Assessing AMD (NVDA): Valuation After Reported Alibaba MI308 Order and Renewed China AI Optimism

Advanced Micro Devices (AMD) just landed in the spotlight after reports that Alibaba may order 40,000 to 50,000 MI308 AI accelerators, a move enabled by renewed U.S. approval for limited GPU exports to China.

See our latest analysis for Advanced Micro Devices.

The Alibaba headlines land on top of a powerful run, with AMD’s 90 day share price return of about 33% and one year total shareholder return above 70%. This shows that momentum is still very much building around its AI story.

If this kind of AI driven move has your attention, it might be worth seeing which other names are breaking out in high growth tech and AI stocks as the next wave of potential winners.

With Wall Street still projecting nearly 30% upside and AMD chasing a hundred billion dollar data center opportunity, investors face a key question: is AI fueled growth still undervalued here or already fully priced in?

Most Popular Narrative: 20.4% Undervalued

With the narrative fair value sitting well above AMD's last close, the valuation story leans toward meaningful upside if its growth plan lands.

AMD has evolved into a formidable player in AI and enterprise compute, propelled by leadership in CPUs (EPYC) and a growing presence in GPUs (Instinct MI series). With solid revenue and earnings growth, strong analyst upgrades, and a valuation that still looks reasonable compared to peers, AMD offers a balanced play on AI infrastructure growth.

Want to see what is baked into that upside call? According to oscargarcia, the narrative leans on powerful revenue expansion, rising margins, and ambitious profit acceleration.

Result: Fair Value of $270.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors still need to weigh Nvidia’s entrenched AI lead and tightening export controls, either of which could quickly undercut that upside case.

Find out about the key risks to this Advanced Micro Devices narrative.

Another View: Multiples Flash a Caution Signal

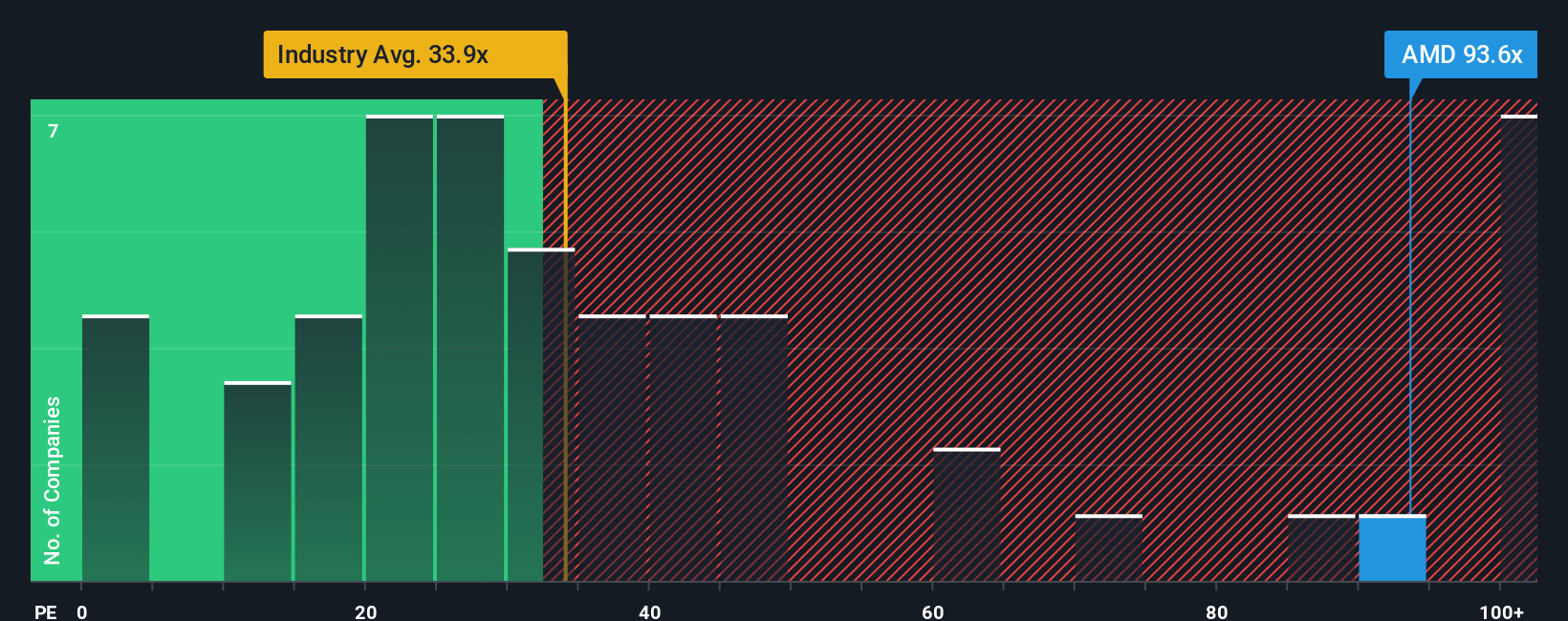

While the narrative fair value points to upside, AMD’s earnings multiple tells a different story. At 111.7 times earnings versus the US semiconductor average of 36.7 times, a peer average of 58.7 times, and a fair ratio of 65 times, the stock already bakes in exceptional execution and leaves less room for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Advanced Micro Devices Narrative

If you see the story differently or want to dig into the numbers yourself, you can quickly build a custom narrative in just minutes: Do it your way.

A great starting point for your Advanced Micro Devices research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Put your research to work and use the Simply Wall Street Screener to uncover fresh, data-backed opportunities before the crowd moves on.

- Target meaningful long term upside by focusing on companies trading below their estimated cash flow value using these 908 undervalued stocks based on cash flows.

- Capitalize on the AI boom by zeroing in on innovators powering the next generation of intelligent software and hardware through these 24 AI penny stocks.

- Lock in potential income streams by filtering for reliable payers offering attractive yields with these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal