Verisk (VRSK) Expands KYND Cyber Partnership: A Fresh Look at Whether the Stock’s Valuation Still Stacks Up

Verisk Analytics (VRSK) is drawing fresh attention after expanding its partnership with KYND to plug richer cyber risk intelligence directly into its Rulebook platform, just as UK retail cyber vulnerabilities are coming into sharper focus.

See our latest analysis for Verisk Analytics.

Even with this cyber push, Verisk’s recent share price return has been weak. The stock is now at $218.85 and momentum is fading in the near term, though the three year total shareholder return of 28.01% still points to a solid longer term compounding story.

If this kind of data driven growth theme interests you, it is also worth exploring high growth tech and AI stocks as a way to uncover other analytics focused names riding similar digital and AI tailwinds.

With shares lagging despite double digit earnings growth and a healthy discount to analyst targets, is Verisk now a quietly mispriced compounder, or has the market already fully baked in its long term cyber and analytics growth story?

Most Popular Narrative: 12.9% Undervalued

With Verisk shares last closing at $218.85 versus a narrative fair value near $251, this framework implies meaningful upside if its growth plan plays out.

Verisk is developing new platforms like the Enterprise Exposure Manager and Verisk Synergy Studio, which are expected to provide scalable and efficient risk assessment solutions, potentially driving revenue growth and expanding market share among insurers and risk managers.

Curious how steady revenue growth, rising margins and a richer earnings multiple all fit together in this story? The full narrative reveals the precise growth runway, the profitability lift and the valuation stretch that are incorporated into that upside case, and explains why analysts still see room for a premium price tag.

Result: Fair Value of $251.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent organic growth deceleration or missteps integrating AccuLynx could undermine margin expansion expectations and challenge the premium multiple embedded in this upside case.

Find out about the key risks to this Verisk Analytics narrative.

Another View on Valuation

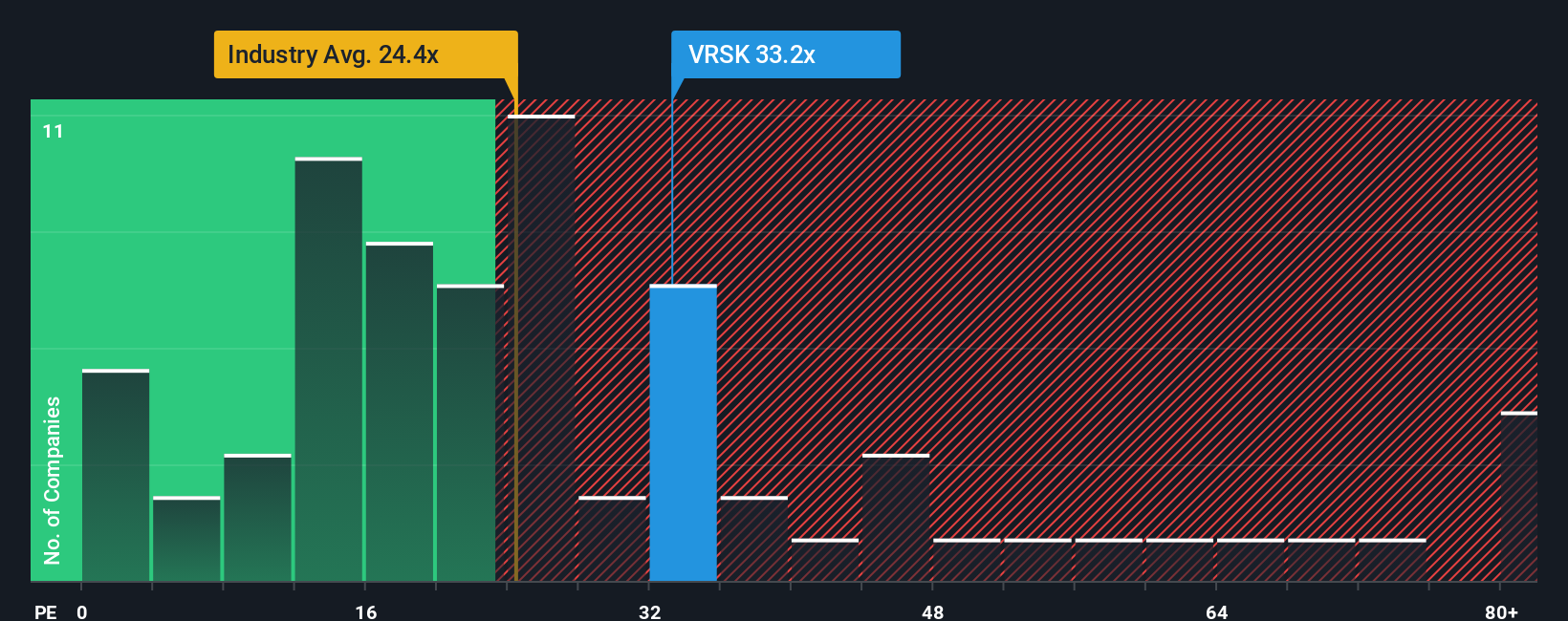

Multiples tell a more cautious story. Verisk trades on a 33.3x price to earnings ratio, above the US Professional Services average of 24.3x and our fair ratio of 29.2x, but slightly cheaper than peer average at 36.9x. Is that a premium worth paying for slower, mid single digit growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Verisk Analytics Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in minutes with Do it your way.

A great starting point for your Verisk Analytics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

If you stop at Verisk, you could miss compelling opportunities. Use the Simply Wall St Screener to pinpoint fresh, data backed ideas tailored to your strategy.

- Capture potential recovery by targeting quality companies trading below intrinsic value through these 905 undervalued stocks based on cash flows before the crowd closes the gap.

- Focus on automation and machine learning innovators within these 24 AI penny stocks that are positioned to compound revenue over time.

- Strengthen your income stream by zeroing in on reliable payers using these 10 dividend stocks with yields > 3% that may help keep cash flowing when markets are volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal