Should Upgraded AI-Driven Growth Assumptions for 2026 Require Action From Schneider Electric (ENXTPA:SU) Investors?

- Earlier in 2025, Bloomberg Intelligence projected nearly 13% earnings-per-share growth for the Stoxx Europe 600 industrials index in 2026, highlighting Schneider Electric as a key beneficiary of rising AI infrastructure demand through its power hardware and digital systems.

- The market reaction has focused on Schneider Electric’s 2030 roadmap, where some analysts now view consensus assumptions for 2026 organic sales growth as potentially too conservative given its AI-linked exposure.

- Next, we’ll examine how Schneider Electric’s AI infrastructure positioning may influence the existing investment narrative built around data center and digital growth.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Schneider Electric Investment Narrative Recap

To own Schneider Electric, you need to believe that electrification, digitalization and AI-driven data center demand will support steady growth across its energy management and industrial automation businesses. The Bloomberg Intelligence update reinforces AI infrastructure as a key short term catalyst, while margin and mix pressure, especially in Systems versus Products, remains a central risk that this news does not materially remove.

The recently reaffirmed 2025 guidance for 7% to 10% organic revenue growth is especially relevant here, as it sets a near term benchmark against which any AI-related upside will be judged. At the same time, management’s flagging of a sizeable negative FX impact on 2025 revenues underlines that currency headwinds could still weigh on how much of that AI growth ultimately reaches reported numbers.

Yet while AI infrastructure demand could support Schneider’s growth story, investors should also be aware of the ongoing risk that product mix and margin pressure could...

Read the full narrative on Schneider Electric (it's free!)

Schneider Electric's narrative projects €48.6 billion revenue and €6.7 billion earnings by 2028. This requires 7.3% yearly revenue growth and about a €2.4 billion earnings increase from €4.3 billion today.

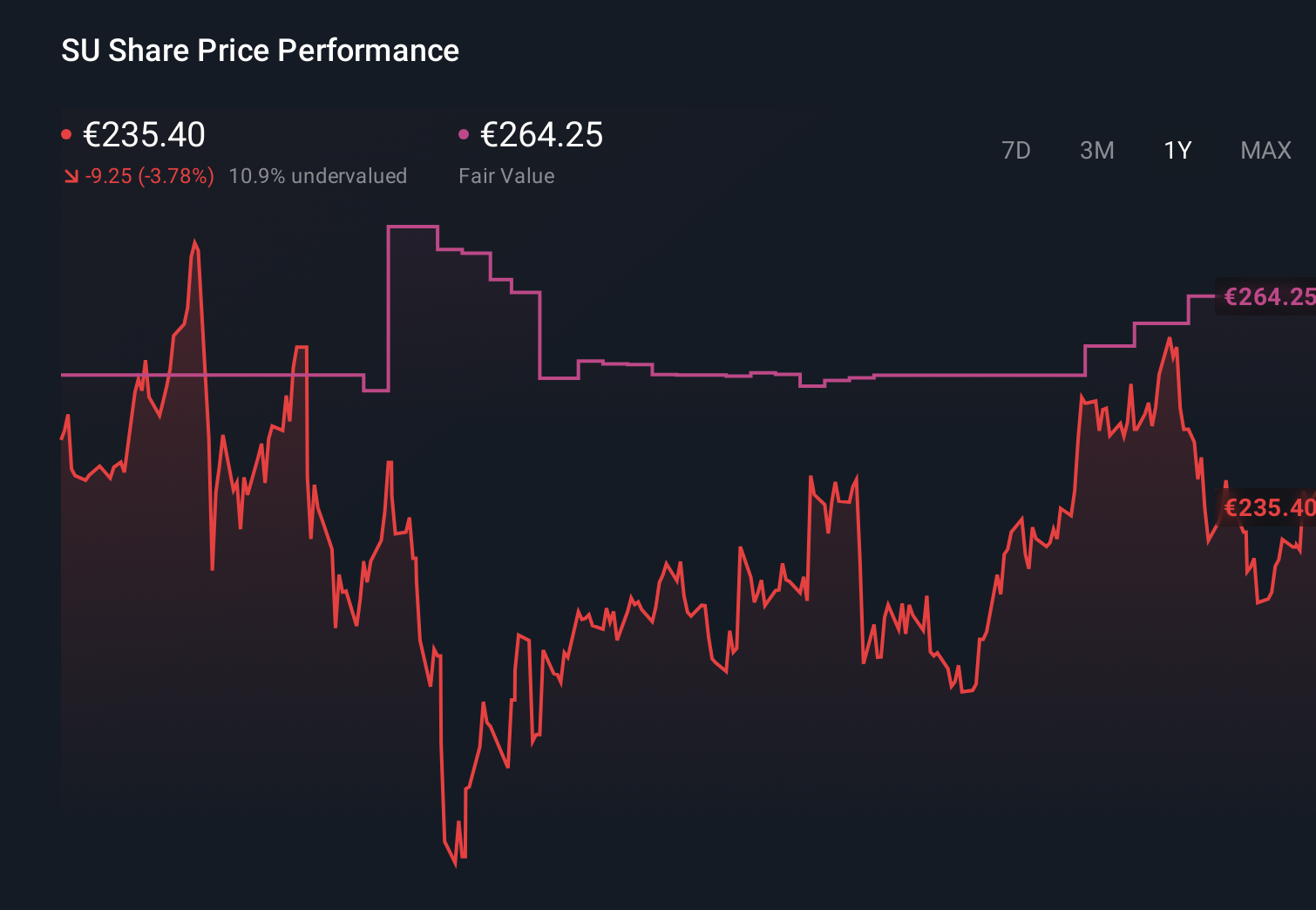

Uncover how Schneider Electric's forecasts yield a €270.55 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly €134 to €271 per share, showing how far apart individual conclusions can be. You can set those views against the current AI driven data center growth catalyst and consider how each investor weighs that against Schneider Electric’s exposure to margin and FX pressures.

Explore 8 other fair value estimates on Schneider Electric - why the stock might be worth 43% less than the current price!

Build Your Own Schneider Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Schneider Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Schneider Electric's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal