WiseTech Global (ASX:WTC) Valuation Update After Founder’s 20 Million Share Collar Deal With Macquarie Bank

WiseTech Global (ASX:WTC) is back in the spotlight after founder Richard White entered a collar derivative and financing deal over 20 million shares with Macquarie Bank, prompting fresh questions about motives and market impact.

See our latest analysis for WiseTech Global.

The founder’s collar deal lands at a tricky moment for sentiment. The latest A$68.74 share price sits well below earlier peaks after a weak year to date share price return, but it is still supported by solid multi year total shareholder returns that hint at durable growth expectations rather than a broken story.

If this kind of strategic founder move has you thinking more broadly about opportunity, now could be a smart time to explore fast growing stocks with high insider ownership.

So with the share price off sharply year to date, but still boasting strong multi year gains and a hefty discount to analyst targets, is WiseTech quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 39.4% Undervalued

With WiseTech Global last closing at A$68.74 against a narrative fair value near A$113, the most followed view suggests meaningful upside if its growth blueprint holds.

The rollout of the new unified, transaction-based CargoWise commercial model (the "Value Pack"), which removes seat-based pricing and bundles advanced AI-driven workflow and management engines, is expected to accelerate market penetration, reduce adoption friction, and open the SME market, resulting in significant recurring revenue uplift and higher customer retention as user engagement scales with transaction volumes.

Curious how a logistics software company gets marked for such a steep upside? The narrative leans on rapid revenue expansion, stubbornly high margins, and a future earnings multiple usually reserved for elite growth names. Want to see which precise growth, profitability, and valuation assumptions power that A$113 fair value and how they stack up over the next few years? Dive in to unpack the full playbook behind this call.

Result: Fair Value of $113.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing organic growth and the complex, high cost integration of E2open could pressure margins and undermine the market’s optimistic long term assumptions.

Find out about the key risks to this WiseTech Global narrative.

Another Lens on Value

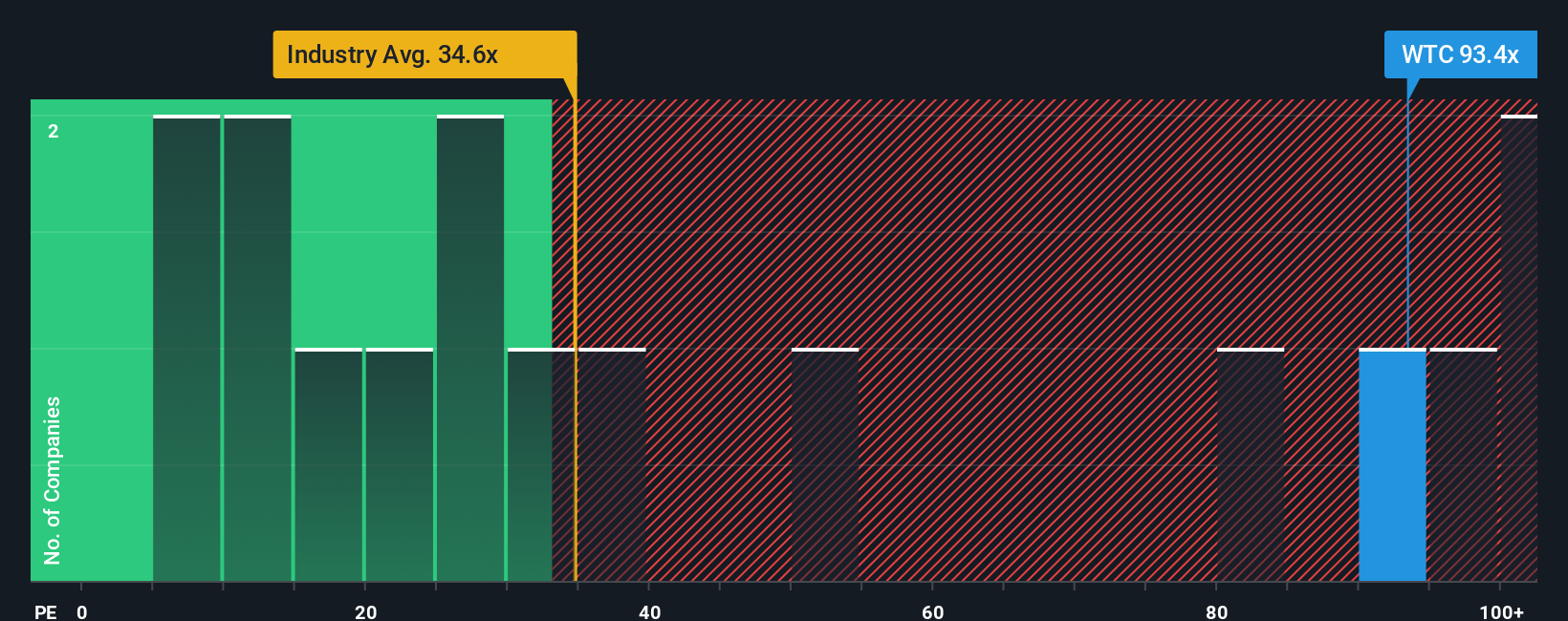

Step away from narratives and the raw earnings multiple paints a different picture. WiseTech trades on 76.4 times earnings, well above the global software average of 27.1 and a fair ratio of 49.2, hinting at meaningful valuation risk even versus rich peers at 94.9. Which signal matters more for you?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WiseTech Global Narrative

If you want to stress test these assumptions or back your own view with the numbers, you can build a fresh WiseTech thesis in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding WiseTech Global.

Ready for your next investing move?

Before you log off, you can scan fresh opportunities with the Simply Wall St Screener so your next decision is grounded, not guessed.

- Look for potentially mispriced quality by targeting these 908 undervalued stocks based on cash flows that pair resilient fundamentals with attractive entry points.

- Explore structural trends in medicine and automation by focusing on these 29 healthcare AI stocks pushing data driven breakthroughs.

- Follow developments in the next digital wave by tracking these 79 cryptocurrency and blockchain stocks involved in payments, infrastructure, and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal