ASX Penny Stocks To Watch In December 2025

As the Australian market winds down for the holiday season, it faces a slight dip, likely due to profit-taking and early closures. Despite this quiet period, opportunities still abound for investors willing to explore beyond major indices. Penny stocks, though an older term, continue to capture interest as they often represent smaller or newer companies with potential value and financial resilience. In this article, we explore three such stocks that could offer both stability and growth potential in the current market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$117.5M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$66.99M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.775 | A$48.26M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.87 | A$471.83M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.075 | A$37.83M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.85 | A$3.62B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.22 | A$1.38B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.84 | A$123.06M | ✅ 4 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.48 | A$228.68M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.21 | A$129.42M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 431 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

IVE Group (ASX:IGL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IVE Group Limited, along with its subsidiaries, operates in the marketing sector in Australia and has a market capitalization of A$471.83 million.

Operations: The company generates revenue from its advertising segment, amounting to A$959.25 million.

Market Cap: A$471.83M

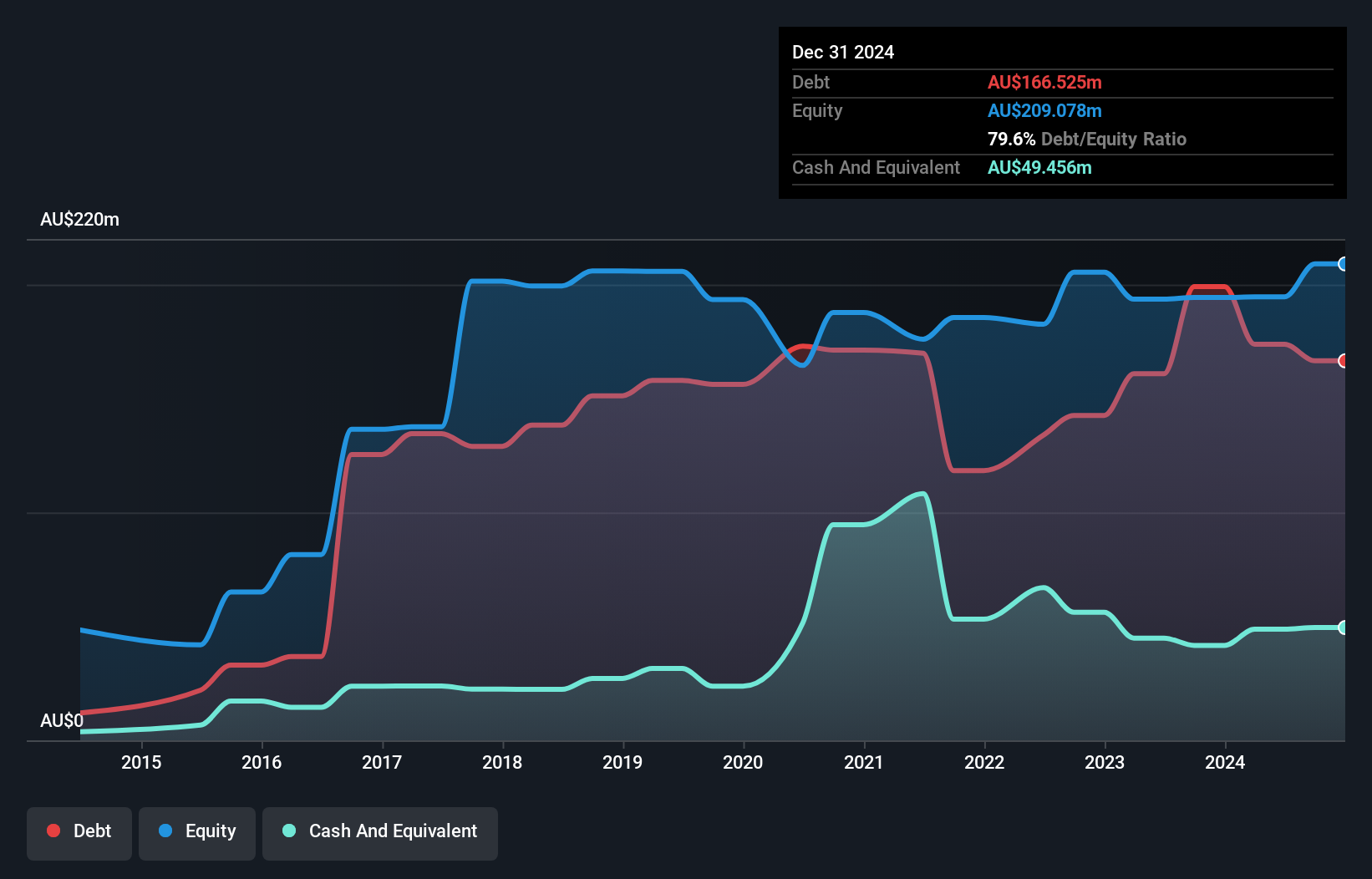

IVE Group Limited, with a market capitalization of A$471.83 million, operates in the marketing sector and has demonstrated robust financial health. The company reported significant revenue of A$959.25 million from its advertising segment and has managed to reduce its debt-to-equity ratio from 105.1% to 75.2% over five years while maintaining stable weekly volatility at 4%. IVE's earnings growth outpaced the media industry significantly last year, achieving a high return on equity at 22%, though it still carries a relatively high net debt-to-equity ratio of 51.7%. Despite an unstable dividend track record, IVE's seasoned management and board provide experienced leadership amidst these dynamics.

- Navigate through the intricacies of IVE Group with our comprehensive balance sheet health report here.

- Explore IVE Group's analyst forecasts in our growth report.

PolyNovo (ASX:PNV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices across several countries including Australia, New Zealand, the United States, and the United Kingdom with a market cap of A$870.46 million.

Operations: PolyNovo's revenue primarily comes from the development, manufacturing, and commercialisation of its NovoSorb Technology, generating A$128.70 million.

Market Cap: A$870.46M

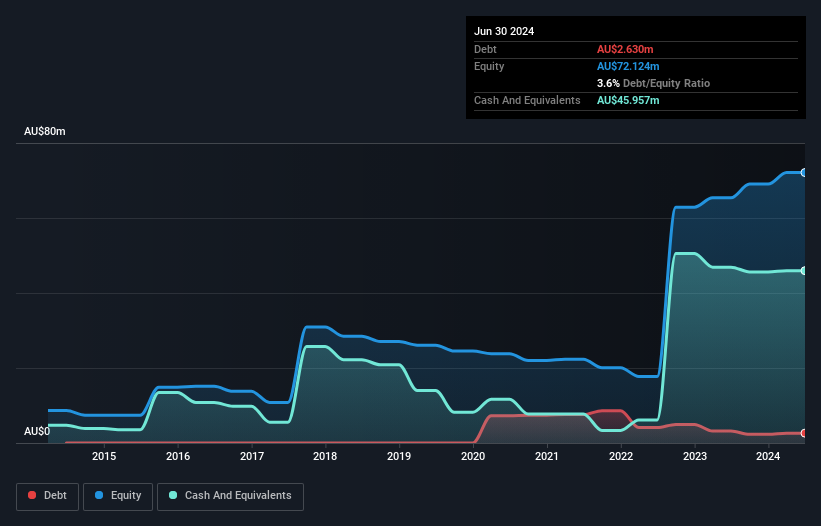

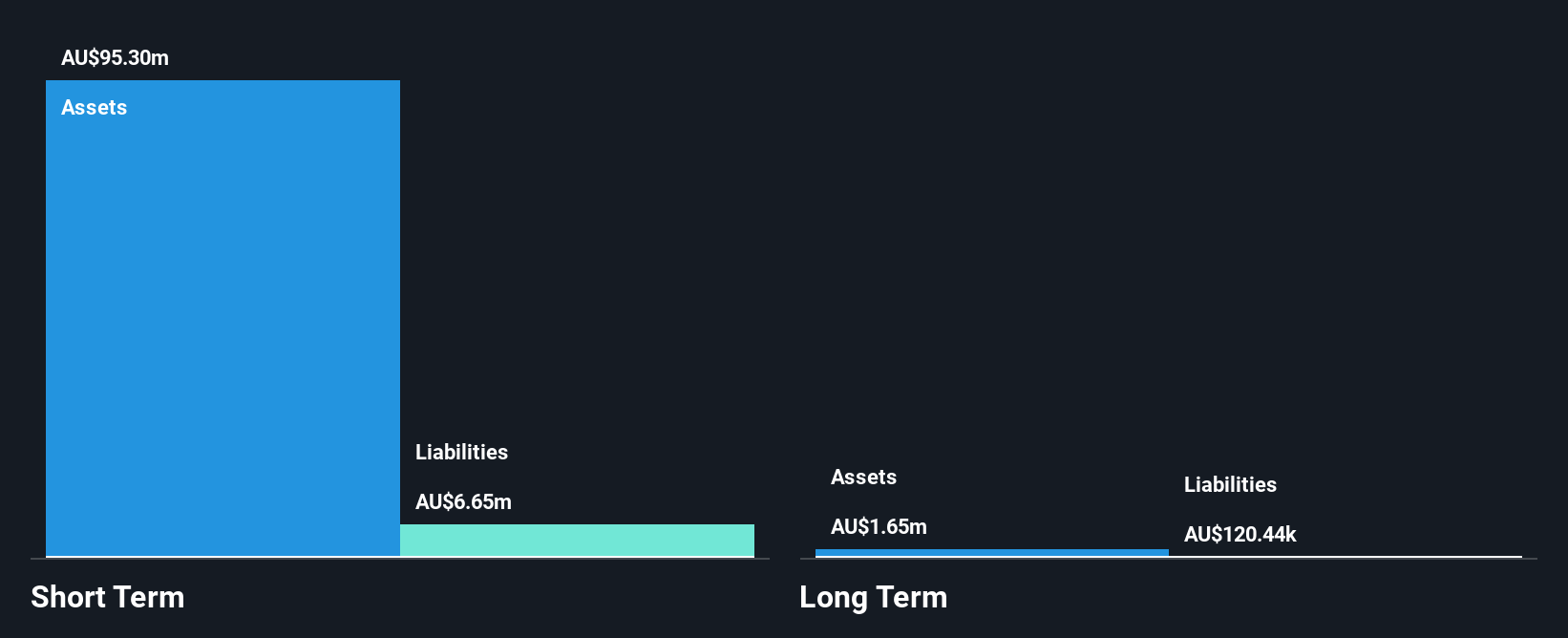

PolyNovo Limited, with a market cap of A$870.46 million, has shown significant financial strength and growth potential. The company has transitioned to profitability over the past five years, achieving an impressive earnings growth rate of 151.2% in the last year alone. Its NovoSorb Technology drives revenue, with earnings forecasted to grow by 27.37% annually. PolyNovo's short-term assets exceed both short-term and long-term liabilities, indicating solid liquidity management. Recent board appointments bring extensive industry experience that could enhance strategic direction and governance as the company continues to expand its medical device offerings globally amidst stable weekly volatility levels.

- Click here and access our complete financial health analysis report to understand the dynamics of PolyNovo.

- Understand PolyNovo's earnings outlook by examining our growth report.

Weebit Nano (ASX:WBT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Weebit Nano Limited develops non-volatile memory using resistive random access memory technology with operations in South Korea and the United States, and has a market cap of A$1.01 billion.

Operations: The company generates revenue primarily from its Memory and Semiconductor Technology Development segment, amounting to A$4.41 million.

Market Cap: A$1.01B

Weebit Nano, with a market cap of A$1.01 billion, is currently pre-revenue with its primary focus on developing non-volatile memory technology. The company has no debt and maintains a cash runway exceeding three years, providing financial stability despite being unprofitable. Recent developments include the successful tape-out of test chips featuring its ReRAM module at onsemi's production fab in New York, marking progress toward commercial deployment. Weebit's strategic partnership with the EDGE AI FOUNDATION aims to advance edge AI technologies using its low-power ReRAM technology, which could bolster future revenue streams and technological adoption in intelligent systems.

- Dive into the specifics of Weebit Nano here with our thorough balance sheet health report.

- Learn about Weebit Nano's future growth trajectory here.

Summing It All Up

- Embark on your investment journey to our 431 ASX Penny Stocks selection here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal