3 High Growth Companies Insiders Are Eager To Own

As the U.S. stock market continues its upward trajectory, with major indices like the S&P 500 hitting all-time highs, investors are increasingly looking for opportunities in high-growth companies that insiders are eager to own. In this environment, companies with substantial insider ownership can be particularly attractive, as they often signal confidence in the company's future prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 74% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.4% | 27.1% |

Let's take a closer look at a couple of our picks from the screened companies.

TeraWulf (WULF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc. operates as a digital asset technology company in the United States, with a market cap of approximately $5.20 billion.

Operations: TeraWulf Inc. generates its revenue primarily through digital asset technology operations within the United States.

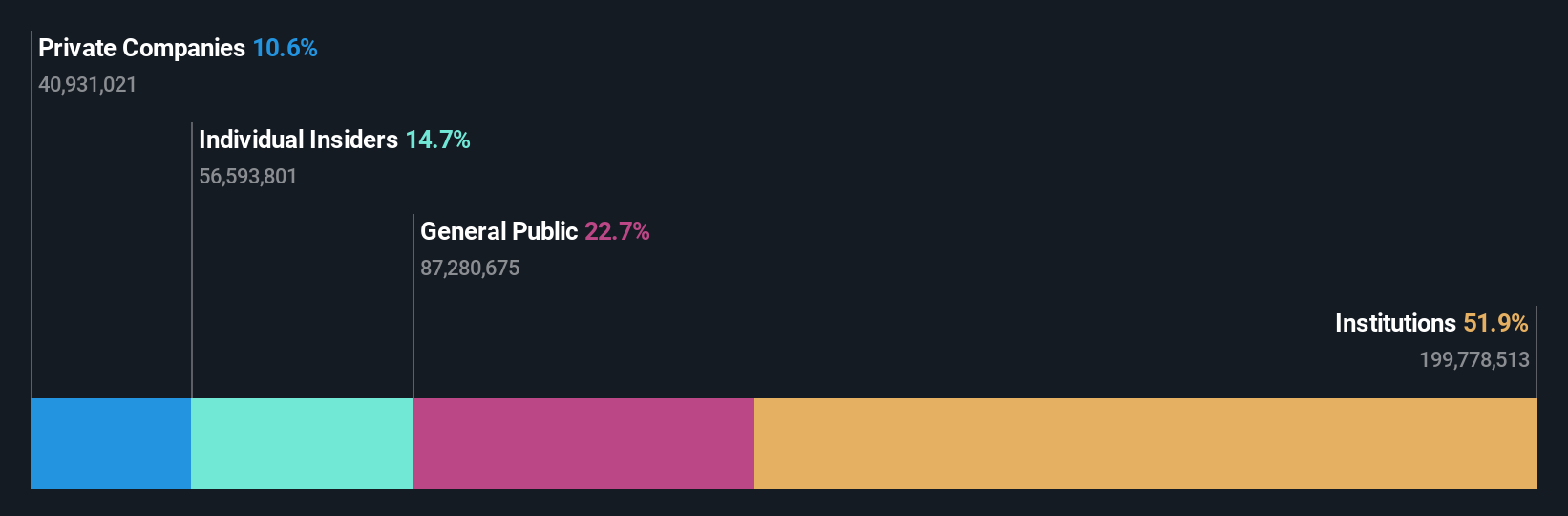

Insider Ownership: 14.2%

Revenue Growth Forecast: 47.1% p.a.

TeraWulf displays significant growth potential, with revenue expected to grow at 47.1% annually, surpassing the US market average. Despite high volatility and a net loss of US$455.05 million in Q3 2025, insider buying indicates confidence in future prospects. The company's strategic joint venture with Fluidstack for a US$9.5 billion project enhances its growth outlook, supported by Google's financial backing and a majority stake in the venture, though it faces short-term cash constraints with less than one year of runway.

- Click here and access our complete growth analysis report to understand the dynamics of TeraWulf.

- Our expertly prepared valuation report TeraWulf implies its share price may be too high.

AAON (AAON)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AAON, Inc. operates in the engineering, manufacturing, marketing, and selling of air conditioning and heating equipment across the United States and Canada, with a market cap of approximately $6.14 billion.

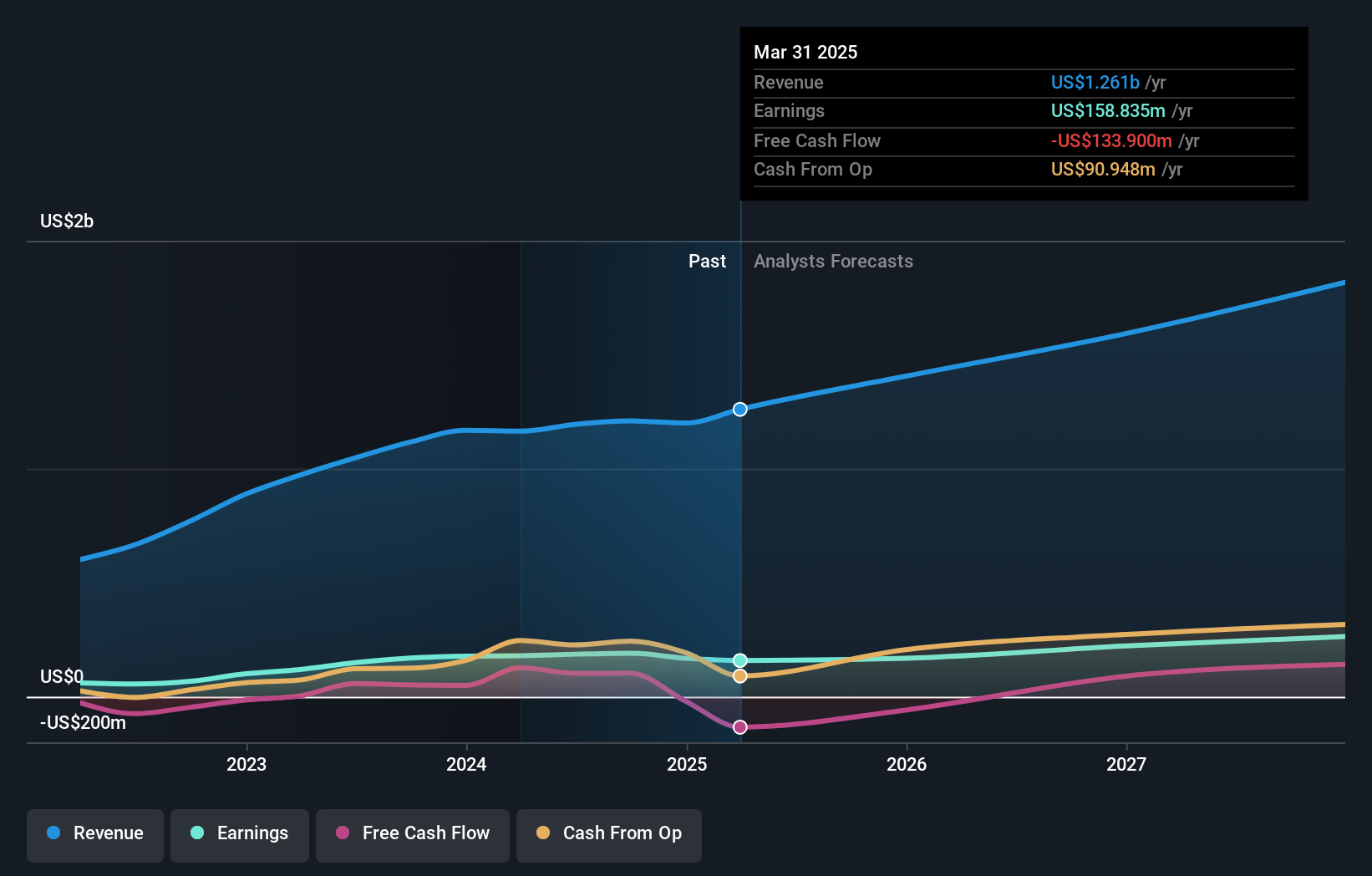

Operations: The company's revenue segments include $800.67 million from AAON Oklahoma, $304.10 million from AAON Coil Products, and $261.14 million from Basx.

Insider Ownership: 15.9%

Revenue Growth Forecast: 14.3% p.a.

AAON is set for robust growth with revenue projected to increase by 14.3% annually, outpacing the US market. Insider confidence remains strong, evidenced by substantial insider buying recently. Despite a decrease in profit margins from 15.8% to 7.6%, earnings are expected to grow significantly at 31.1% per year over the next three years. The company trades below its fair value estimate and has raised its full-year sales growth guidance, reflecting optimism about future performance amid strategic leadership changes.

- Dive into the specifics of AAON here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that AAON is priced lower than what may be justified by its financials.

BBB Foods (TBBB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BBB Foods Inc. operates a chain of grocery retail stores in Mexico and has a market cap of $4.03 billion.

Operations: The company generates revenue of MX$72.53 billion from the sale, acquisition, and distribution of various products and consumer goods through its subsidiaries.

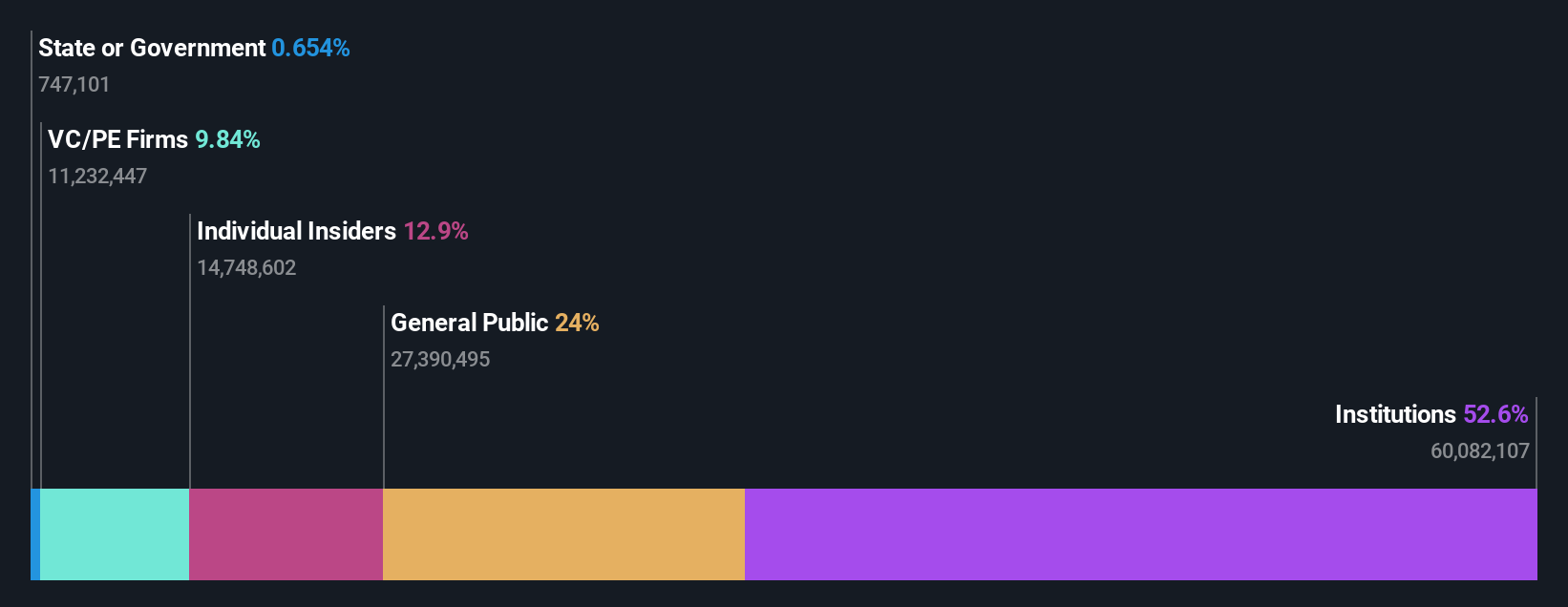

Insider Ownership: 12.9%

Revenue Growth Forecast: 22.9% p.a.

BBB Foods is poised for significant growth, with revenue expected to increase by 22.9% annually, outstripping the US market average. Despite recent net losses of MXN 1,424.01 million in Q3 2025 and MXN 1,797.06 million over nine months, the company is forecast to become profitable within three years. Trading at a discount to its estimated fair value enhances its appeal as a growth stock with high insider ownership potential amidst strong projected earnings growth of 71.1% per year.

- Get an in-depth perspective on BBB Foods' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report BBB Foods implies its share price may be lower than expected.

Summing It All Up

- Access the full spectrum of 208 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Searching for a Fresh Perspective? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal