IPO News | China's circular packaging service provider Eulesai once again submitted the Hong Kong Stock Exchange has established 78 warehousing networks covering more than 100 cities

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 24, Suzhou Yulesai Shared Services Co., Ltd. (abbreviation: Yulesai) submitted a listing application to the main board of the Hong Kong Stock Exchange, with CITIC Construction Investment International as the sole sponsor. The company submitted listings to the Hong Kong Stock Exchange on November 18, 2024 and June 13, 2025.

Company profile

According to the prospectus, Eulesai is a recycling packaging service provider in China, which mainly focuses on providing services to auto parts manufacturers and OEMs in the automotive industry. The company mainly provides shared operation. This is a shared model. According to this model, it manages recycled packaging such as trays, crates, or containers for customers, and handles the storage, delivery and return of recycled packaging on behalf of customers (mainly through subcontracted third-party logistics service providers), cleaning and maintenance.

In addition to shared operations, Eulux also provides leasing services to customers who prefer to independently manage recycled packaging, providing value-added services such as warehousing management and customer-owned container management, and also sells containers to customers who can independently manage containers. According to Frost & Sullivan, in terms of 2024 revenue, Yulexai is the second-largest provider of recycling packaging services in China, with a market share of 1.5%; it is also the largest provider of car sharing and operation services in China, with a market share of 8.2%. In 2024, recycling packaging services, shared operation services and car sharing operation services accounted for 6.4%, 2.4% and 1.0% of the overall logistics packaging solutions market in China, respectively.

As of August 31, 2025, Eulesai has established 78 warehousing networks covering more than 100 cities, which can effectively serve customers. According to the Frost & Sullivan report, in order to keep up with sustainable development trends, the logistics packaging industry is accelerating the shift from single-use packaging to recycled packaging to meet growing sustainable development needs and support ESG initiatives. In 2024, China's overall logistics packaging solutions market will reach US$118.7 billion, of which logistics container sales account for 93.6%. The market is highly fragmented and has more than 3,500 participants. The top five players account for only 4.7% of total revenue, and the largest players only account for 1.5% of the market share. In 2024, Eulax will have 0.1% of the market share, and the main focus is on recycling packaging services.

Financial data

revenue

In 2022, 2023, 2024, and 2025 for the eight months ended August 31, the company recorded revenue of RMB 648 million, RMB 794 million, RMB 838 million and RMB 533 million respectively.

profit

In 2022, 2023, 2024, and the eight months ended August 31, 2025, the company recorded annual/period profits of 31.21 million yuan, 64,149 million yuan, 507.41 million yuan, and 26.892 million yuan, respectively.

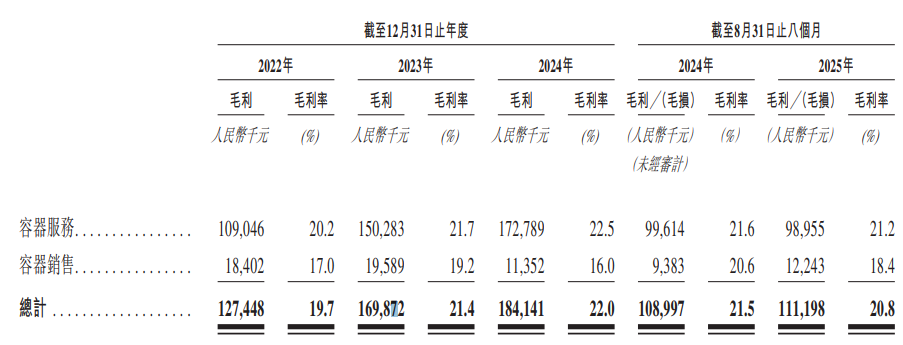

gross profit margin

For the eight months ended August 31 in 2022, 2023, 2024, and 2025, the company's corresponding gross profit margins were 19.7%, 21.4%, 22.0%, and 20.8%.

Industry Overview

The logistics industry plays an important role in the global economy. As international trade continues to expand, the logistics industry has also experienced significant growth. According to Frost & Sullivan, the total global logistics expenditure in 2024 is approximately US$11.6 trillion, and is expected to reach US$14.7 trillion by 2030. In 2024, China's share of the global logistics industry will be 25.0%. According to Frost & Sullivan, China's logistics spending in 2024 is about 2.9 trillion US dollars, and is expected to reach 3.7 trillion US dollars in 2030.

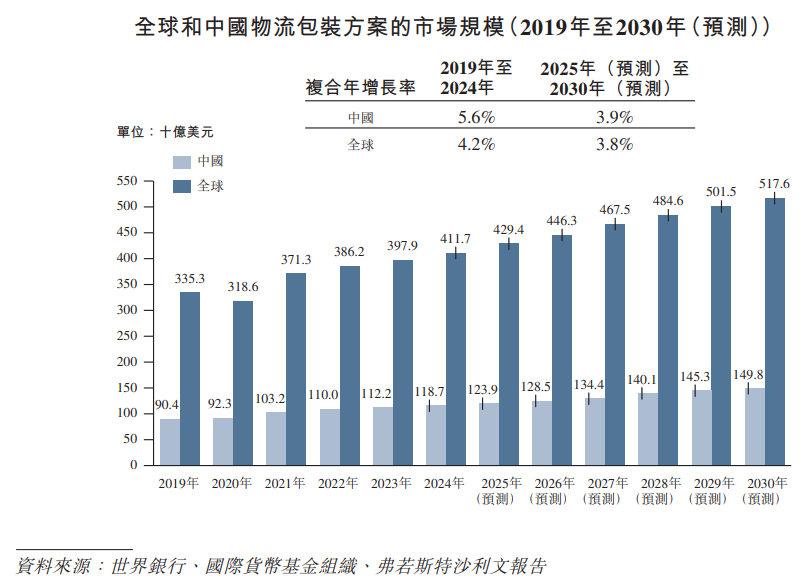

According to Frost & Sullivan, in terms of revenue, the global logistics packaging program increased from US$335.3 billion in 2019 to US$411.7 billion in 2024, with a compound annual growth rate of 4.2%. It is expected to reach US$517.6 billion in 2030, and a CAGR of 3.8% from 2025 to 2030. In the global logistics packaging solutions market, the size of the container sales market grew from US$295.3 billion in 2019 to US$355.2 billion in 2024, with a compound annual growth rate of 3.8%. It is expected to reach US$425.9 billion in 2030, and a compound annual growth rate of 3.0% from 2025 to 2030.

Driven by many factors in China, the size of the logistics packaging solutions market continues to grow. According to Frost & Sullivan, in terms of revenue, China's logistics packaging plan increased from US$90.4 billion in 2019 to US$118.7 billion in 2024, with a compound annual growth rate of 5.6%, expected to reach US$149.8 billion in 2030, and a compound annual growth rate of 3.9% from 2025 to 2030. The size of the container sales market grew from US$85.5 billion in 2019 to US$111 billion in 2024, with a CAGR of 5.4%. It is expected to reach US$136.5 billion in 2030, and a CAGR of 3.4% from 2025 to 2030.

Board Information

The board of directors consists of nine directors, including three executive directors, three non-executive directors, and three independent non-executive directors.

Shareholding structure

As of the last practical date, Mr. Sun and Suzhou Anwar held 36,093,750 shares and 3,318,924 shares, accounting for approximately 51.56% and 4.74% of the total number of issued shares, respectively. Since Mr. Sun directly owns 90% of Suzhou Anhua's shares and can control the voting rights attached to the shares held by Suzhou Anwar, Mr. Sun and Suzhou Anwar are regarded as a group of controlling shareholders. Together, these controlling shareholders held about 56.30% of the total number of issued shares as of the last viable date.

Intermediary team

Sole sponsor: CITIC Construction Investment (International) Finance Co., Ltd.

Company Financial Advisor: DBS Asia Capital Limited

Company legal advisors: Zhou Junxuan Law Firm is a joint venture with Beijing Commerce Law Firm, Beijing Commerce Law Firm

Sole sponsor legal advisors: Jingtian Gongcheng Law Firm Limited Liability Partnership, AllBright Law Firm

Auditor and reporting accountant: Ernst & Young

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal