3 European Stocks Estimated To Be Trading At Discounts Of Up To 49.9%

The European market has recently experienced a lift, with the pan-European STOXX Europe 600 Index rising by 1.60% amid signs of steady economic growth and supportive monetary policies. As investors navigate this environment, identifying stocks that are potentially undervalued can be a strategic approach, particularly when these equities are trading at significant discounts relative to their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sanoma Oyj (HLSE:SANOMA) | €9.21 | €18.40 | 49.9% |

| Redelfi (BIT:RDF) | €11.70 | €23.30 | 49.8% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.278 | €8.48 | 49.6% |

| LINK Mobility Group Holding (OB:LINK) | NOK32.95 | NOK65.74 | 49.9% |

| Hemnet Group (OM:HEM) | SEK170.90 | SEK337.22 | 49.3% |

| Exail Technologies (ENXTPA:EXA) | €84.10 | €167.48 | 49.8% |

| Cyber_Folks (WSE:CBF) | PLN201.50 | PLN397.65 | 49.3% |

| cyan (XTRA:CYR) | €2.26 | €4.50 | 49.8% |

| Artifex Mundi (WSE:ART) | PLN12.20 | PLN24.36 | 49.9% |

| Allegro.eu (WSE:ALE) | PLN30.625 | PLN60.22 | 49.1% |

Let's review some notable picks from our screened stocks.

Sanoma Oyj (HLSE:SANOMA)

Overview: Sanoma Oyj is a media and learning company with operations in Finland, the Netherlands, Poland, Spain, Belgium, and other international markets, and it has a market cap of €1.50 billion.

Operations: The company's revenue is primarily generated from its Learning segment, which accounts for €754 million, and the Media Finland segment, contributing €564.30 million.

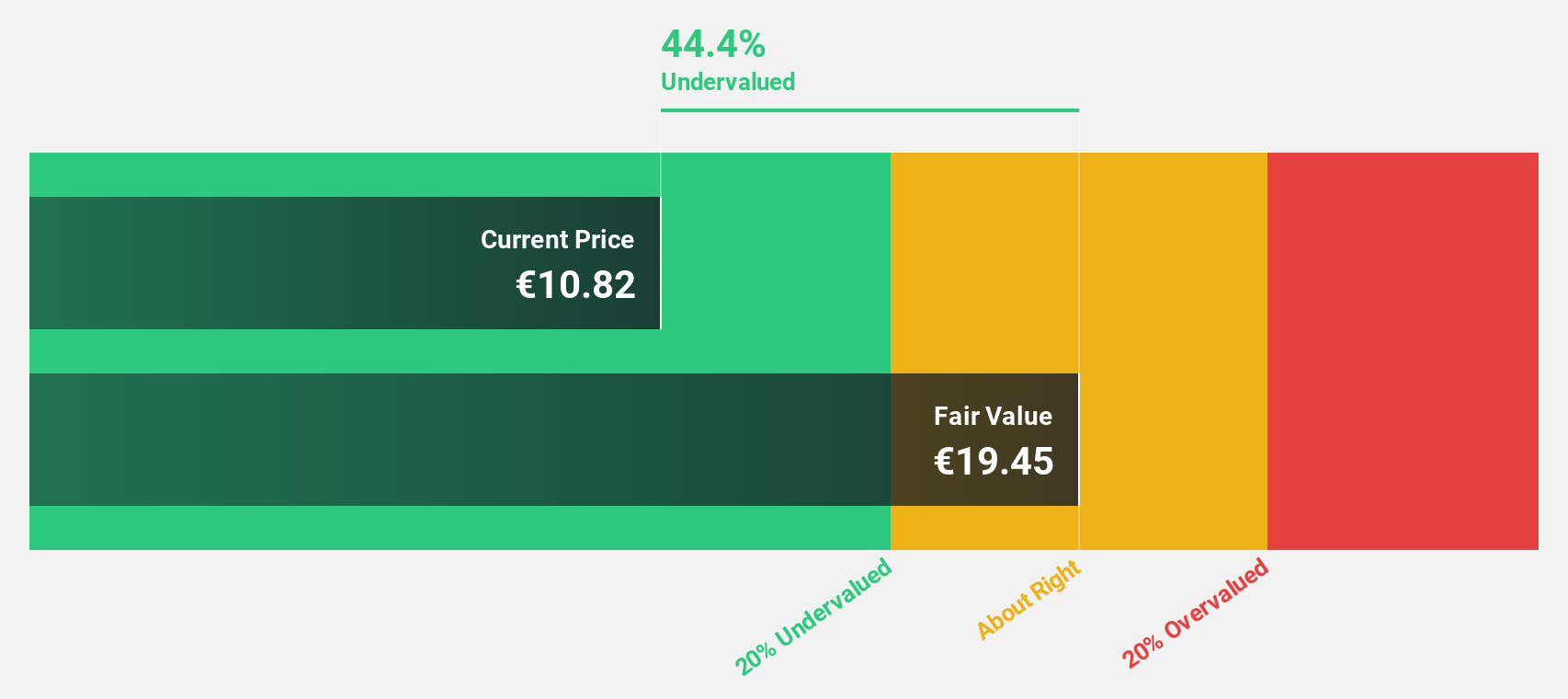

Estimated Discount To Fair Value: 49.9%

Sanoma Oyj is trading significantly below its estimated fair value of €18.4, with a current price of €9.21, indicating potential undervaluation based on cash flows. Despite lower profit margins and high debt levels, Sanoma's earnings are projected to grow substantially at 61% annually, outpacing the Finnish market. Recent refinancing efforts through a €220 million syndicated loan aim to bolster financial stability and support strategic acquisitions in K-12 content to drive growth.

- Our earnings growth report unveils the potential for significant increases in Sanoma Oyj's future results.

- Delve into the full analysis health report here for a deeper understanding of Sanoma Oyj.

Ependion (OM:EPEN)

Overview: Ependion AB, along with its subsidiaries, offers digital solutions for secure control, management, visualization, and data communication in industrial applications and has a market cap of SEK3.61 billion.

Operations: Ependion's revenue is primarily derived from its Westermo segment, generating SEK1.36 billion, and the Beijer Electronics (including Korenix) segment, contributing SEK875.54 million.

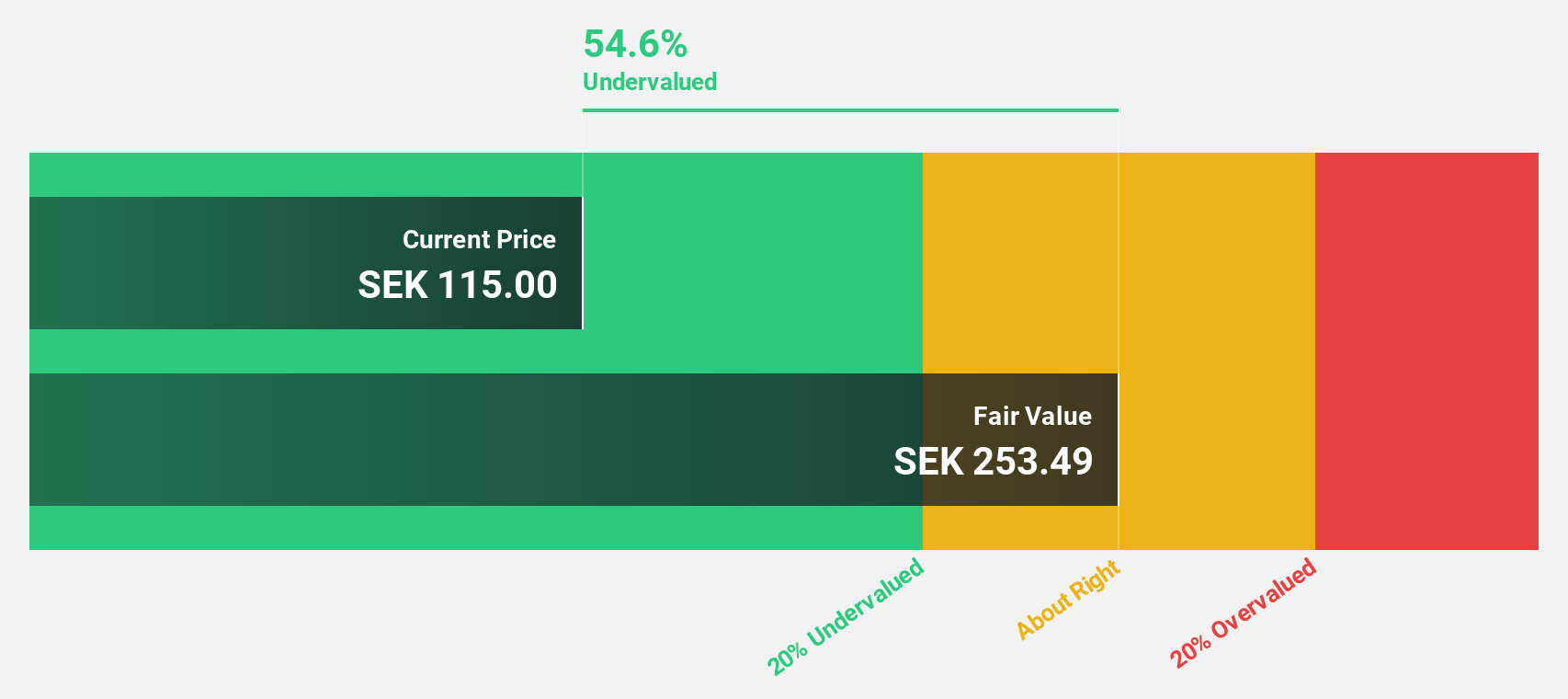

Estimated Discount To Fair Value: 26.8%

Ependion is trading at SEK112.2, significantly below its estimated fair value of SEK153.21, highlighting potential undervaluation based on cash flows. Earnings are projected to grow robustly at 28.1% annually, surpassing the Swedish market's growth rate. However, revenue growth is slower than 20% annually and Return on Equity remains modest at a forecasted 13.4%. Recent earnings show improved quarterly results with net income increasing to SEK40.44 million from SEK31.41 million year-over-year despite nine-month declines.

- Our expertly prepared growth report on Ependion implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Ependion with our comprehensive financial health report here.

Basler (XTRA:BSL)

Overview: Basler Aktiengesellschaft develops, manufactures, and sells digital cameras for professional users both in Germany and internationally, with a market capitalization of €442.15 million.

Operations: The company's revenue is primarily generated from the camera segment, amounting to €214.97 million.

Estimated Discount To Fair Value: 33%

Basler, trading at €14.38, is undervalued compared to its fair value estimate of €21.45. Forecasted earnings growth at 52% annually outpaces the German market's 16.8%, while revenue is expected to grow by 9.6% per year, surpassing the market average of 6.3%. Recent results show a turnaround with net income reaching €11.08 million from a previous loss and sales increasing to €168 million for nine months ending September 2025, reflecting financial recovery and potential for future growth despite low forecasted Return on Equity at 12.7%.

- Upon reviewing our latest growth report, Basler's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Basler's balance sheet health report.

Seize The Opportunity

- Reveal the 194 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal