Assessing Barclays (LSE:BARC) Valuation After Its Recent Share Price Rally

Why Barclays Shares Have Caught Investors’ Attention

Barclays (LSE:BARC) has quietly delivered a strong run, with the stock up about 17% over the past month and nearly 25% in the past 3 months, prompting fresh interest from value focused investors.

See our latest analysis for Barclays.

That recent surge has come on top of a powerful backdrop, with the year to date share price return at 76.00% and the 1 year total shareholder return close to 83.00%. This is signalling momentum that investors are treating as a rerating story rather than a short term bounce.

If you are weighing up whether this rally is isolated or part of a wider trend in financials, it is worth scanning fast growing stocks with high insider ownership for other compelling ideas.

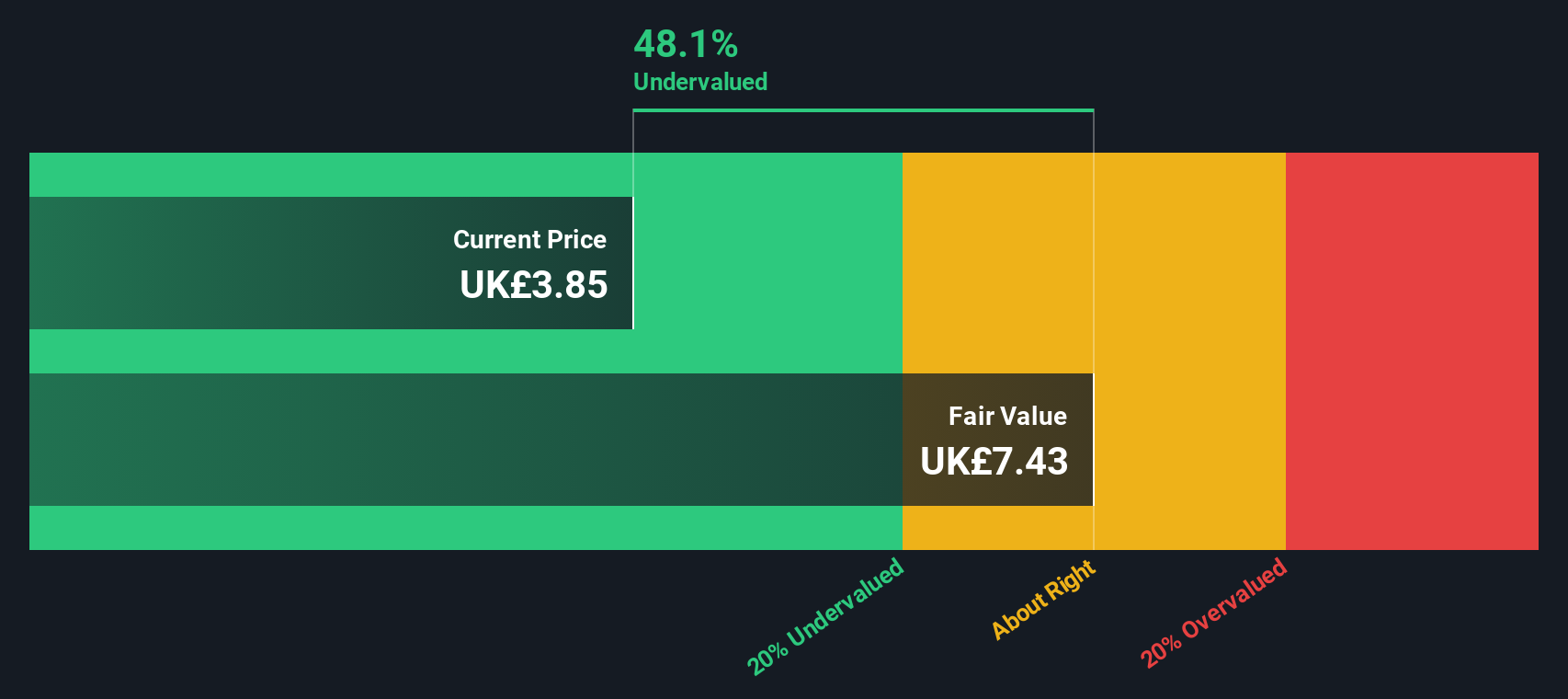

With the shares now near analyst targets but still trading at a hefty intrinsic discount, the key question is whether Barclays remains undervalued or if the market is already pricing in the next leg of growth.

Most Popular Narrative: 2% Overvalued

With the narrative fair value sitting just below Barclays recent close, the current share price bakes in slightly richer long term expectations.

Analysts have raised their price target for Barclays slightly to reflect a modest uptick in fair value, supported by incremental improvements in projected revenue growth, profit margins, and future earnings multiples.

Curious what justifies paying more for each pound of future profit? The narrative leans on sturdier revenues, firmer margins, and a punchier earnings multiple. Want to see exactly how those moving parts combine into that upgraded fair value? Dive into the full breakdown to uncover the assumptions driving this call.

Result: Fair Value of £4.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition for deposits and any macro slowdown that lifts credit impairments could quickly undermine the stronger growth and margin assumptions embedded in this outlook.

Find out about the key risks to this Barclays narrative.

Another Lens On Value

Our DCF model paints a very different picture, suggesting Barclays is trading about 40.6% below its fair value estimate of £7.91 per share. If cash flow fundamentals point to deep value while the narrative flags slight overvaluation, which signal should investors trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Barclays for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Barclays Narrative

If you see the story differently or prefer to lean on your own due diligence, you can build a custom narrative in minutes, Do it your way.

A great starting point for your Barclays research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before Barclays takes over your watchlist, use the Simply Wall St Screener to uncover fresh opportunities that match your style and could sharpen your portfolio edge.

- Capture potential mispricings by scanning these 905 undervalued stocks based on cash flows that combine solid fundamentals with attractive cash flow based valuations.

- Ride structural growth trends by focusing on these 29 healthcare AI stocks using data and automation to reshape patient care and medical decision making.

- Target powerful cash generators by zeroing in on these 10 dividend stocks with yields > 3% that keep paying investors while markets stay unpredictable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal