Japan's debt is “snowballing”! The key assumption is that interest rates hit a new high in 30 years, and repayment costs have increased dramatically the risk of getting out of control

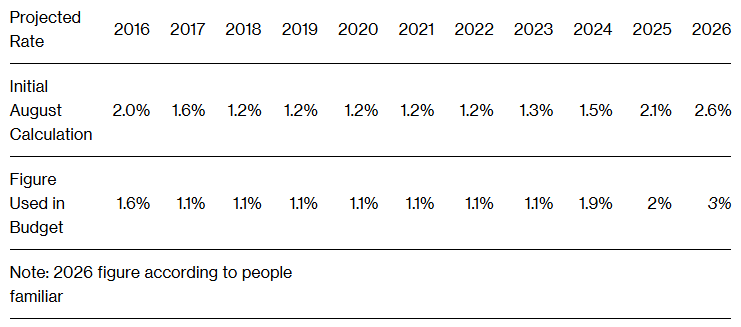

The Zhitong Finance App learned that according to people familiar with the matter, Japan's Ministry of Finance will set the key assumed interest rate used to calculate interest expenses on treasury bonds at 3.0% in the next fiscal year, which is the highest level in nearly 30 years. People familiar with the matter said that in the 2026 fiscal year beginning in April 2026, the interest rate used to support debt repayment costs will be raised from 2.6% initially set during the August budget application phase. This level is a significant increase from the 2% used in the current fiscal year. It will set the highest value since FY1997, and is expected to push Japan's debt repayment expenses to a new record high.

According to reports, this figure is a benchmark for measuring the cost of paying interest on government debt. For bonds newly issued next year and maturing debts that have been rolled over, in a market environment where yields are rising, in order to attract buyers, it is necessary to pay higher interest rates to attract buyers. The relevant budget figures are expected to be officially announced and approved by the cabinet on Friday.

The move comes at a time when the market continues to worry about Japan's fiscal situation and Prime Minister Sanae Takaichi's adoption of a more expansionary fiscal policy stance. On December 16, the Diet of Japan approved the supplementary budget for fiscal year 2025 (April 2025 to March 2026). The fiscal expenditure reached 18.3 trillion yen, claiming to be the largest after the pandemic. This budget is in the name of dealing with rising prices and promoting economic growth. Of this, 11.7 trillion yen will be raised through the issuance of new treasury bonds.

Meanwhile, the Japanese government plans to finalize the draft 2026 budget this Friday. According to the draft, the country's total budget for fiscal year 2026 will exceed 122 trillion yen for the first time, a record high. The increase in spending is mainly driven by two major factors: first, social welfare costs continue to rise; second, the government plans to introduce a new round of financial support measures to mitigate the impact of rising living costs on households and businesses.

The Japanese government will also announce plans to issue Japanese treasury bonds at that time. Market participants are increasingly concerned that the Japanese authorities may increase the issuance of ten-year Japanese treasury bonds to help fill the fiscal gap. People familiar with the matter said that the new bond issuance scale covering the fiscal year beginning in April next year will remain below 30 trillion yen (about 193 billion US dollars), but it will exceed the 28.6 trillion yen issuance amount at the beginning of this fiscal year.

With interest rates rising, the cost of financing Japan's huge public debt will undoubtedly increase significantly. Japan's Ministry of Finance predicts that the yield on Japan's 10-year treasury bonds will rise to 2.5% by 2028, and interest on debt will increase from 7.9 trillion yen last year to 16.1 trillion yen in 2028. According to International Monetary Fund (IMF) data, Japan's total government debt is expected to reach 229.6% of its gross domestic product (GDP) in 2025, leading the list among developed countries.

The increase in key assumptions interest rates reflects the recent rise in Japanese government bond yields. Since Sanae Takaichi took office as Prime Minister of Japan in October and signaled the implementation of a more expansionary fiscal policy, the upward trend in Japanese treasury bond yields has further accelerated. Japan's 10-year treasury yield once hit 2.1% on Monday, the highest level since 1999. The benchmark yield hovered around 2.025% on Wednesday.

The Bank of Japan raised interest rates by 25 basis points as scheduled on Friday, raising the benchmark interest rate to 0.75%, the highest level in 30 years, and hinted that further rate hikes may be made in the future. As the Bank of Japan gradually normalizes monetary policy, the reduction in stimulus measures means that Japanese treasury yields may continue to face upward pressure.

Based on an assumed interest rate of 3%, total debt-related expenses, including interest payments, are expected to rise to a new high in the next fiscal year, exceeding the allocation of approximately 28.2 trillion yen in this fiscal year's budget. The report said that debt repayment costs will rise to 31.3 trillion yen. This part of the cost accounts for about a quarter of total expenditure, making it the second-largest expenditure item after social security. In the initial budget for this fiscal year, 10.5 trillion yen was allocated for coupon payments and 17.7 trillion yen was used for bond redemptions.

Rising debt spending is putting pressure on the public finances of the world's most heavily indebted major economy. Takaichi Sanae has stated that as part of its responsible fiscal policy approach, Japan will work to reduce its debt-to-GDP ratio rather than focus on annual budget balance goals. Japan's continued inflation has boosted the nominal size of the economy, which will benefit Sanae Takaichi's policy. Finance Minister Katayama Satsuki said on Monday that the increase in debt repayment costs has been gradual so far, adding that this shift has positive significance for economic growth.

The Japanese government's act of implementing expansionary fiscal policies and continuing large-scale debt issuance against the backdrop of rising interest rates will undoubtedly increase Japan's fiscal burden. Some financial experts have warned that this uncontrolled fiscal expansion may cause Japanese treasury bond yields to continue to rise, the yen to depreciate further, and even cause chaos in the financial market.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal