3 Global Dividend Stocks Offering Up To 6.2% Yield

As global markets navigate mixed signals from economic data and central bank policy shifts, investors are increasingly focusing on dividend stocks as a means of securing reliable income amid uncertainty. With recent fluctuations in major indices and evolving interest rate environments, selecting dividend-paying stocks with strong fundamentals can offer stability and potential income growth in a volatile market landscape.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.55% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.26% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.85% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.51% | ★★★★★★ |

| NCD (TSE:4783) | 4.00% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.65% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.15% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.64% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.28% | ★★★★★★ |

Click here to see the full list of 1294 stocks from our Top Global Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Regional. de (BMV:R A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Regional S.A.B. de C.V. offers a range of banking products and services, with a market cap of MX$48.32 billion.

Operations: Regional S.A.B. de C.V.'s revenue is derived from its diverse offerings in banking products and services.

Dividend Yield: 6.2%

Regional S.A.B. de C.V. offers a dividend yield of 6.24%, placing it in the top 25% of dividend payers in the MX market, though its track record is volatile over the past seven years. With a current payout ratio of 23.1%, dividends are well-covered by earnings and forecast to remain sustainable with a future payout ratio of 50.4%. Recent earnings show stable net interest income growth, despite slight declines in net income year-over-year.

- Click here and access our complete dividend analysis report to understand the dynamics of Regional. de.

- Our expertly prepared valuation report Regional. de implies its share price may be lower than expected.

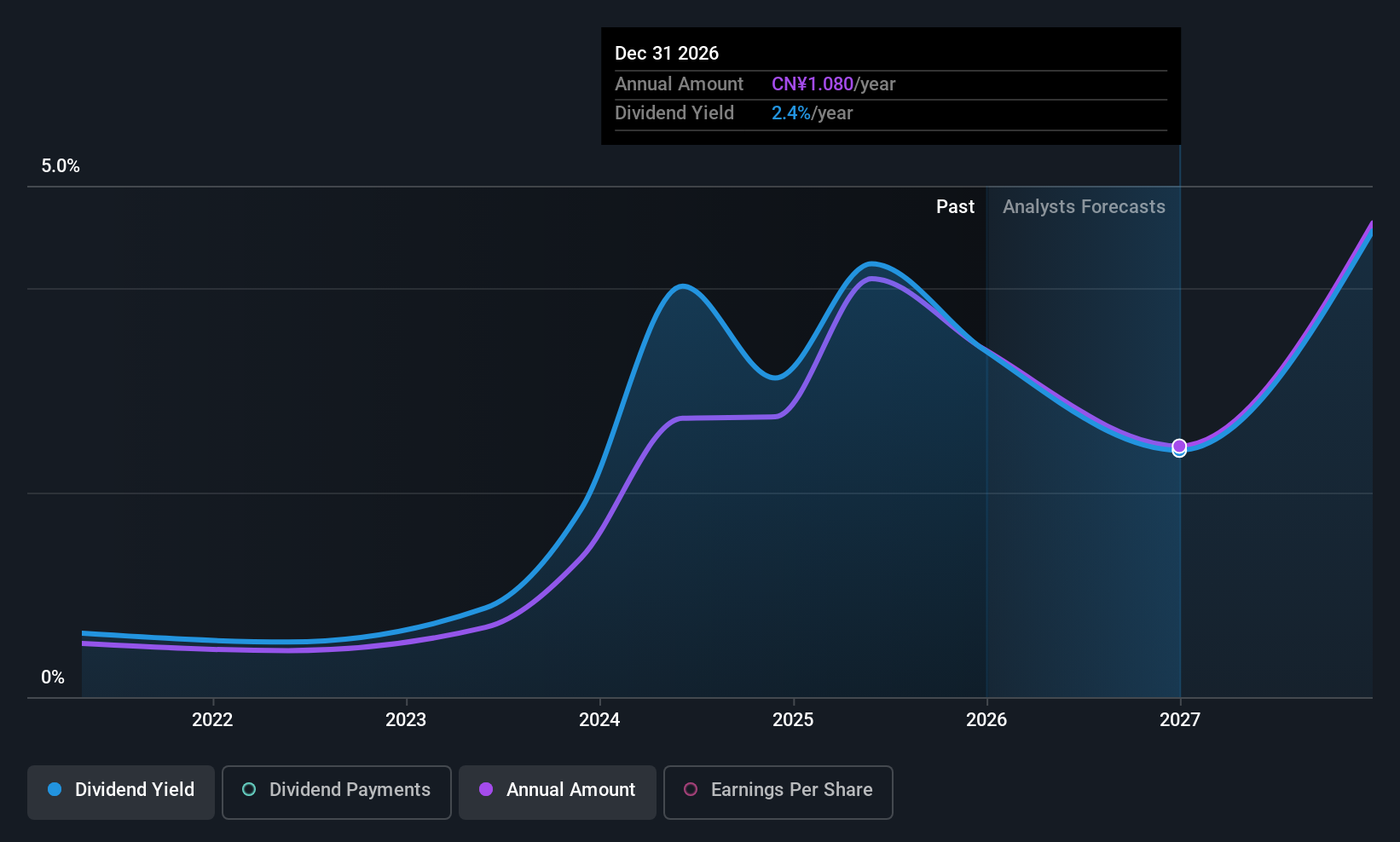

Dongguan Aohai Technology (SZSE:002993)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dongguan Aohai Technology Co., Ltd. is engaged in the design, research, development, production, and sale of consumer electronics products both domestically and internationally, with a market cap of CN¥11.85 billion.

Operations: Dongguan Aohai Technology Co., Ltd. generates revenue of CN¥7.07 billion from its Computer, Communications, and Other Electronic Equipment Manufacturing segment.

Dividend Yield: 3.3%

Dongguan Aohai Technology's dividend yield of 3.27% ranks it in the top 25% of CN market payers, though its five-year track record is unstable. The company's dividends are covered by earnings and cash flows with payout ratios of 78.8% and 81.1%, respectively. Recent approval of a CNY6 per 10 shares dividend for Q3 2025 highlights ongoing distributions despite volatility, while earnings have grown significantly over the past year, reflecting strong financial performance.

- Navigate through the intricacies of Dongguan Aohai Technology with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Dongguan Aohai Technology's share price might be too pessimistic.

Yuan Jen EnterprisesLtd (TWSE:1725)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yuan Jen Enterprises Co., Ltd. is a petrochemical trading company with a market capitalization of approximately NT$4.91 billion.

Operations: Yuan Jen Enterprises Ltd. generates revenue primarily from its petrochemical segment, amounting to NT$8.47 billion.

Dividend Yield: 4.6%

Yuan Jen Enterprises Ltd. offers a stable dividend history with reliable payments over the past decade, supported by earnings and cash flows with payout ratios of 77.8% and 67.2%, respectively. Despite recent revenue declines to TWD 1,955.35 million in Q3 2025, net income improved to TWD 233.57 million year-over-year, indicating financial resilience. The stock trades at a significant discount to estimated fair value but yields a modest 4.6%, below Taiwan's top dividend payers' average of 5.44%.

- Delve into the full analysis dividend report here for a deeper understanding of Yuan Jen EnterprisesLtd.

- Insights from our recent valuation report point to the potential undervaluation of Yuan Jen EnterprisesLtd shares in the market.

Key Takeaways

- Unlock more gems! Our Top Global Dividend Stocks screener has unearthed 1291 more companies for you to explore.Click here to unveil our expertly curated list of 1294 Top Global Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal