Interest rate hikes are overshadow+supply pressure! The bid sale of Japan's two-year treasury bonds is likely to get cold

The Zhitong Finance App learned that investors are waiting with bated breath for the Japanese two-year treasury bond auction to be held on Thursday at a time when the market speculates that the Bank of Japan may need to raise interest rates more drastically to contain inflation and support the yen. This auction is less than a week since the Bank of Japan raised policy interest rates to a 30-year high. Bank of Japan Governor Kazuo Ueda failed to give clear guidance on the timing of future monetary tightening in his speech after the interest rate decision was announced, leading to a weakening of the yen and a sharp rise in treasury bond yields.

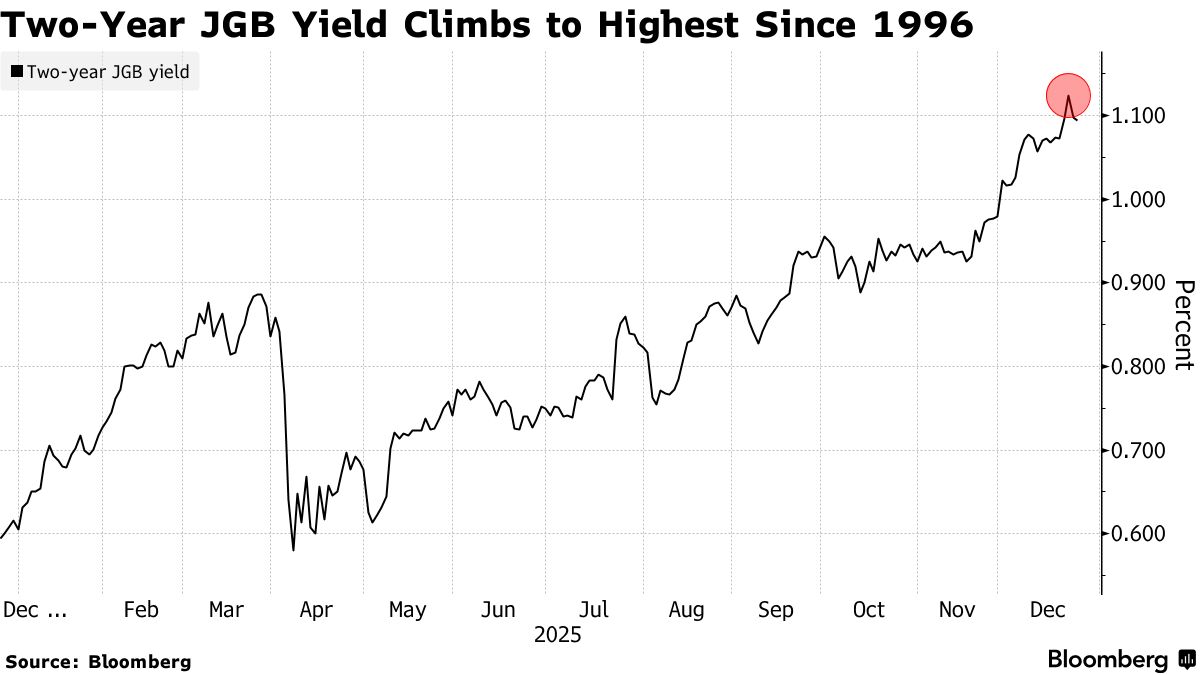

Two-year Treasury yields, which are more sensitive to monetary policy expectations, rose to their highest level since 1996 earlier this week. Meanwhile, the 10-year break-even inflation rate — an important measure of the market's expectations of future price pressures — also rose to its highest level since 2004 this week.

Katsutoshi Inadome, senior strategist at Sumitomo Mitsui Trust Asset Management, said, “The market is uneasy about this auction due to concerns that the Bank of Japan is lagging behind the situation in terms of policy, inflation expectations, and predictions of neutral interest rates are rising.”

Admittedly, after the Japanese authorities issued verbal warnings about the exchange rate, the depreciation of the yen and the rise in yield have eased somewhat since the beginning of this week, but this auction will still be a key indicator for measuring the market's views on the Bank of Japan's policy stance. Overnight index swaps show that there is still some possibility that the Bank of Japan will raise interest rates again until September next year.

Markets Live strategist Mark Cranfield said, “The last two-year treasury bond auction this year looks like it will be the first issue of a period treasury bond with a yield of more than 1%, but even so, there is no guarantee that this auction will perform well after the Bank of Japan raised interest rates last week.” “The Bank of Japan went through a tortuous process to get to the point where it raised interest rates. However, Kazuo Ueda hinted last week that when the central bank again tries to persuade politicians to accept the rationality of interest rate hikes next year, it may return to the “starting point.” This is why traders are currently only counting until the next 25 basis point rate hike in September 2026.”

Investors are also concerned about the government's treasury bond issuance plan in connection with the 2026 budget, which is expected to be approved by the cabinet on Friday. Japan's first-tier traders said this month that in the next fiscal year, it is desirable to increase the issuance of two-year, five-year, and 10-year treasury bonds, while calling for a reduction in the issuance of ultra-long-term treasury bonds. According to people familiar with the matter, the amount of additional treasury bonds issued in the budget covering the year beginning in April will be limited to 30 trillion yen (1920 billion US dollars), but it will still be higher than the 28.6 trillion yen initially planned for this fiscal year.

Den Miki, senior interest rate strategist at SMBC Nikko Securities, said, “Now is not a good time to buy.” “The issuance of two-year treasury bonds is likely to increase, so there is a high risk of book loss immediately after purchase.”

The results of this auction will be announced at 12:35 Tokyo time on Thursday. Investors will pay close attention to bid multiples, an important measure of demand, which was 3.53 in the last auction in November. At the same time, they will also pay attention to the so-called “tail margin,” that is, the gap between the average winning bid price and the lowest winning bid price.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal