Undiscovered Gems in Global Stocks for December 2025

As global markets navigate a complex landscape marked by mixed economic signals and fluctuating indices, small-cap stocks have faced particular challenges with the Russell 2000 Index declining amid broader market volatility. However, amidst this backdrop of uncertainty and opportunity, investors often seek out undiscovered gems—stocks that may offer potential value due to their strong fundamentals or unique positioning within their industries.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Xuchang Yuandong Drive ShaftLtd | 0.06% | -13.76% | -28.84% | ★★★★★★ |

| Saha-Union | 0.70% | 0.67% | 18.29% | ★★★★★★ |

| Grade Upon Technology | NA | 21.73% | 65.67% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Uju Holding | 34.04% | 5.58% | -25.17% | ★★★★★★ |

| Wholetech System Hitech | 14.93% | 13.36% | 18.63% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Changjiu Holdings | 50.46% | 54.90% | 14.57% | ★★★★☆☆ |

| Tai Sin Electric | 37.42% | 10.92% | 7.66% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Acter Technology Integration Group (SHSE:603163)

Simply Wall St Value Rating: ★★★★★★

Overview: Acter Technology Integration Group Co., Ltd. operates in the technology integration sector with a market capitalization of CN¥7.10 billion.

Operations: Revenue and cost breakdowns for Acter Technology Integration Group Co., Ltd. are not available, limiting detailed financial analysis.

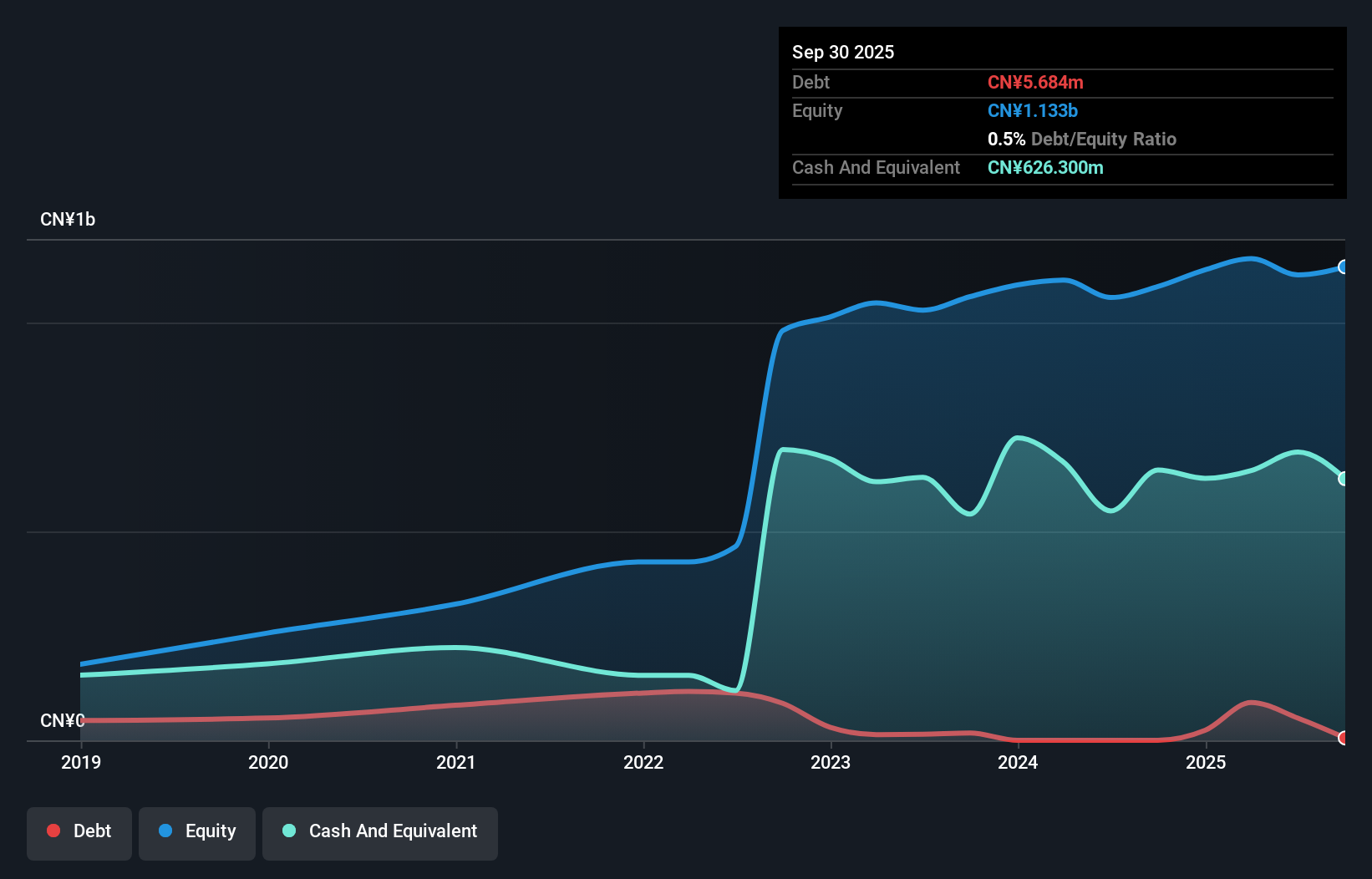

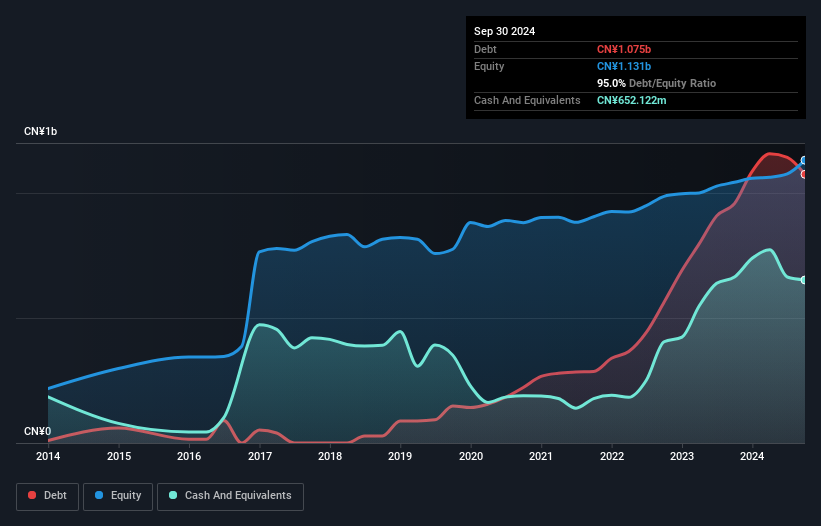

Acter Technology Integration Group, a nimble player in its field, has shown robust earnings growth of 38% over the past year, outpacing the broader construction industry's -7.3%. The company's financial health is solid with more cash than total debt and a reduced debt-to-equity ratio from 24.7% to 0.5% over five years. Recent earnings for nine months ending September 2025 revealed sales of CNY 2.12 billion, up from CNY 1.45 billion last year, while net income rose to CNY 95.65 million compared to CNY 74.09 million previously, reflecting effective operational strategies despite share price volatility.

Xizang Gaozheng Civil Explosives (SZSE:002827)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xizang Gaozheng Civil Explosives Co., Ltd. operates in the civil explosives industry and has a market capitalization of CN¥10.65 billion.

Operations: The company generates revenue primarily from its operations in the civil explosives sector. Its financial performance includes a notable net profit margin trend, which reflects the efficiency of its cost management and pricing strategies.

Xizang Gaozheng Civil Explosives, a small cap player in the chemicals sector, has been making waves with its robust financial metrics. Over the past year, earnings surged by 30.1%, outpacing the industry average of 6.8%. The company trades at a significant discount, about 46% below its estimated fair value. Its net debt to equity ratio stands at a satisfactory 29.8%, indicating manageable leverage levels despite an increase in overall debt from 25% to 98% over five years. With EBIT covering interest payments twelve times over, financial stability seems well-supported for future growth prospects.

Chengdu CORPRO TechnologyLtd (SZSE:300101)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chengdu CORPRO Technology Co., Ltd. specializes in providing satellite navigation components and terminals, with a market capitalization of CN¥13.03 billion.

Operations: Chengdu CORPRO Technology Co., Ltd. generates revenue primarily from its satellite navigation components and terminals. The company's financial performance is characterized by a focus on these core products, with specific cost structures and margins that influence its profitability.

Chengdu CORPRO Technology has shown robust financial performance recently, with earnings skyrocketing by 127,602% over the past year, significantly outpacing the Communications industry average of 14.4%. The company's revenue for the first nine months of 2025 reached CN¥735.64 million, up from CN¥563.44 million in the previous year, while net income rose to CN¥92.78 million from CN¥70.94 million. Despite a satisfactory net debt to equity ratio of 10%, a large one-off gain of CN¥23M impacted recent results; however, EBIT covers interest payments comfortably at 13.3 times coverage.

- Navigate through the intricacies of Chengdu CORPRO TechnologyLtd with our comprehensive health report here.

Learn about Chengdu CORPRO TechnologyLtd's historical performance.

Taking Advantage

- Embark on your investment journey to our 2999 Global Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal