Bristol Myers Squibb (BMY): Reassessing Valuation After Breyanzi’s Landmark FDA Approval in Marginal Zone Lymphoma

Bristol Myers Squibb (BMY) has been back on investors radar after the FDA cleared Breyanzi as the first CAR T therapy for relapsed or refractory marginal zone lymphoma, reinforcing the company presence in B cell malignancies.

See our latest analysis for Bristol-Myers Squibb.

The latest Breyanzi approval lands at a moment when sentiment is already shifting, with a 30 day share price return of 14.55% and a 90 day share price return of 26.03% from $54.71, even though the 1 year total shareholder return is still slightly negative. This suggests that momentum is rebuilding as investors reassess Bristol Myers Squibb pipeline strength, dividend growth and recent drug pricing commitments.

If this kind of catalyst driven rerating interests you, it is worth seeing what other healthcare names are setting up for the next leg higher via healthcare stocks.

With the shares now hovering near analyst targets and pipeline news coming thick and fast, the key question is whether Bristol Myers Squibb still trades at a discount or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 2.2% Overvalued

With Bristol-Myers Squibb last closing at $54.71 against a narrative fair value of $53.55, the current setup implies only modest downside from here. This puts more weight on how long term cash flows are modeled than on near term headlines.

Analysts expect earnings to reach $9.2 billion (and earnings per share of $4.69) by about September 2028, up from $5.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $12.0 billion in earnings, and the most bearish expecting $6.3 billion.

Want to unpack why modest revenue shrinkage still supports richer profits and a higher future multiple? The narrative leans on a sharp margin reset and disciplined discounting. Curious which line items do the heavy lifting in that model and how sensitive the valuation is if those levers move even slightly? The full breakdown reveals the assumptions that turn a challenged top line into a premium earnings story.

Result: Fair Value of $53.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming patent cliffs on Eliquis and Opdivo, along with tougher drug pricing reforms, could quickly erode the margin reset that this narrative leans on.

Find out about the key risks to this Bristol-Myers Squibb narrative.

Another Angle on Value

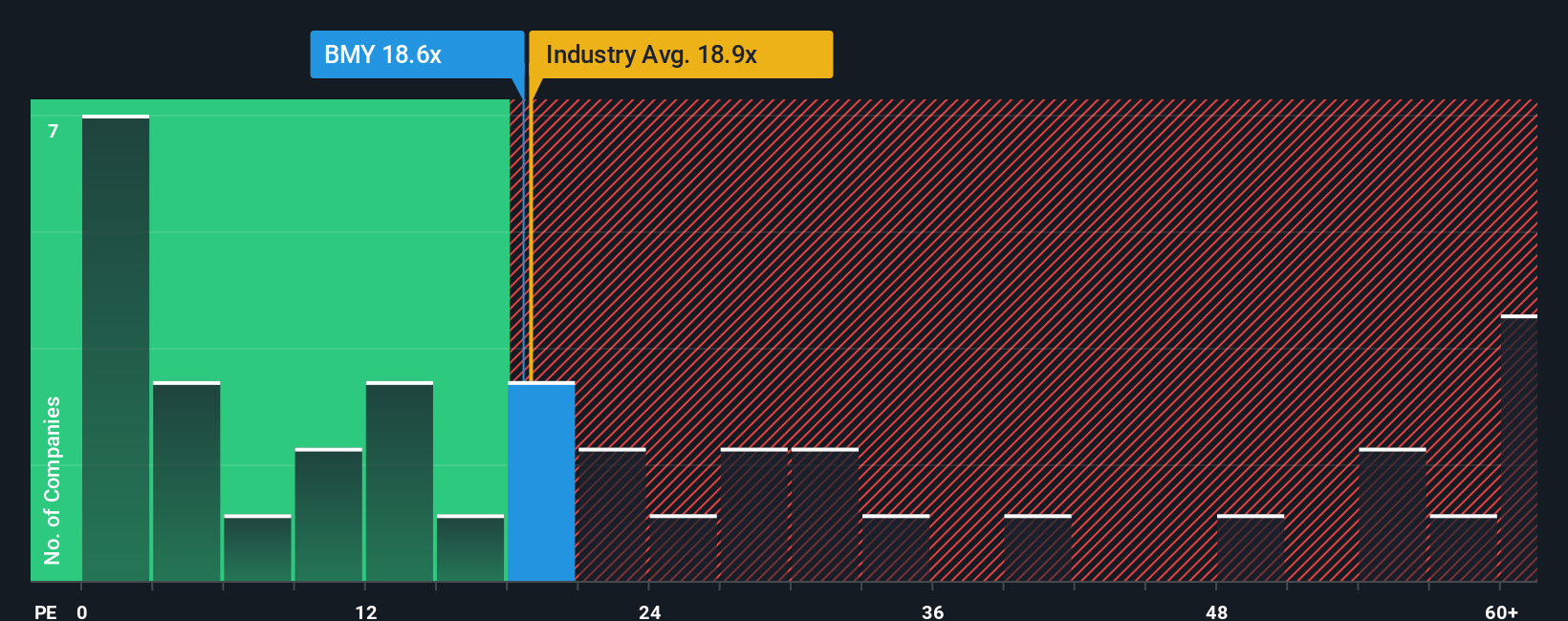

On simple earnings multiples, Bristol Myers Squibb looks very different. It trades on a price to earnings ratio of 18.4x versus peers at 25.1x and a fair ratio of 26.2x, which suggests the market applies a hefty safety discount. Is that caution justified or an opening?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bristol-Myers Squibb Narrative

If you are skeptical of this view or simply prefer digging into the numbers yourself, you can build a personalized Bristol Myers Squibb storyline in under three minutes: Do it your way.

A great starting point for your Bristol-Myers Squibb research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Opportunity?

Do not stop at one idea. Turn today momentum into a habit by using the Simply Wall St Screener to uncover more focused, data driven opportunities.

- Capture potential mispricings by scanning these 905 undervalued stocks based on cash flows that may be trading below their long term cash flow power.

- Tap into rapid innovation by reviewing these 24 AI penny stocks positioned at the heart of the artificial intelligence boom.

- Lock in income potential by screening these 10 dividend stocks with yields > 3% that could strengthen your portfolio with reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal