December 2025's European Penny Stocks To Watch

As 2025 draws to a close, the European market has shown resilience, with the pan-European STOXX Europe 600 Index rising by 1.60% amid signs of steady economic growth and looser monetary policies. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—continue to present intriguing opportunities. By focusing on those with solid financial foundations and potential for growth, these stocks can offer both stability and upside potential for discerning investors seeking value in lesser-known companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.518 | €1.56B | ✅ 4 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.75 | €84.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.10 | €65.75M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.00 | SEK182.52M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.29 | €379.17M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.26 | €312.38M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0718 | €7.72M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 296 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

OCI (ENXTAM:OCI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OCI N.V. is a company that produces and distributes hydrogen-based and natural gas-based products to agricultural, transportation, and industrial sectors across Europe, the Americas, the Middle East, Africa, Asia, and Oceania with a market cap of €642.52 million.

Operations: The company's revenue from its Nitrogen EU segment amounts to $1.03 billion.

Market Cap: €642.52M

OCI N.V. has shown volatility in its share price, with high weekly fluctuations compared to other Dutch stocks. Despite being unprofitable, OCI's short-term assets significantly exceed liabilities, and it maintains a stable cash runway. The company recently announced a strategic combination with Orascom Construction PLC, aiming to create a diversified infrastructure platform anchored in Abu Dhabi. This merger is expected to enhance growth prospects and financial strength by leveraging both companies' expertise and global reach. However, the transaction requires shareholder approval and will result in OCI delisting from Euronext Amsterdam upon completion.

- Click here and access our complete financial health analysis report to understand the dynamics of OCI.

- Assess OCI's future earnings estimates with our detailed growth reports.

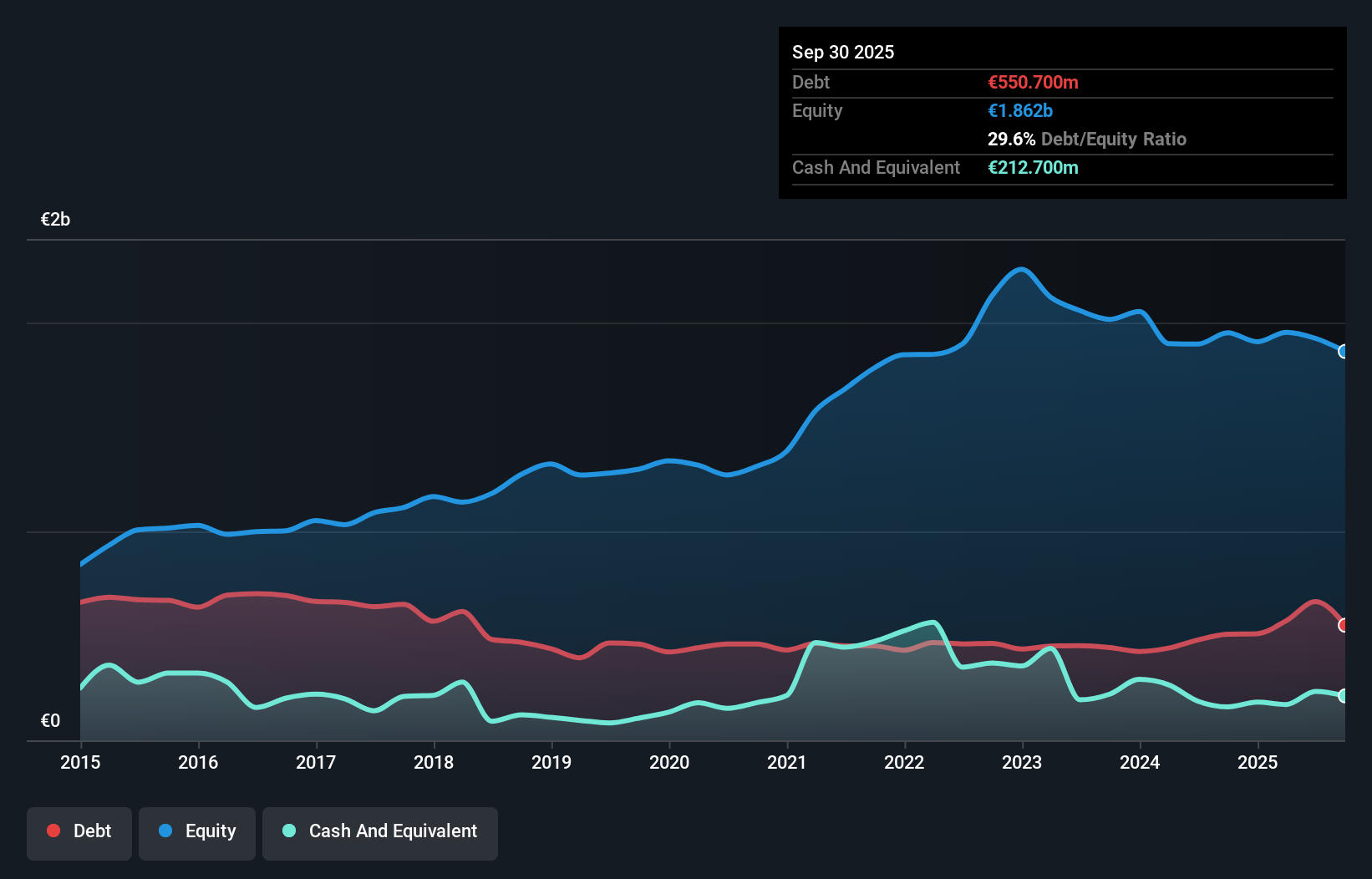

Ontex Group (ENXTBR:ONTEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ontex Group NV is a company that develops, produces, and supplies personal hygiene products for baby, feminine, and adult care across various international markets with a market cap of €356.65 million.

Operations: The company generates revenue of €1.82 billion from its Hygienic Disposable Products segment.

Market Cap: €356.65M

Ontex Group NV, with a market cap of €356.65 million, faces challenges as its earnings have declined by 4.3% annually over the past five years and profit margins dropped to 0.4% from 1.9%. The company recently lowered its revenue guidance for 2025, anticipating a high-single digit drop in Q4 compared to the previous year due to soft market conditions. Despite these hurdles, Ontex is expanding its North American operations by tripling production capacity for baby pants, aiming to capitalize on the growing demand for private label products in this segment while leveraging its expertise in innovation and cost efficiency.

- Click here to discover the nuances of Ontex Group with our detailed analytical financial health report.

- Evaluate Ontex Group's prospects by accessing our earnings growth report.

Metsä Board Oyj (HLSE:METSB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Metsä Board Oyj operates in the folding boxboard, fresh fibre linerboard, and market pulp sectors both in Finland and internationally, with a market cap of €1.09 billion.

Operations: The company's revenue is primarily derived from its folding boxboard, fresh fibre linerboard, and market pulp businesses, totaling €1.83 billion.

Market Cap: €1.09B

Metsä Board Oyj, with a market cap of €1.09 billion, is navigating a challenging landscape as it remains unprofitable, reporting a net loss of €38 million for Q3 2025. Despite this, the company is implementing a €200 million cost savings program to improve efficiency and competitiveness. Recent strategic moves include completing a €60 million modernization at its Simpele mill to enhance product quality and sustainability efforts. Additionally, Metsä Board secured a new €250 million revolving credit facility tied to climate goals. The management team has seen changes with Anssi Tammilehto set to become CFO in early 2026.

- Jump into the full analysis health report here for a deeper understanding of Metsä Board Oyj.

- Examine Metsä Board Oyj's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Get an in-depth perspective on all 296 European Penny Stocks by using our screener here.

- Interested In Other Possibilities? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal