Disney (DIS): Revisiting Valuation After a 9% One-Month Share Price Rebound

Walt Disney (DIS) has been grinding higher lately, and with the stock up about 9% over the past month, investors are starting to revisit whether this long standing media name still offers upside.

See our latest analysis for Walt Disney.

That 1 month share price return of 8.57% at around $113 suggests momentum is starting to rebuild, even though the year to date share price gain and 1 year total shareholder return remain modest as investors weigh streaming profits against park strength.

If Disney’s rebound has you rethinking media exposure, it might also be a good moment to see what is happening across high growth tech and AI stocks for the next wave of digital entertainment plays.

With shares still trading at a double digit discount to analyst targets, but only modestly above their estimated intrinsic value, investors now have to ask: Is Disney genuinely undervalued, or is the market already pricing in its next chapter of growth?

Most Popular Narrative: 13.9% Undervalued

According to Cashflow_Queen, a fair value of about $131.50 versus Disney’s recent $113 close implies meaningful upside if the company can hit its next growth phase.

The next five years are poised to be transformative: ESPN’s NFL-driven streaming dominance, streaming scaling into multibillion-dollar profits, parks and cruises expanding globally, and blockbuster releases fueling the IP machine. Disney could see sustained double-digit EPS growth and a re-rating of the stock as sports transforms from a cable anchor into a digital rocket booster.

Want to see what kind of earnings power and profit margins could justify that higher price tag? The narrative’s long term roadmap might surprise you.

Result: Fair Value of $131.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, escalating sports rights costs or weaker park spending in a softer economy could derail the ESPN-centric growth story investors are betting on.

Find out about the key risks to this Walt Disney narrative.

Another Take on Value: Market Ratio Signals

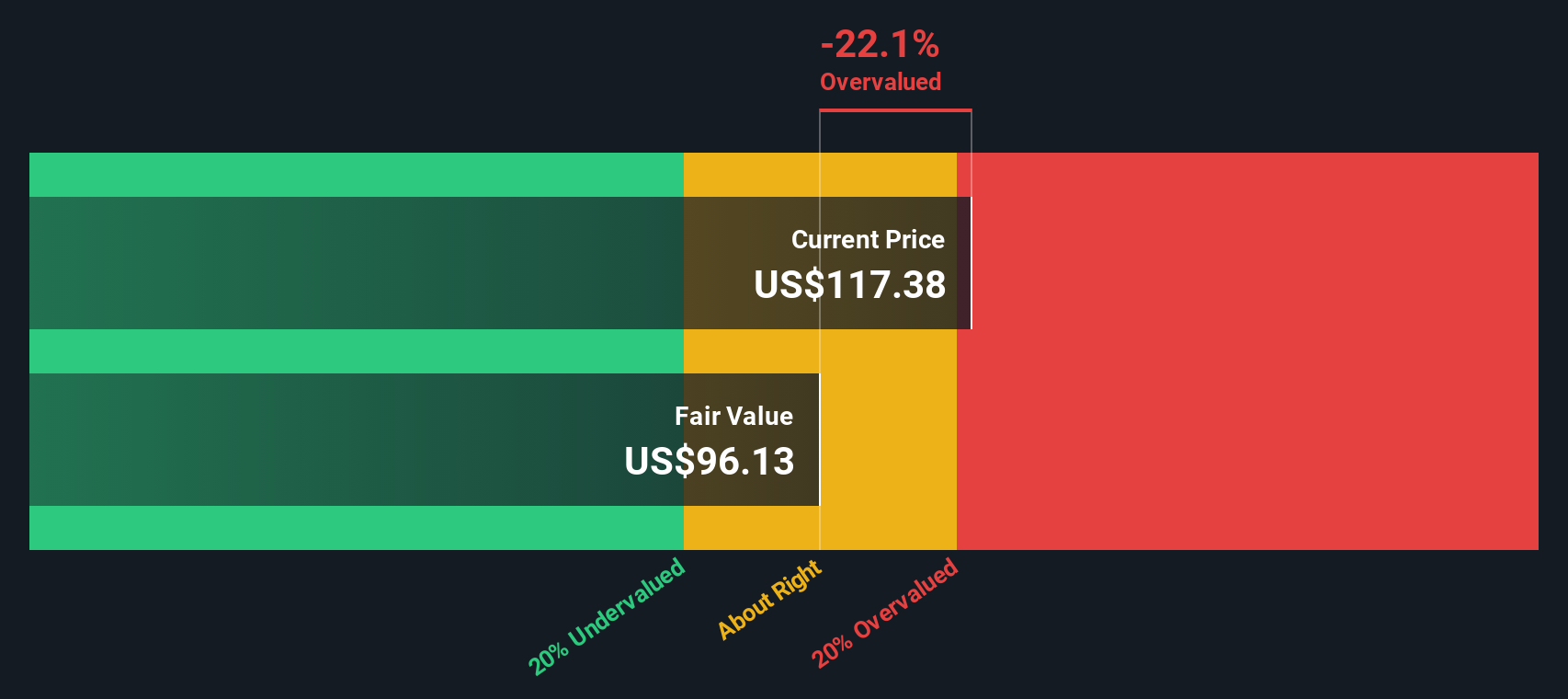

Our DCF view is cautious, suggesting Disney is slightly overvalued at around $113 versus an estimated fair value near $107, even as analysts and the narrative point to upside. Is the recent price strength running ahead of fundamentals, or is the model too conservative on ESPN and streaming?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Walt Disney for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Walt Disney Narrative

If this view does not fully align with your own, or you would rather dig into the numbers yourself, you can build a complete narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Walt Disney.

Ready to act on your next opportunity?

Do not stop at Disney. Use the Simply Wall Street Screener to move confidently toward fresh, data driven ideas that could help reshape your portfolio’s future.

- Target income potential with these 10 dividend stocks with yields > 3% that may strengthen your cash flow while markets stay unpredictable.

- Capture cutting edge innovation through these 24 AI penny stocks positioned at the front of artificial intelligence growth.

- Seize value opportunities using these 908 undervalued stocks based on cash flows that could be mispriced relative to their underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal