3 Top Dividend Stocks To Consider

As the U.S. stock market reaches new heights with the S&P 500 closing at a record high, investors are increasingly looking for stable income sources amidst buoyant economic growth and rising indices. In this environment, dividend stocks can offer a reliable stream of income, making them an attractive option for those seeking to capitalize on the current market momentum while potentially benefiting from consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.69% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.33% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.83% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.24% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.95% | ★★★★★★ |

| Ennis (EBF) | 5.53% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.52% | ★★★★★☆ |

| Dillard's (DDS) | 4.99% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.03% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.43% | ★★★★★★ |

Click here to see the full list of 117 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

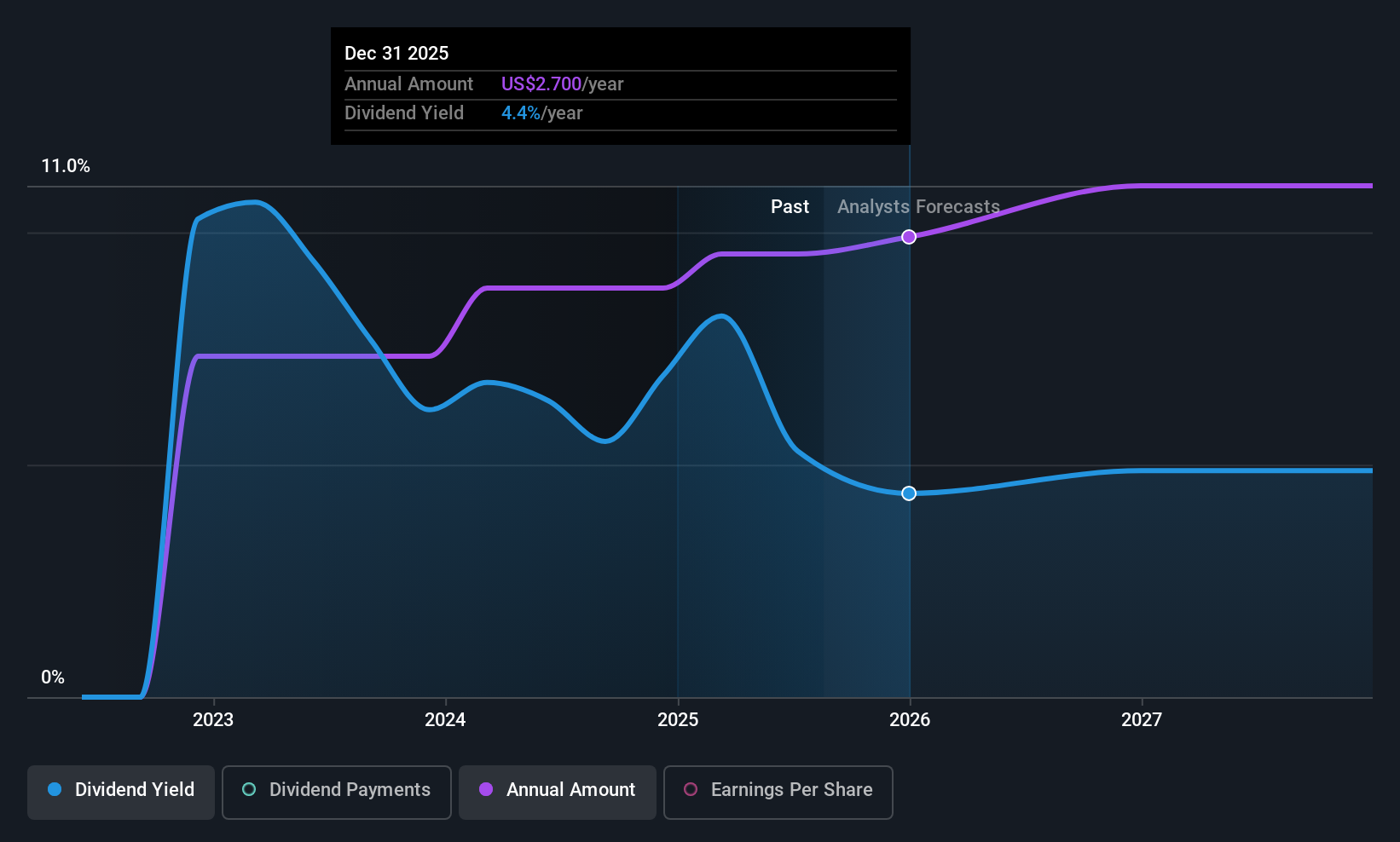

Euroseas (ESEA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Euroseas Ltd. offers ocean-going transportation services globally and has a market cap of $382.28 million.

Operations: Euroseas Ltd. generates revenue of $223.79 million from its transportation - shipping segment.

Dividend Yield: 5.1%

Euroseas has demonstrated a strong position among dividend stocks, with a 5.13% yield placing it in the top 25% of US dividend payers. Despite only three years of dividend history, payments have increased and remain well-covered by earnings (payout ratio: 11.8%) and cash flows (cash payout ratio: 48.5%). Recent charter contracts for its vessels are expected to enhance revenue visibility through 2029, supporting future dividend sustainability amidst global market uncertainties.

- Click to explore a detailed breakdown of our findings in Euroseas' dividend report.

- Our valuation report here indicates Euroseas may be undervalued.

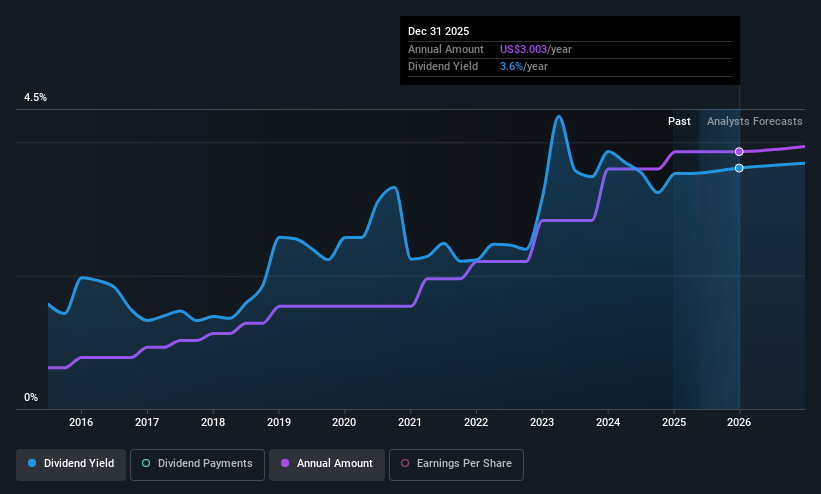

Preferred Bank (PFBC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Preferred Bank offers a range of banking products and services to small and mid-sized businesses, entrepreneurs, real estate developers, professionals, and high net worth individuals, with a market cap of $1.23 billion.

Operations: Preferred Bank's revenue is primarily derived from its Commercial Bank segment, which generated $271.35 million.

Dividend Yield: 3%

Preferred Bank recently increased its annual dividend to US$3.20 per share, reflecting a 6.7% rise, with payments well-covered by earnings due to a low payout ratio of 29.9%. Despite being below the top tier of US dividend payers, its stable and growing dividends over the past decade offer reliability for investors. The bank's recent financial performance shows steady growth in net income and earnings per share, supporting its dividend sustainability amidst strategic buybacks and minimal charge-offs.

- Dive into the specifics of Preferred Bank here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Preferred Bank shares in the market.

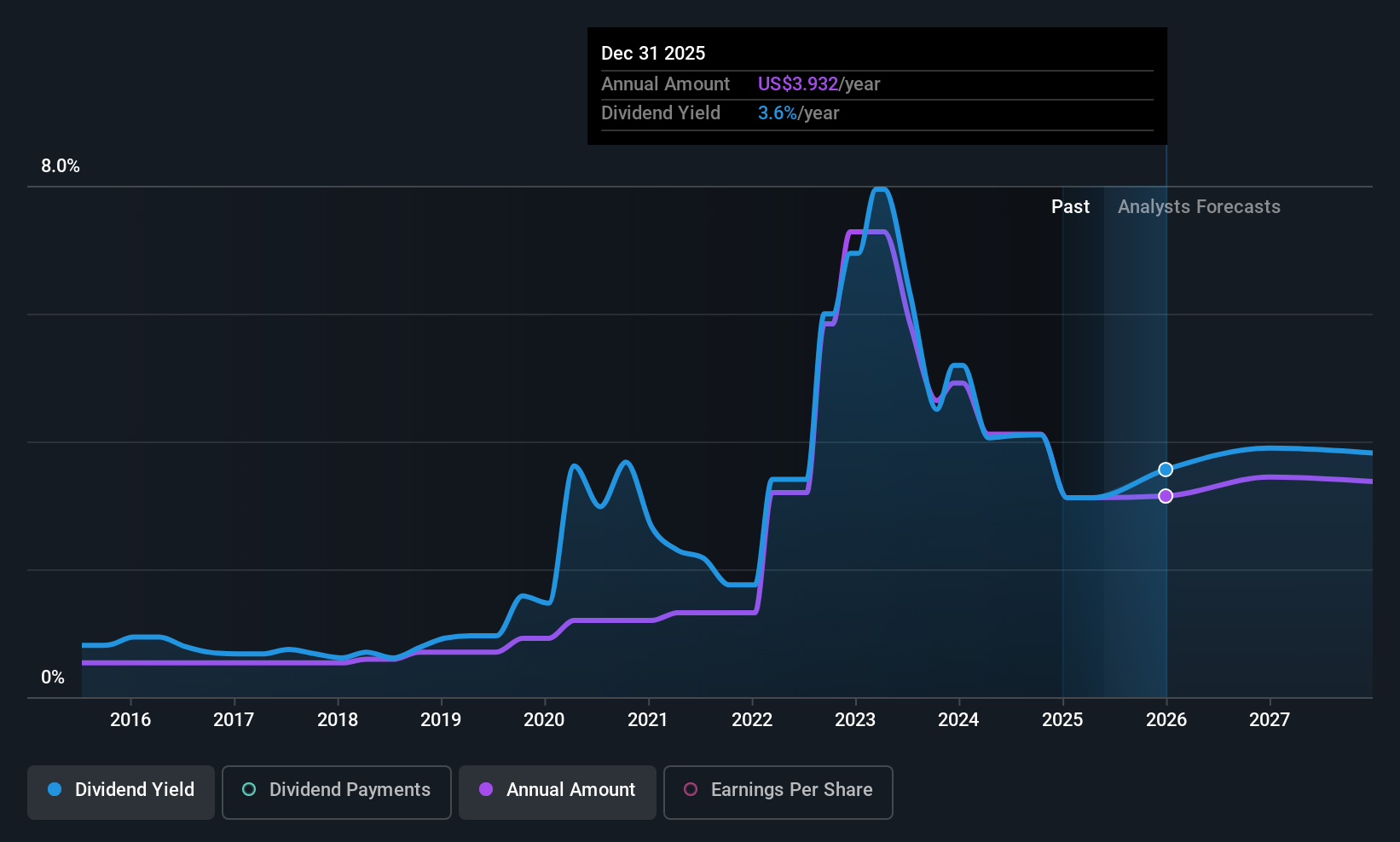

EOG Resources (EOG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EOG Resources, Inc. is engaged in the exploration, development, production, and marketing of crude oil, natural gas liquids, and natural gas across producing basins in the United States and internationally, with a market cap of approximately $56.12 billion.

Operations: EOG Resources generates revenue primarily through its crude oil and natural gas exploration and production segment, which contributes $22.65 billion.

Dividend Yield: 3.9%

EOG Resources' dividend yield of 3.92% is below the top quartile of US dividend payers, and its payments have been volatile over the past decade. However, dividends are well-covered by earnings and cash flows, with payout ratios of 39.1% and 56.9%, respectively. Recent strategic moves include a $3 billion credit facility to strengthen liquidity and board changes enhancing financial oversight, which may support future stability in dividends despite historical volatility concerns.

- Get an in-depth perspective on EOG Resources' performance by reading our dividend report here.

- Our valuation report unveils the possibility EOG Resources' shares may be trading at a discount.

Next Steps

- Click through to start exploring the rest of the 114 Top US Dividend Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal