying a reasonable price for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher normal or fair PE ratio, while slower growth and higher uncertainty should pull that multiple down.

Pinnacle currently trades on a PE of about 12.8x, which is slightly above the Banks industry average of roughly 11.9x, but below the peer group average of around 14.2x. To move beyond simple comparisons, Simply Wall St uses a Fair Ratio, which is the PE multiple the company would typically deserve given its earnings growth outlook, industry, profit margins, size, and risk profile. For Pinnacle, that Fair Ratio is estimated at about 25.1x, implying that, once these factors are accounted for, the stock’s current earnings multiple is well below what might be considered fair value.

On this preferred multiple basis, Pinnacle Financial Partners looks undervalued rather than expensive versus both its peers and its own fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pinnacle Financial Partners Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Pinnacle Financial Partners future with a financial forecast, a fair value, and ultimately a decision about whether today’s price offers enough upside.

A Narrative on Simply Wall St is your story behind the numbers, where you spell out how you think Pinnacle’s revenue, earnings, and margins will evolve, and the platform then turns that story into a forecast and an implied fair value that you can compare directly to the current share price to decide whether to buy, hold, or sell.

These Narratives live in the Community page used by millions of investors and update dynamically as new earnings, merger news, or credit data comes in. They can also differ meaningfully. For example, one investor might focus on an optimistic Synovus integration path and target something closer to 130 dollars, while a more cautious investor might build in execution and credit risk and land nearer 95 dollars. This gives you a clear, real time range of reasoned viewpoints to benchmark your own.

Do you think there's more to the story for Pinnacle Financial Partners? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal