High Growth Tech Stocks To Watch In December 2025

As we approach December 2025, global markets are navigating a complex landscape marked by mixed performances across major indices and economic indicators. In the U.S., while the Russell 2000 Index saw a decline, the Nasdaq Composite managed to edge higher amid fluctuating tech-stock sentiment driven by AI valuation concerns and mixed economic data. With these dynamics at play, identifying high growth tech stocks requires an understanding of how companies can leverage innovation and adapt to shifting market conditions, particularly in sectors like AI where spending and valuations are under scrutiny.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

DuoLun Technology (SHSE:603528)

Simply Wall St Growth Rating: ★★★★★☆

Overview: DuoLun Technology Corporation Ltd. specializes in developing intelligent training, testing, and application systems for motor vehicle drivers in China with a market capitalization of CN¥7.02 billion.

Operations: DuoLun Technology generates revenue primarily from its electronic security devices segment, contributing CN¥411.95 million. The company focuses on providing innovative solutions for motor vehicle driver training and testing systems in China.

DuoLun Technology, amidst a challenging fiscal year, reported a significant revenue drop to CNY 312.27 million from CNY 422.96 million, reflecting intensified market conditions. Despite this downturn, the company's R&D commitment remains robust, underpinning its strategic focus on innovation to regain momentum. Impressively, DuoLun is poised for a rebound with expected annual revenue growth at 28.4% and profit growth forecasted at an extraordinary 72.2%, signaling potential recovery and market competitiveness in the forthcoming years. This outlook is bolstered by their positive free cash flow status and an anticipated profitability within three years, aligning with above-market expectations for both revenue and earnings growth.

Beijing InHand Networks Technology (SHSE:688080)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing InHand Networks Technology Co., Ltd. is a company focused on providing industrial IoT and smart city solutions, with a market cap of CN¥3.68 billion.

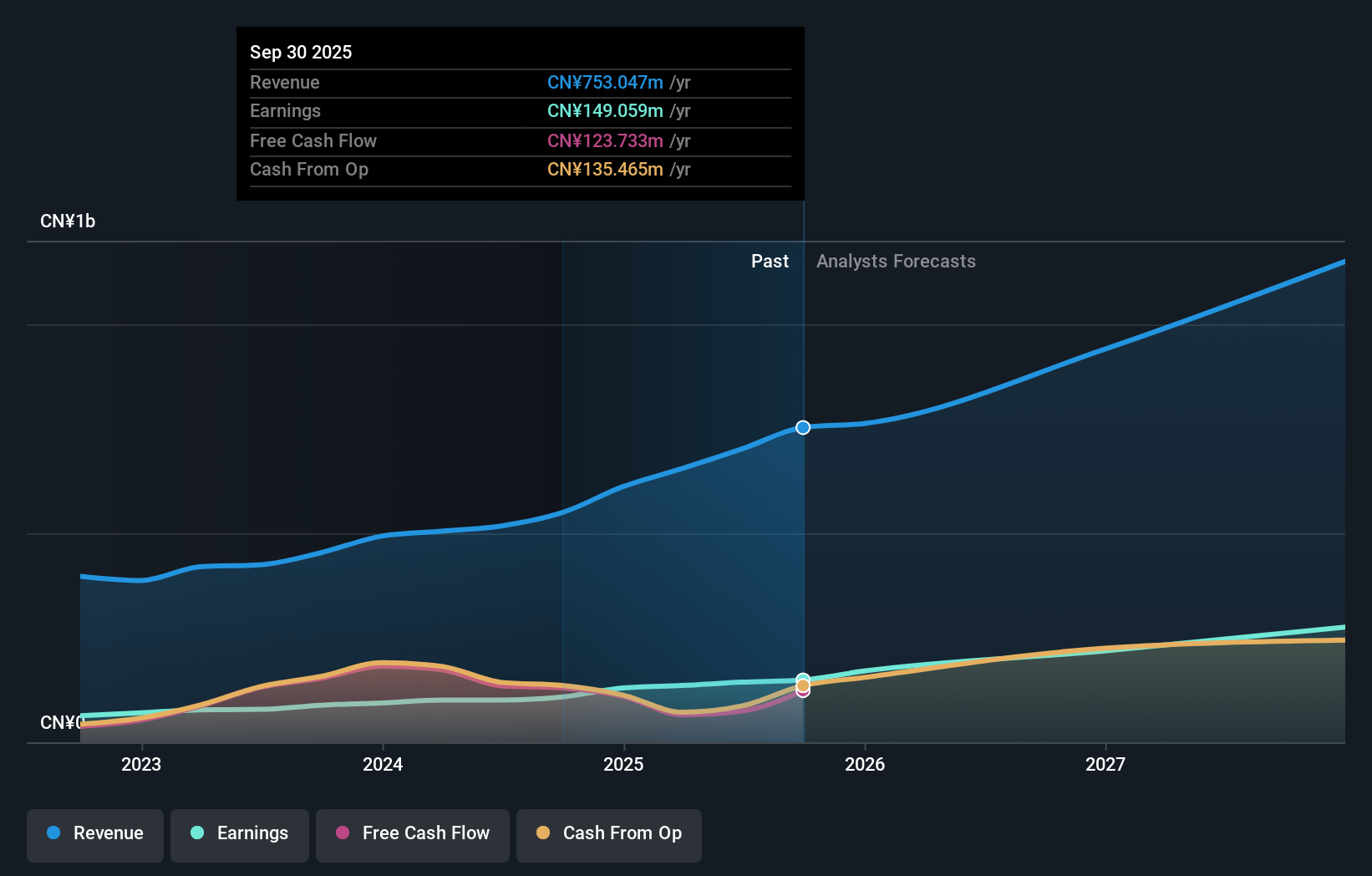

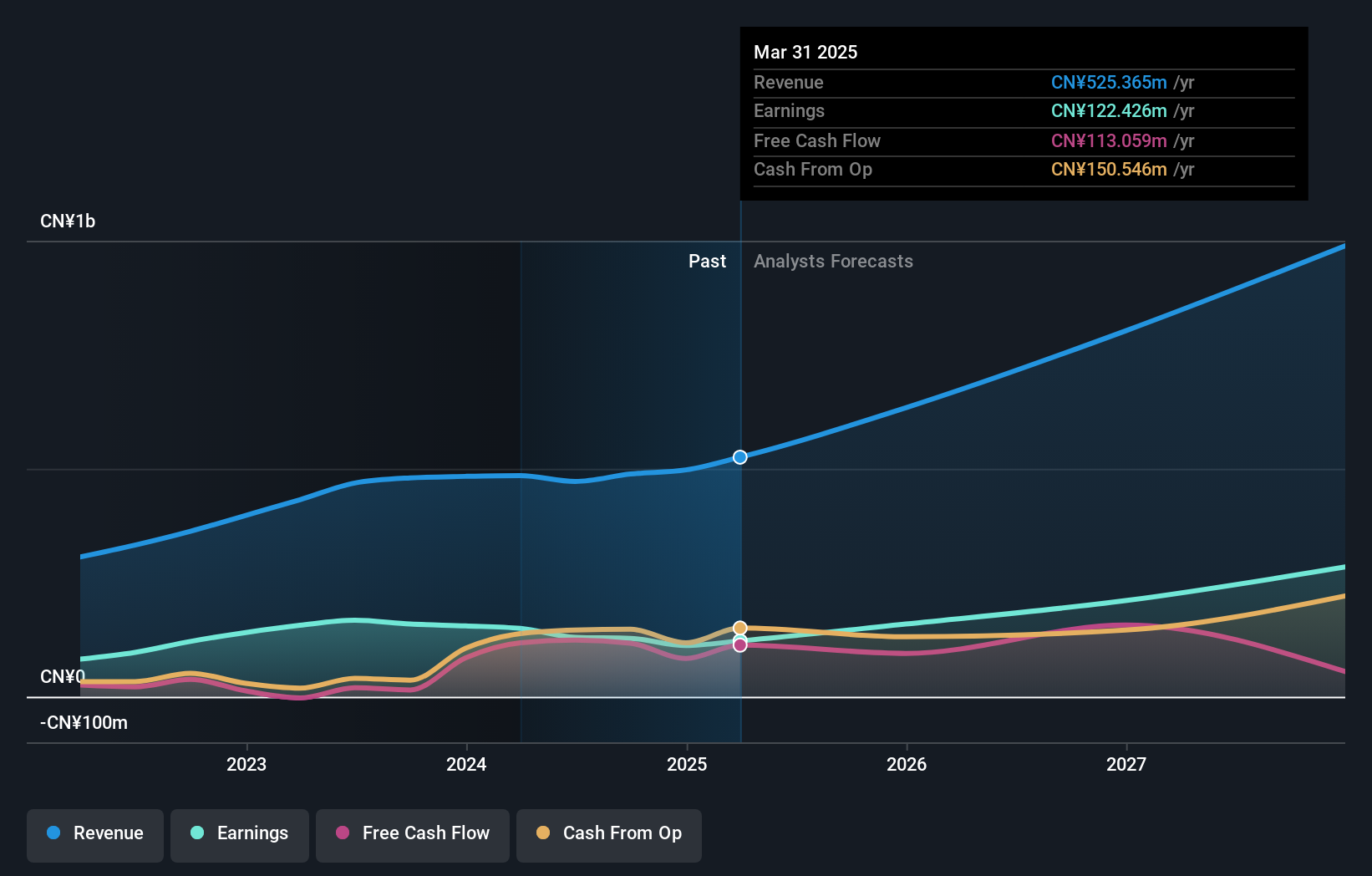

Operations: InHand Networks generates revenue primarily from its Computer Networks segment, amounting to CN¥753.05 million.

Beijing InHand Networks Technology has demonstrated robust growth, with revenue soaring to CNY 549.56 million from CNY 408.25 million year-over-year, a substantial increase of 34.6%. This growth is complemented by a notable rise in net income to CNY 102.54 million, up from CNY 83.37 million, reflecting a solid earnings improvement of approximately 23%. The firm's commitment to innovation is evident in its R&D efforts, crucial for maintaining competitive advantage in the fast-evolving tech landscape. With an annual revenue growth forecast at an impressive rate of over 20%, InHand is strategically positioned to capitalize on market opportunities, underscored by recent positive earnings results and proactive shareholder engagements through multiple meetings this year.

- Navigate through the intricacies of Beijing InHand Networks Technology with our comprehensive health report here.

Understand Beijing InHand Networks Technology's track record by examining our Past report.

Siglent TechnologiesLtd (SHSE:688112)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Siglent Technologies Co., Ltd. engages in the research, development, production, sale, and servicing of electronic test and measurement equipment both in China and internationally, with a market cap of CN¥5.96 billion.

Operations: Siglent Technologies focuses on the electronic test and measurement equipment sector, catering to both domestic and international markets. The company generates revenue through the sale of its developed products while also offering related services.

Siglent Technologies has shown a strong trajectory in its financial performance, with revenue climbing to CNY 431.48 million from CNY 354.64 million year-over-year—an increase of 21.7%. This growth is underpinned by a significant rise in net income, which surged to CNY 111.35 million from CNY 91.65 million, marking an earnings growth of approximately 21.5%. The company's dedication to innovation is reflected in its R&D spending trends, crucial for sustaining its competitive edge in the dynamic tech sector. With earnings projected to grow at an impressive annual rate of nearly 31%, Siglent is well-positioned to leverage emerging market opportunities, further evidenced by recent positive quarterly results and proactive investor communications during special shareholder meetings this year.

Where To Now?

- Unlock more gems! Our Global High Growth Tech and AI Stocks screener has unearthed 242 more companies for you to explore.Click here to unveil our expertly curated list of 245 Global High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal