Is It Too Late To Consider FedEx After Its 82.4% Three Year Surge?

- Wondering if FedEx is still a bargain after its big multi year run, or if most of the upside has already been priced in? This article will walk through what the numbers say about its current value.

- The stock has kept grinding higher, with shares up 4.9% over the last week, 10.8% over the past month, 7.9% year to date, 11.4% over the last year, and 82.4% over three years, ahead of the broader market.

- Behind those moves, investors have been reacting to FedEx's multi year cost cutting program, network optimization efforts, and strategic focus on higher margin parcels, which have all helped reset expectations. At the same time, ongoing debates about global trade volumes, e commerce growth, and competitive pressure from UPS and Amazon continue to shape how the market values the stock.

- Despite that backdrop, FedEx has a 2/6 valuation check rating, which suggests potential upside in a couple of areas but also pockets where the market may be getting ahead of itself. Next, we will look at the main valuation approaches investors use for FedEx, then finish with a more holistic way to think about what the stock may be worth.

FedEx scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: FedEx Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future, then discounting those cash flows back to today in $ terms.

For FedEx, the latest twelve month Free Cash Flow is about $3.6 billion. Analysts and model assumptions project this to climb gradually, reaching roughly $5.2 billion by 2035, with detailed forecasts over the next decade and analyst sourced numbers for the nearer years. Beyond the first five years, Simply Wall St extends the trend using its own growth assumptions.

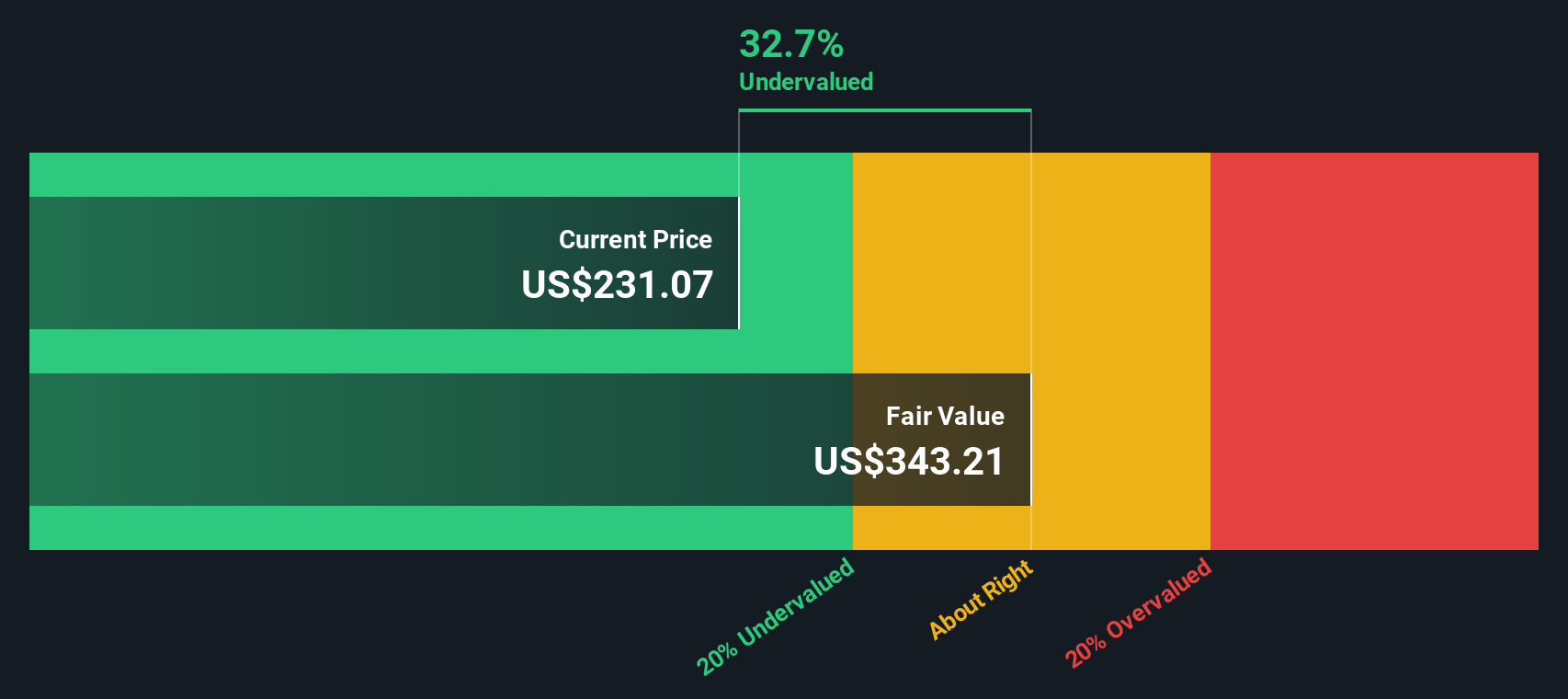

When all those projected cash flows are discounted back using a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value comes out at about $294.31 per share. That implies the stock is roughly 0.5% overvalued relative to its current market price, which is effectively a rounding error in valuation terms.

In other words, the DCF suggests FedEx is trading very close to the level justified by its long term cash generation.

Result: ABOUT RIGHT

FedEx is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: FedEx Price vs Earnings

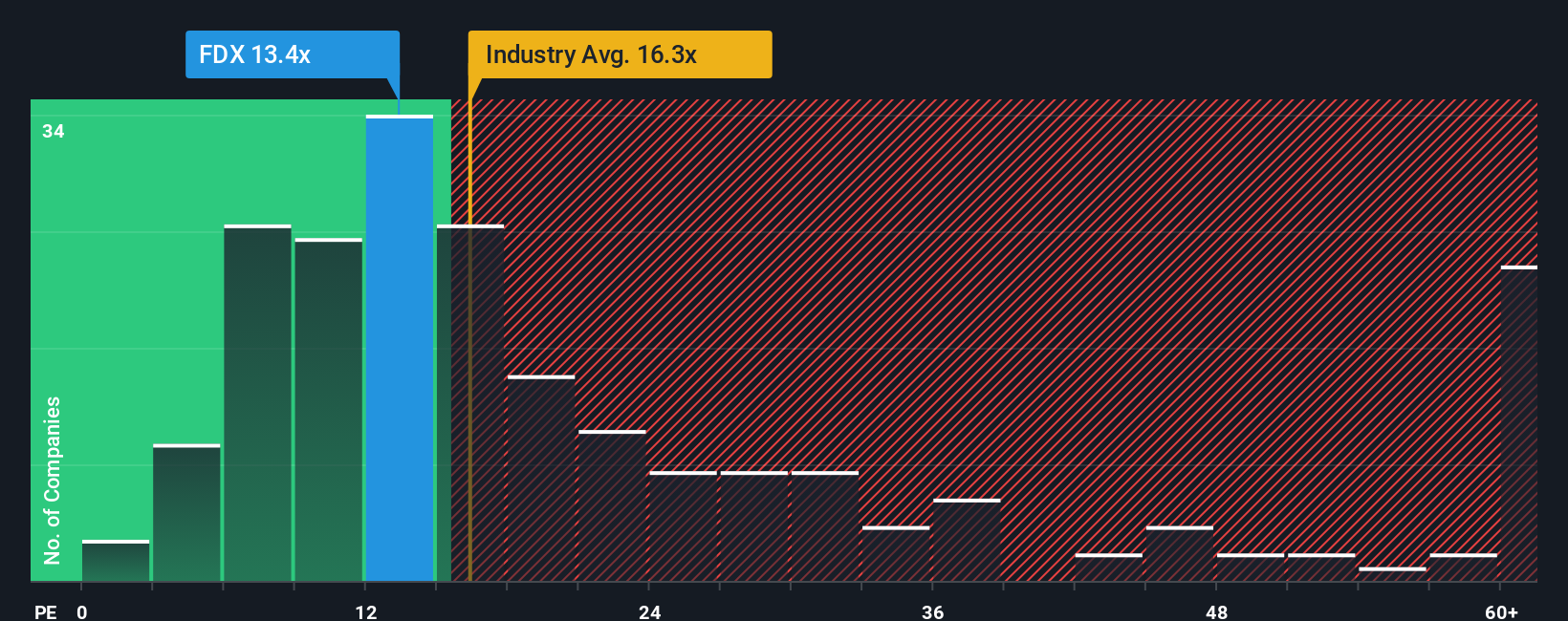

For a mature, consistently profitable company like FedEx, the Price to Earnings ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of current earnings. In general, higher growth and lower perceived risk justify a higher PE, while slower growth or greater uncertainty usually demand a discount.

FedEx currently trades on about 16.1x earnings, which is slightly above the Logistics industry average of roughly 15.9x but below the broader peer group average of around 21.3x. Simply Wall St adds another layer with its proprietary Fair Ratio, which estimates what FedEx’s PE should be after adjusting for its earnings growth outlook, profit margins, risk profile, industry positioning and market cap. On this basis, FedEx’s Fair Ratio is 19.5x, which suggests the shares trade at a discount to what would be expected given those fundamentals.

In other words, while FedEx does not look aggressively cheap against the industry, it appears modestly undervalued when you factor in its specific growth and risk characteristics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FedEx Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your story about FedEx to the numbers by linking your assumptions for future revenue, earnings and margins to a financial forecast, a fair value, and ultimately an investment decision.

On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to map out how they think a company’s business will evolve, compare the fair value that follows from that story to the current share price, and then decide whether FedEx looks worth buying, holding or selling based on that gap.

Narratives also stay current, automatically updating when new information such as earnings releases, major news or guidance changes come in, so your fair value view does not go stale just because the world has moved on.

For example, one FedEx Narrative might assume that cost discipline, network efficiency and steady demand can justify a fair value near the top of analyst targets around $320. A more cautious Narrative that emphasizes freight, tariff and macro risks might land closer to the low end near $200 instead.

Do you think there's more to the story for FedEx? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal