Has The Recent 16.7% Jump In Rezolve AI Created An Opportunity In 2025?

- Wondering whether Rezolve AI at around $2.80 is a bargain in the making or a value trap, this article will walk you through the numbers in plain English.

- The stock has bounced 16.7% over the last week even though it is still down 12.5% over 30 days and 31.5% year to date, and long term holders are sitting on a 72.3% drawdown over three years.

- That recent short term strength has come as investors refocus on Rezolve AI's position in AI driven software, with renewed interest in smaller names that could benefit if sentiment toward the sector improves. At the same time, earlier sharp declines still hang over the stock, reflecting lingering questions about execution, scale, and long run competitiveness that the market has not forgotten.

- On our checklist of valuation tests, Rezolve AI only scores a 2 out of 6, which suggests there is some value support but also clear pockets of overvaluation. Next we will break down what different valuation approaches say about the stock and, toward the end of the article, look at a more complete way to think about Rezolve AI's true worth.

Rezolve AI scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rezolve AI Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth by projecting its future cash flows and then discounting them back to today using a required rate of return.

For Rezolve AI, the latest twelve month Free Cash Flow is around $71.3 Million outflow, which means the business is still burning cash rather than generating it. Analysts expect this to flip into positive territory over the next few years, with Free Cash Flow projected to reach about $262.4 Million by 2035. This is based on a two stage Free Cash Flow to Equity model that blends analyst forecasts and longer term extrapolations by Simply Wall St.

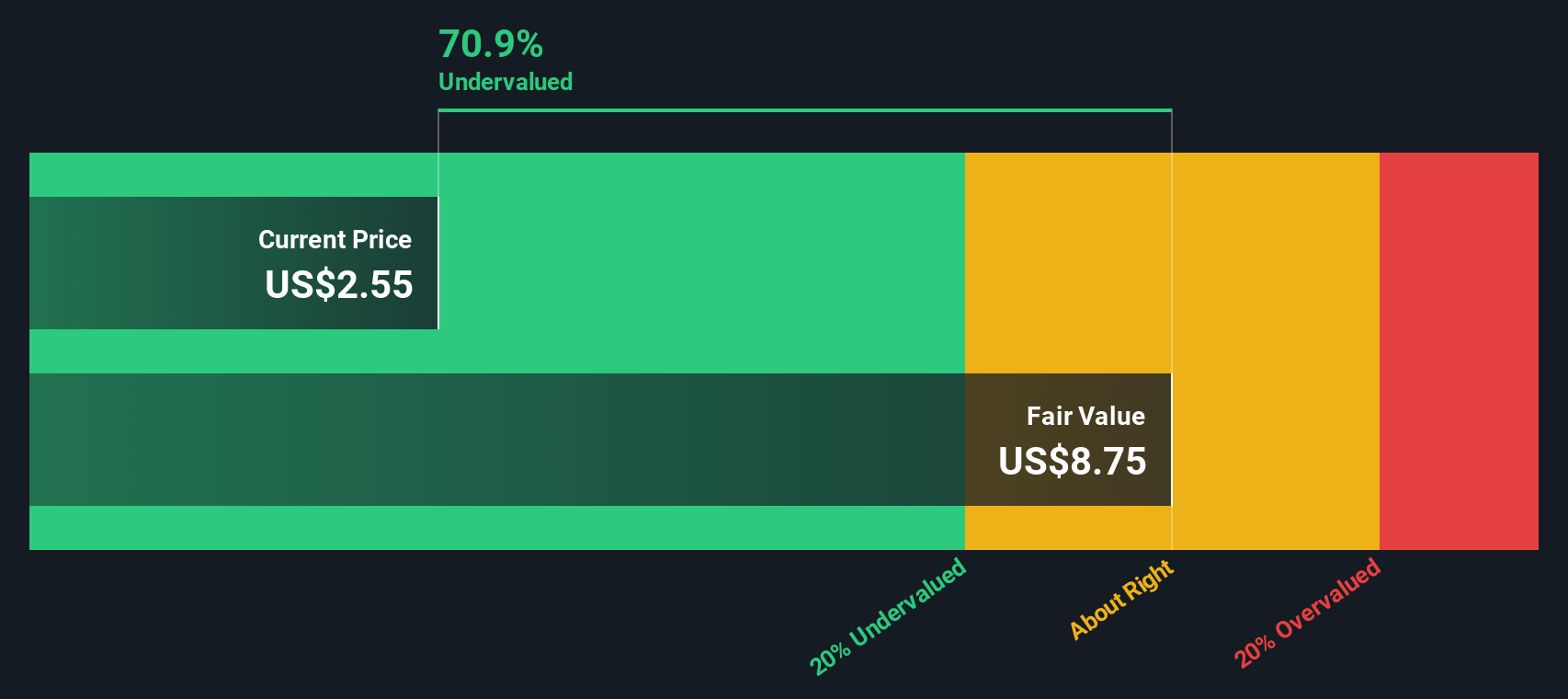

Putting all of those projected cash flows together and discounting them back to today gives an estimated intrinsic value of roughly $8.78 per share. Compared with a recent market price near $2.80, the model implies Rezolve AI is about 68.1% undervalued on this basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rezolve AI is undervalued by 68.1%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Rezolve AI Price vs Book

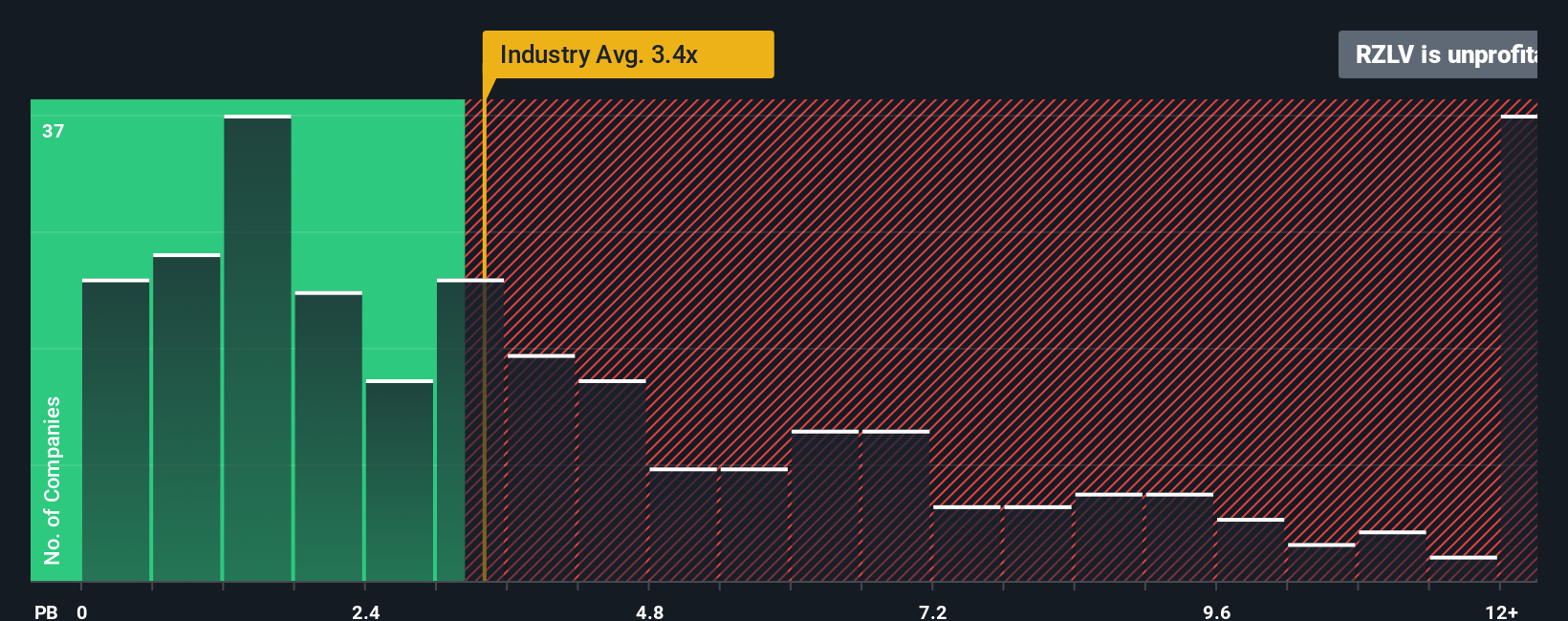

For many profitable, established companies, the price to book, or P/B, ratio is a straightforward way to gauge whether investors are paying a sensible price relative to the net assets on the balance sheet. In general, stronger growth prospects and lower perceived risk justify paying a higher multiple, while slower growth or higher uncertainty usually calls for a discount.

Rezolve AI currently trades on a P/B ratio of about -59.0x, which is not only far from the Software industry average of around 3.5x, but also significantly below the peer group average of roughly 7.9x. Such a deeply negative multiple typically reflects accounting losses and balance sheet pressures rather than a plain bargain, so simple comparisons with industry or peers can be misleading.

This is where Simply Wall St's Fair Ratio comes in, a proprietary estimate of what P/B multiple might be reasonable once factors like expected earnings growth, profitability, risk profile, industry dynamics and company size are all taken into account. Because it adjusts for these fundamentals, the Fair Ratio is more informative than a basic peer or sector comparison. On this measure, Rezolve AI screens as meaningfully cheaper than its Fair Ratio would suggest, indicating that the stock appears undervalued if the business can execute on its plan.

Result: UNDERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1457 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rezolve AI Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Rezolve AI’s future with the numbers behind it. A Narrative is your story about the company, translated into assumptions for future revenue, earnings and margins, which then flow through to a financial forecast and, ultimately, a fair value estimate. On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to map out what they believe will happen, compare that fair value to today’s share price, and decide whether Rezolve AI looks like a buy, a hold or a sell. Because Narratives are linked to live data, they automatically update when new information such as earnings releases or major news arrives, keeping your view current without extra work. For Rezolve AI, one investor Narrative might see rapid adoption and a much higher fair value than today’s price, while another might assume slower growth, tighter margins and a fair value below the current market.

Do you think there's more to the story for Rezolve AI? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal