Dollarama (TSX:DOL): Assessing Valuation After Strong Multi‑Year Share Price Gains

Dollarama (TSX:DOL) has quietly pushed to fresh highs after another strong stretch of same store sales and earnings growth. The stock’s recent climb has many investors asking whether the rally still has room to run.

See our latest analysis for Dollarama.

At around CA$204.69, Dollarama’s latest move higher caps a strong run, with the share price return this year reinforcing a three year total shareholder return above 150 percent. This signals clear, sustained momentum rather than a brief pop.

If Dollarama’s momentum has you rethinking your watchlist, now is a good time to explore fast growing stocks with high insider ownership for other fast moving ideas with aligned insiders.

With the shares hovering just below analyst targets and trading after years of rapid gains, investors now face a key question: is Dollarama still undervalued or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 3.2% Undervalued

With Dollarama closing at about CA$204.69 against a narrative fair value near CA$211, the story leans modestly positive, hinging on sustained global expansion and efficiency gains.

The company's aggressive international expansion opening Dollarcity's first store in Mexico and acquiring Australia's largest discount retailer unlocks new, large addressable markets, positioning Dollarama for multi year top line revenue growth through broader geographic and demographic exposure.

Want to know what kind of revenue path and margin profile this narrative is baking in, and why the future earnings multiple stays elevated? The fair value hinges on a careful balance of compounding sales, resilient profitability, and a premium rating that does not fade overnight. Curious how these moving parts combine to justify only a small gap between price and value, even after a major run up? Dive into the full narrative to see the exact assumptions driving that conclusion.

Result: Fair Value of $211.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in Australia, or cost inflation and regulatory shifts in newer markets, could quickly erode margins and challenge the current growth narrative.

Find out about the key risks to this Dollarama narrative.

Another View Using Market Multiples

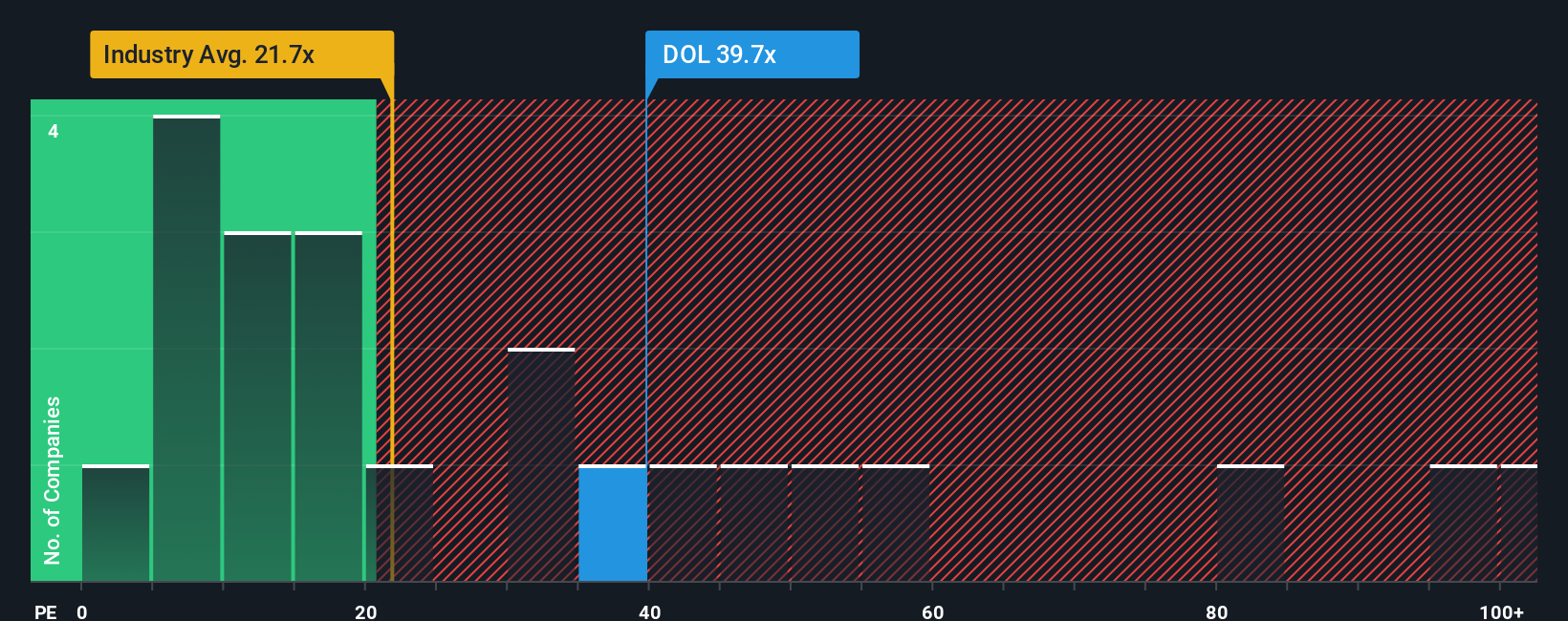

While the narrative fair value suggests Dollarama is modestly undervalued, its current price to earnings ratio of 42.8 times sits well above a fair ratio of 31.8 times and the global retail average of 19.5 times. If sentiment cools, that valuation gap could unwind quickly.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dollarama Narrative

If you see the numbers differently or want to dig into the assumptions yourself, you can build a custom view in minutes, Do it your way.

A great starting point for your Dollarama research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street to work for you with targeted screens that can uncover opportunities you might otherwise overlook.

- Capture potential market mispricings by scanning these 908 undervalued stocks based on cash flows that look cheap relative to their cash flows and future prospects.

- Ride the wave of innovation by focusing on these 24 AI penny stocks shaping how businesses and consumers use artificial intelligence every day.

- Strengthen your income strategy by zeroing in on these 10 dividend stocks with yields > 3% that can help support cash returns in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal